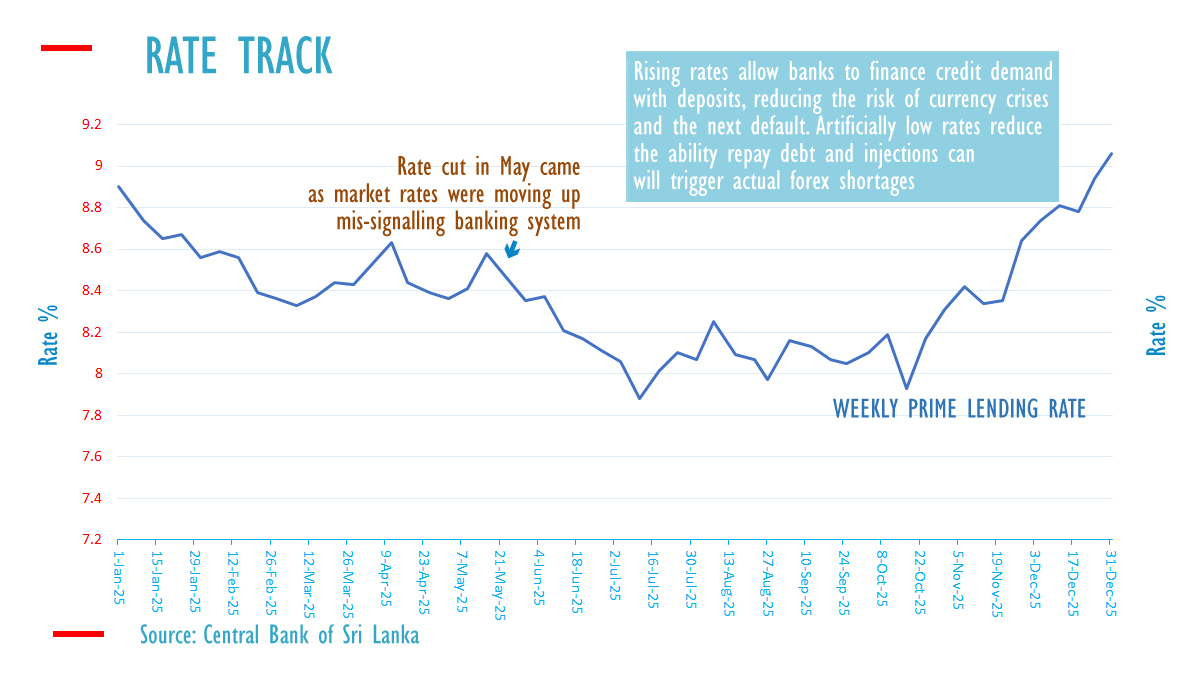

In 2025, Sri Lanka experienced a rise in interest rates, which analysts suggest has reduced the risk of a second sovereign default, despite reserve collections falling short of initial targets due to insufficient deflationary policy. The central bank lowered rates in May 2025, amidst warnings that its operating framework was aligning with ‘flexible inflation targeting’ practices, which historically led to currency crises during the second year of International Monetary Fund programs. These programs are typically triggered when private credit recovers following rate cuts implemented two years earlier.

During the week leading up to January 1, 2025, the central bank’s prime lending rate was recorded at 8.90 percent. The central bank’s overnight policy rate was reduced to 7.75 percent as of May 22, with standing facilities positioned 50 basis points on either side. Over the preceding two weeks, the Prime Lending Rate had increased from 8.36 percent to 8.58 percent. By the end of December 2025, the PLR had risen to 8.94 percent.

Overnight rates saw a similar upward movement, with the maximum unbacked call money rate climbing to 8.05 percent and averaging 8.03 percent by December 30. The gilt-backed overnight repo rate, where trading occurs later in the day, rose to 8.10 percent. Analysts have cautioned that if rates remain high, the ceiling rate may need to be increased to prevent a currency crisis and a second default.

Throughout 2025, Sri Lanka operated under a scarce reserve regime. Under this system, banks were discouraged from extending loans using central bank open market operations funds, which analysts indicate mitigates the risks of a rapid currency crisis and a second default. This regime, wherein the central bank provides funds only overnight at a penalty rate, dissuades banks from lending with newly printed money, thus avoiding balance of payments deficits.

Interbank market activity has increased, with both bank lending and deposit rates edging upwards over the year, as reflected in data released by the central bank. Reserve collection capabilities declined notably following the May rate cut, as private credit growth accelerated, driving up imports.

Analysts emphasize that modest increases in interest rates can help avert currency crises and depreciation, provided the central bank maintains a consistent exchange rate policy. Nevertheless, the rupee depreciated in 2025, which an analyst attributed to ‘Political Ravishment with a twist’—a selective denial of convertibility to private borrowers due to flaws in the operating framework. This depreciation has partially offset the fiscal gains achieved by higher taxpayer contributions.

Sri Lankan taxpayers faced elevated rates, and import taxes were initially increased after the central bank’s rate cut approximately 18 months after its establishment, which led to balance of payments issues. The ensuing stabilization crisis resulted in the ousting of the first post-independent government, which initially established the central bank, replacing an East Asia-style currency board.

The economy was further impacted by Cyclone Ditwah in December, which dampened economic activity. The International Monetary Fund has estimated that the growth costs could amount to about 0.2 percent of the gross domestic product. In 2004, a tsunami, which occurred when the rupee was also depreciating amid money printing and private credit growth, sharply reduced credit growth in January, stabilizing the exchange rate.

In 2025, the government announced extensive relief payments, which analysts warn could strain credit markets. The funding is expected to be supported by an over-borrowed buffer, established when public debt was under the central bank’s control. Warnings have been issued that it is not feasible to build domestic buffers within the banking system for future contingencies, as such reserves should be invested abroad.

Large-scale deposit withdrawals could also place banks under stress, compelling them to borrow from central bank windows until funds are redistributed to other banks. Analysts caution that accommodating such bank run-style withdrawals with term liquidity operations at low rates could exert pressure on the currency.

(Colombo/Dec31/2025)