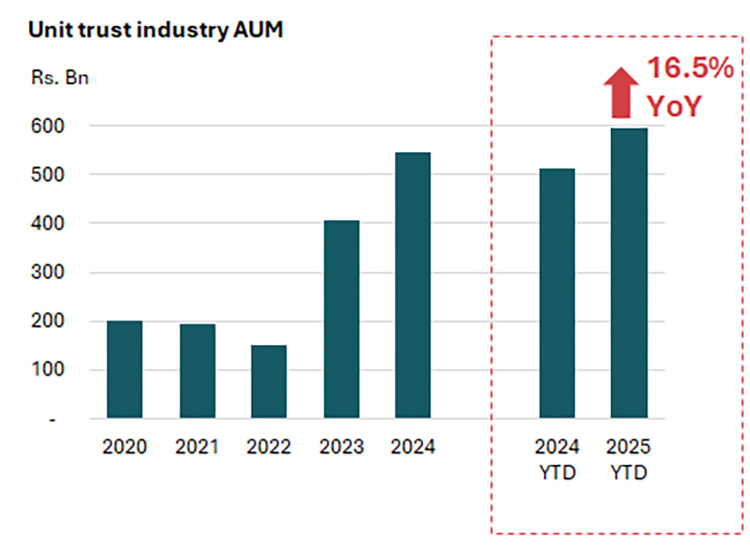

Sri Lanka’s unit trust industry recorded a strong expansion in 2025, with assets under management (AUM) rising 16.5% year-on-year to Rs. 597 billion by the end of November. These assets are managed across 85 funds operated by 16 licensed management companies.

Growth in industry AUM was supported by continued inflows into equity-related funds, which attracted Rs. 3.4 billion in new investments during November alone. Investor participation also strengthened, with 2,945 new unit holders joining the market during the month and a total of 27,720 new investors added year-to-date. As at end-November, the total number of unit trust investors stood at 141,252, reflecting an increase of about 25% compared to a year earlier, underscoring the growing acceptance of unit trusts as an alternative investment option.

Commenting on the industry’s role, Securities and Exchange Commission of Sri Lanka Chairman Prof. Hareendra Dissabandara emphasised the importance of unit trusts in deepening Sri Lanka’s capital markets by enabling wider public participation through accessible, well-regulated and professionally managed investment avenues. He noted that unit trusts allow even small savers to become investors, promoting financial inclusion, channelling savings into productive investments and strengthening the overall economy. He also highlighted that while all investments carry some risk, unit trusts offer a relatively safe option due to SEC regulation, independent trusteeship—often by banks—and mandatory performance disclosures that ensure transparency and accountability.

Reflecting on recent performance, Vice President of the Unit Trust Association of Sri Lanka (UTASL) and CEO of First Capital Asset Management Limited, Kavin Karunamoorthy, said the industry was encouraged by its positive momentum over the past year but acknowledged that further progress is needed. He noted that following the success of the Investor Awareness Initiative held in October, efforts remain focused on improving financial literacy and expanding investor participation nationwide. He added that these initiatives, undertaken in collaboration with the SEC and the Colombo Stock Exchange, are expected to gain further traction through the SEC’s recently launched national campaign, “A Share for Each – A Unit for Everyone.”

The UTASL represents Sri Lanka’s 16 SEC-regulated fund management companies and is committed to maintaining high standards of professionalism, integrity and transparency across the industry. The association aims to promote unit trusts and encourage Sri Lankans to adopt long-term, professionally managed investment strategies alongside short-term savings, contributing to sustainable national economic growth.