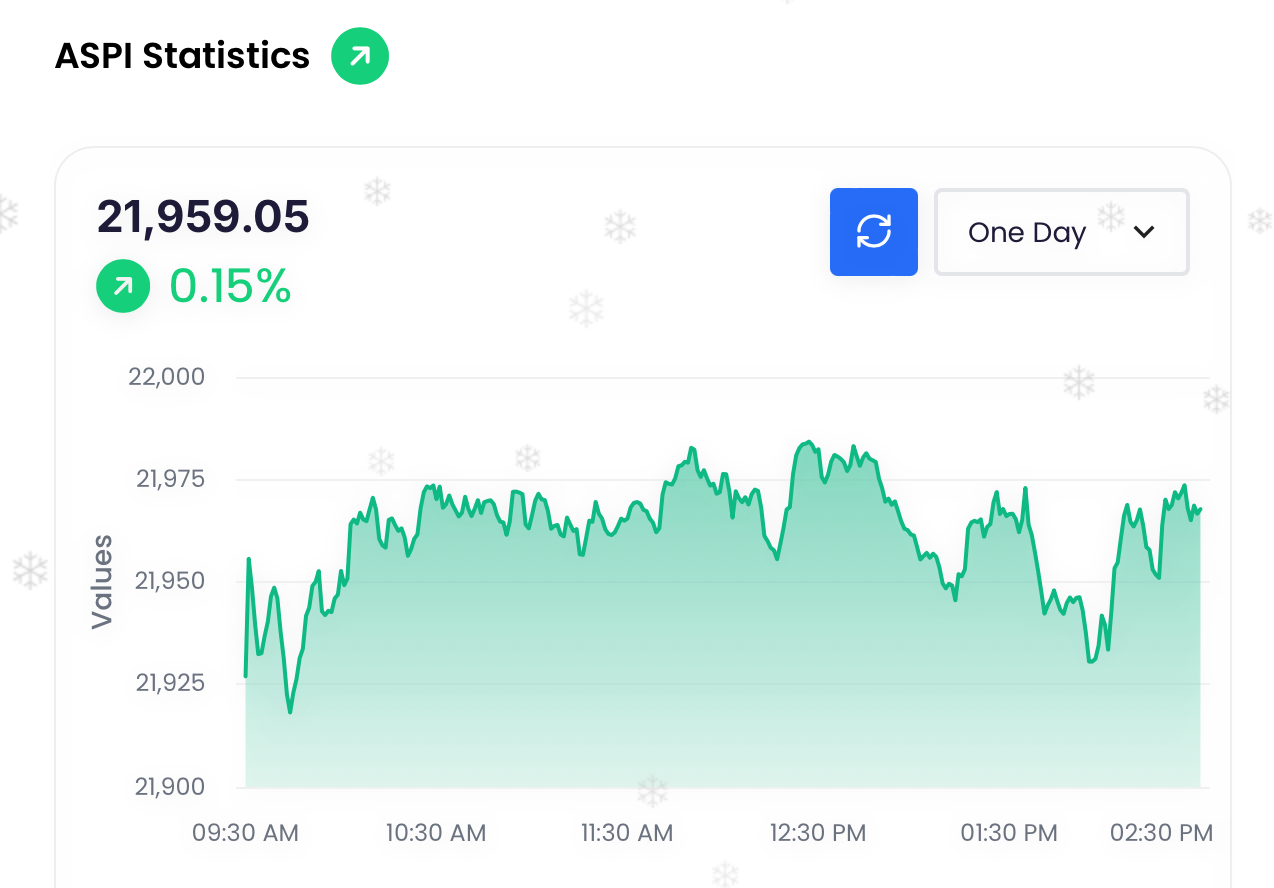

The Colombo Stock Exchange (CSE) concluded the session with a 0.15 percent increase, predominantly driven by select banking stocks, as per data available on its website. In anticipation of the Christmas holiday, the broader All Share Price Index (ASPI) rose by 32.05 points, closing at 21,959.05. Meanwhile, the S&P SL20 experienced a modest gain of 0.07 percent, or 4.17 points, closing at 6,015.48.

Investor interest was notably directed towards banking and retail shares. Key contributors to the ASPI included Senkadagala Finance, which increased by 71.50 rupees to 1,201.50 rupees, Aitken Spence, up 4 rupees to 152 rupees, Sampath Bank, rising 1 rupee to 142.75 rupees, Bukit Darah, up 23.50 rupees to 1,046.25 rupees, and Cargills (Ceylon), which climbed 9.25 rupees to 777.25 rupees.

The construction sector continued its upward momentum for the second consecutive session, following reports of Cyclone Ditwah causing approximately 4.1 billion US dollars in damage. Tokyo Cement Company (Lanka) saw an increase of 25 cents to 112.25 rupees, while Royal Ceramics closed 50 cents higher at 44.50 rupees. Other companies remained stable as the holiday season approached.

Market turnover surged to 4.1 billion rupees from the previous session’s 2.5 billion rupees. John Keells Holdings led the session with a turnover of 1.6 billion rupees, followed by Colombo Dockyard with 316 million rupees, and DOCK.N with 264 million rupees. The session recorded a share volume of 147,195,789 across 22,718 trades.

The CSE faced a net foreign outflow of 331 million rupees. Regionally, equity markets closed in negative territory ahead of the Christmas holiday. Notably, foreign investors acquired Indian stocks worth 644 million US dollars over two months, according to The Economic Times.

India’s Nifty 50 traded 0.018 percent higher at 26,177.15, while the Sensex index dipped by 0.050 percent to 85,524.84. Japan’s Nikkei 225 index ended 0.14 percent lower at 50,344.10, according to Japan’s Mainichi newspaper, which noted a lack of new trading cues as many investors remained on the sidelines ahead of overseas Christmas holidays.

In Pakistan, the Karachi Stock Exchange 100 index fell by 0.14 percent to 170,830.22. Meanwhile, Hong Kong’s Hang Seng index rose by 0.17 percent to 25,818.93, and Singapore’s Straits Times Index (STI) decreased by 0.06 percent or 2.630 points, closing at 4,636.340.

Gold and silver prices surged in response to the Federal Reserve’s rate cuts and the cessation of deflationary policies. As of 4:15 PM Sri Lankan time, spot gold was trading at 4,487.95 US dollars, marking an increase of 0.26 percent. (Colombo/Dec24/2025)