Sri Lanka’s delicate economic recovery has been severely disrupted by Cyclone Ditwah, marking the most devastating natural disaster to hit the island since the 2004 tsunami. Just as signs of stabilization began to surface, the widespread destruction has delayed recovery timelines significantly.

Officials have estimated the reconstruction costs to reach up to USD 7 billion, while analysts project GDP growth to decelerate to approximately three percent by 2026. This projection could represent a best-case scenario.

Azusa Kubota, the UNDP Resident Representative in Sri Lanka, highlighted that Ditwah struck areas already weakened by years of economic hardship. She warned that recovery would be particularly slow and costly in regions where severe flooding coincides with long-standing vulnerabilities.

As rebuilding demands grow, the government has appealed for USD 200 million in emergency assistance from the IMF, a request currently under review. However, Kubota cautions that Sri Lanka cannot afford to incur additional debt for reconstruction purposes.

A report by First Capital following the disaster emphasizes the extensive economic repercussions, noting that private consumption, which constitutes nearly 68 percent of GDP, is expected to decline.

Meanwhile, Moody’s warns that the cyclone could hinder Sri Lanka’s post-default fiscal recovery, citing significant infrastructure damage and a limited capacity to manage climate risks.

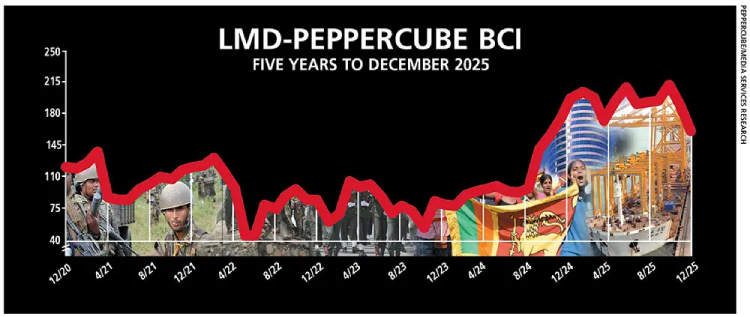

These developments are reflected in the latest LMD-PEPPERCUBE Business Confidence Index (BCI), which fell by 25 basis points from 189 in November to 164 in December. This places the index 39 points below its historical median of 125, marking its lowest point in the past 12 months and 29 points below the 12-month average of 193. For comparison, the BCI was at 174 in December 2025, which is 15 points higher than the current reading.

PepperCube Consultants note that the BCI mirrors a nation grappling with the operational, economic, and emotional aftermath of a large-scale climate disaster. The firm warns that sustaining confidence will require targeted policies focused on human capital development, improved operational efficiency, and a strategic approach to addressing broader socioeconomic challenges.

The cyclone has undoubtedly dealt a blow to business confidence, following a brief and fragile resurgence over the past year. The BCI had reached a record high in June, retreated, rebounded to another peak in October, and has since declined once more.

In a macroeconomic landscape shaped by both global uncertainties and heightened climate risk, the business confidence barometer may continue to exhibit volatility in the coming months, despite the potential stabilizing effect of Budget 2026.

In this context, the president has emphasized that existing debt sustainability frameworks are inadequate for climate-vulnerable nations, asserting that Sri Lanka faces a crisis largely beyond its control.

It appears that Sri Lanka is once again teetering on the edge.