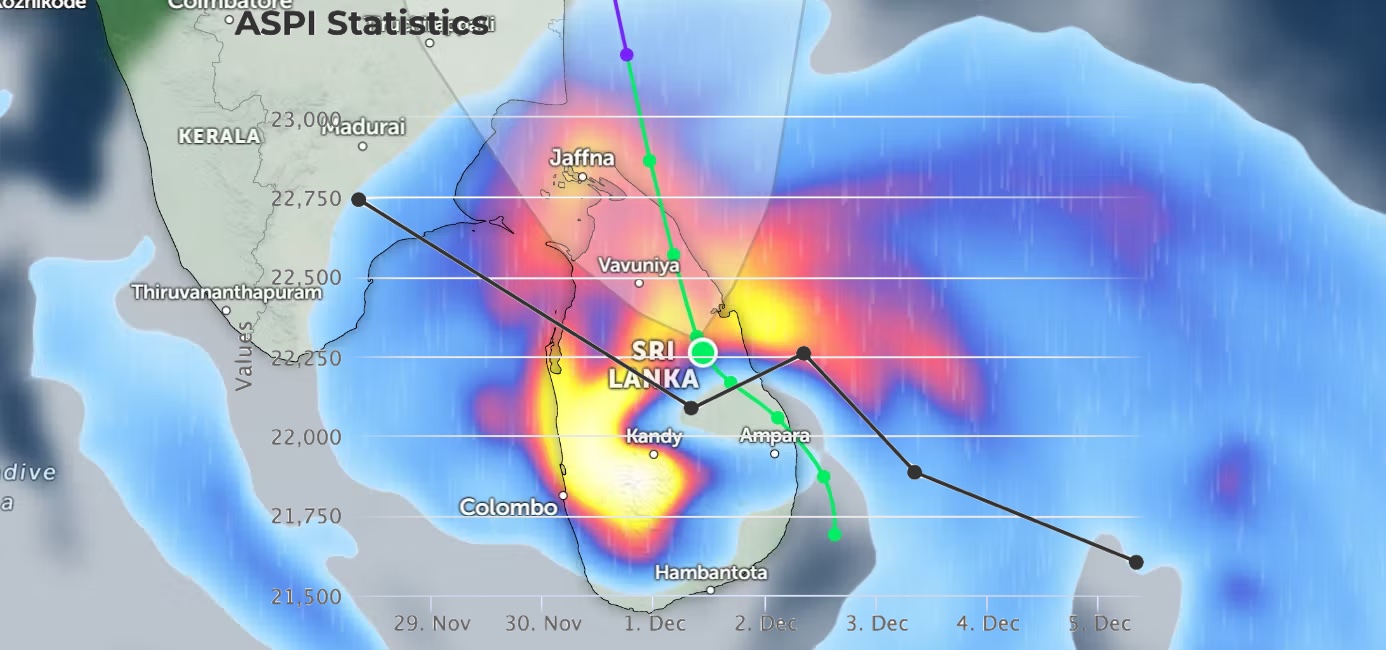

Cyclone Ditwah, which unleashed one of Sri Lanka’s worst flooding disasters in two decades and affected all 25 districts, is set to trigger sweeping changes across the country’s equity markets, with impacts varying sharply by sector. According to an impact assessment, the disaster will push short-term inflation higher, strain tourism and financial sectors, and drive a multi-year boost in construction, healthcare and select consumer industries.

The report warns that severe crop damage across rice, vegetables and inputs like corn and maize will push food inflation upward, with headline inflation expected to rise toward 3% in the near term, compared to 2.1% in November. However, with 2026 inflation still projected at just 3.5%–4%, below the Central Bank’s 5% target, monetary policy is expected to remain unchanged.

Insurance, Tourism, Banks and Plantations Hit Hard

General insurers are among the most severely impacted, as flood-related claims spike in late 2025 and early 2026. Sector profitability is expected to weaken due to increasingly high reinsurance costs and expanding policy claims. Insurers with larger SME exposure are seen as most vulnerable.

Tea plantation companies operating in high-grown regions face significant losses from landslides, soil erosion and damaged transport links. The report highlights that estates in districts such as Nuwara Eliya, Badulla, Hatton and Maskeliya carry high risk, with near-term output declines expected to trigger price spikes but dent earnings.

Tourism operators, particularly those in the Central Province, are grappling with cancellations and damaged access routes. While bookings for the 2026 winter season remain steady, room inventories in flood-affected areas will shrink until repairs are completed, posing a medium-term revenue risk.

Finance and banking institutions with high SME and regional exposure are likely to experience a sharp deterioration in loan quality, raising the probability of debt relief measures similar to those introduced after the 2017 floods.

Construction, Healthcare and Lubricants Emerge as Winners

On the upside, reconstruction efforts are forecast to stimulate a strong recovery in building materials, contractors and infrastructure developers. More than 15,000 homes and over 200 roads and bridges have been damaged, driving immediate nationwide demand for cement, cables, aluminum fixtures and PVC piping. The report highlights that a similar surge occurred after the 2016 floods.

Healthcare providers and pharmaceutical distributors are also expected to benefit, with higher incidences of water-borne diseases and injuries increasing hospital and diagnostic volumes. Lubricant suppliers, too, are poised to record sharp sales growth due to flood-related vehicle damage.

Currency Stability Expected Despite Shock

Despite trade disruptions, Sri Lanka’s current account may strengthen in the coming months as reduced discretionary imports intersect with higher remittance and donor inflows. This cushioning effect is likely to support currency stability, even as government expenditure is redirected toward rehabilitation and reconstruction.