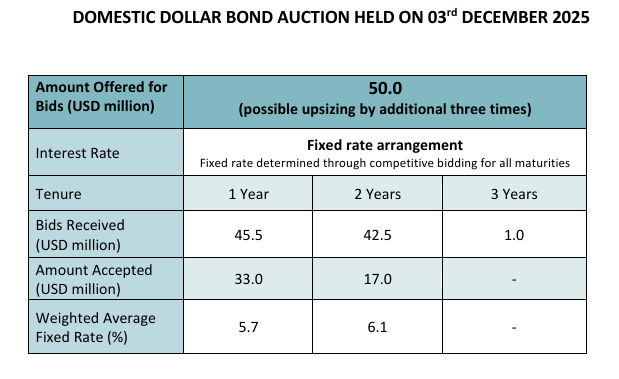

In a recent domestic dollar bond auction held on December 3, 2025, the government offered a total of USD 50 million, with the possibility of upsizing the amount by an additional three times. The auction attracted significant interest from investors, reflecting a robust demand for fixed-rate securities in the current economic climate.

Key Highlights:

– Total Bids Received: The auction saw bids totaling USD 88 million, with USD 45.5 million for one-year bonds and USD 42.5 million for two-year bonds. Only USD 1 million was bid for three-year bonds.

– Amount Accepted: The government accepted USD 33 million in one-year bonds and USD 17 million in two-year bonds, while no bids were accepted for the three-year maturity.

– Interest Rates: The weighted average fixed rates for the accepted bids were 5.7% for one-year bonds and 6.1% for two-year bonds, indicating a competitive bidding environment.

– Settlement Date: The date of settlement for the accepted bids is set for December 10, 2025.

This auction reflects the ongoing confidence of investors in the domestic bond market, as they seek stable returns amid fluctuating economic conditions. The government’s ability to attract substantial bids underscores the importance of maintaining investor trust and confidence in the financial system.

As the market continues to evolve, further bond auctions are anticipated, providing opportunities for both the government and investors to engage in beneficial financial arrangements.