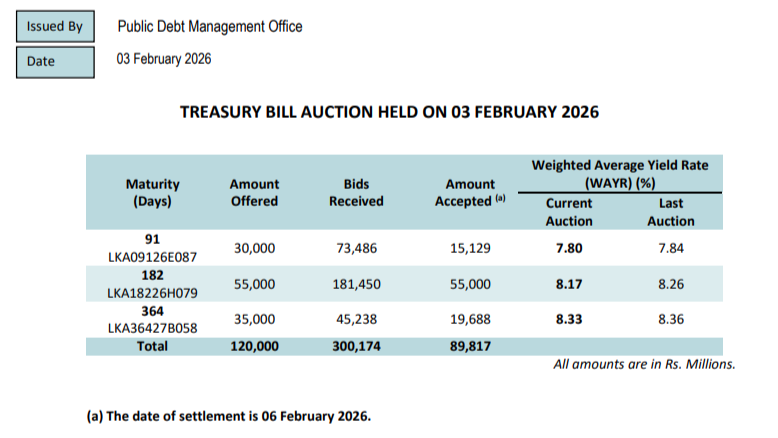

Sri Lanka’s Treasury bill yields increased across all maturities at Tuesday’s auction, according to data released by the Public Debt Management Office. The 12-month Treasury bill yield rose by 16 basis points, reaching 8.19 percent.

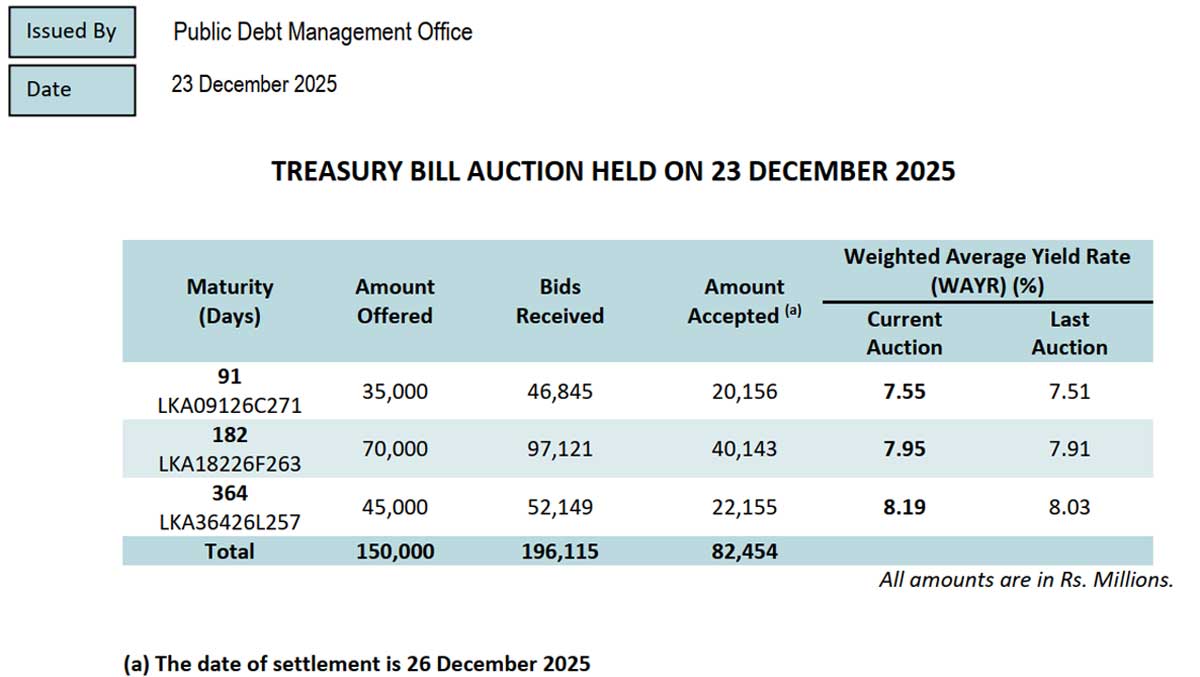

The weighted average yield for the 3-month bills climbed 4 basis points to 7.55 percent. Out of the 35 billion rupees offered in this category, 20.1 billion rupees were sold. For the 6-month bills, the weighted average yield also increased by 4 basis points to 7.95 percent, with 40 billion rupees sold out of 70 billion offered.

The 12-month yield’s increase to 8.19 percent continues a trend where short-term bill yields had previously remained unusually low—sometimes even below the overnight interbank rate—and relatively flat for extended periods. This has occurred despite significant growth in private sector credit, a situation that analysts monitoring the balance of payments have referred to as the “ramrod rate anomaly.”

Higher yields are expected to attract more funds into the Treasury bill market. However, some concerns have been raised that the rate cut implemented in May could complicate efforts to accumulate reserves and meet debt obligations, potentially due to mis-signals regarding interest rates. It is noted that, unlike in 2025, there have been no inflationary open market operations, and a prudent reserve management policy remains in place.

At this week’s auction, the debt office offered a total of 150 billion rupees in Treasury bills, approximately 50 billion more than the amount of maturing bills, based on market estimates. Ultimately, 82.4 billion rupees were raised.

Meanwhile, the Sri Lankan government is currently making sizable cash payments for cyclone relief efforts.