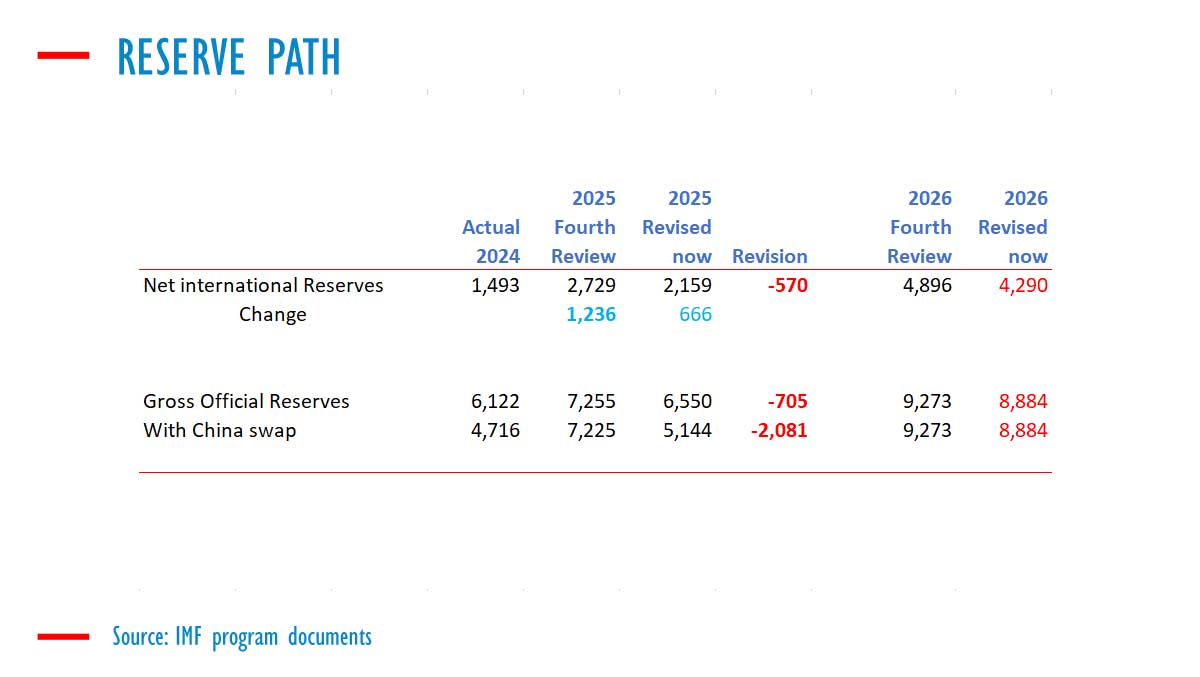

The International Monetary Fund (IMF) has revised its projections for Sri Lanka’s international reserves for 2025, according to a recent country report related to the nation’s emergency loan program. The updated forecast now expects Sri Lanka’s Net International Reserves (NIR) to reach approximately USD 2,159 million by the end of December 2025, down from the previous estimate of USD 2,729 million. This represents an increase of USD 666 million from 2024 levels, compared to the earlier anticipated growth of USD 1,236 million. The IMF program target for end-December is USD 448 million.

Analysts have cautioned that the downward revision was likely due to recent interest rate cuts and robust growth in private credit. They warn that reducing rates based solely on past inflation figures, without accounting for domestic credit expansion, can undermine the central bank’s capacity to accumulate reserves, as the ability to purchase foreign currency diminishes after rate reductions.

The country was also affected by Cyclone Ditwah in the last week of December. Analysts noted that the central bank may have an opportunity to purchase more dollars during December.

Concerns have been raised over the current IMF program’s lack of a downward-sloping net credit to government ceiling as a quantitative performance criterion. This omission limits the central bank’s ability to purchase and retain reserves. Analysts argue that without a sufficiently deflationary policy—essential for creating a balance of payments surplus—attempts to build reserves may instead lead to currency depreciation, even in the absence of an outright balance of payments deficit.

Additionally, analysts point out that any inflationary policies, including emergency liquidity assistance from the central bank, could trigger balance of payments deficits, especially given strong private credit growth. In the previous program, which lost momentum by 2019, the implementation of inflationary measures to suppress interest rates resulted in missed reserve targets, waivers, and currency depreciation. This, in turn, eroded confidence in the government’s economic strategy and contributed to rising food and energy prices, eventually leading to the administration’s ouster.

The report also notes that the Federal Reserve has paused its quantitative tightening measures, and prices for precious and base metals have started to rise. It remains unclear whether food and energy prices will follow this trend.

In Sri Lanka, deflationary policy measures for 2025 are expected to be limited to coupon payments on the central bank’s bond holdings and certain bonds acquired outright during previous currency crises. The central bank is projected to accumulate some reserves over the year, which would help it repay its own reserve-related liabilities and improve net reserves.

However, if the central bank does not pursue adequate deflationary policies and allows excess liquidity to remain in the money markets until it becomes import credits, Sri Lanka’s capacity to repay its debts could be compromised. In such a scenario, the Treasury may neither purchase dollars from the market nor receive sufficient dollar-denominated tax revenues.

Analysts have suggested that the Treasury should operate independently of the central bank, have the authority to levy dollar-denominated taxes, and be permitted to buy dollars for debt repayment purposes. In 2025, the Treasury reportedly over-borrowed by approximately 1.2 trillion rupees. Part of these funds could be used to purchase dollars and settle foreign debt obligations if the central bank refrains from implementing deflationary policies or reduces rates to stimulate private credit growth.

The IMF program states: “We are gradually rebuilding gross international reserves, including through outright FX purchases in the market, supported by a non-interest current account surplus, new external financing, and other non-debt creating inflows, as well as sovereign debt relief. We stand ready to undertake outright FX purchases on a net basis of US$2.65 billion between November 2024 and end-2025 to meet reserves targets, and another US$1.3 billion in the first half of 2026. We strive to save any overperformance in NIR accumulation. As a signal of our proactive approach to reserves accumulation, we have a cap on the adjustor for NIR targets in cases of shortfalls in project financing.”