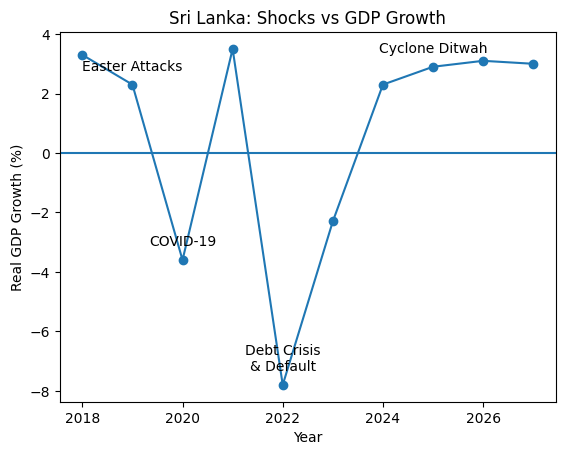

How repeated shocks have hit Sri Lanka’s GDP, how many shocks can this economy take?

How Many Shocks Can Sri Lanka Take?

The chart tells a blunt story.Every major shock since 2019 has pushed growth below trend — but the 2022 debt crisis was the breaking point, not just another dip.

What the timeline shows

• 2019 – Easter Sunday attacks: Growth slows sharply. Tourism confidence collapses.

• 2020 – COVID-19: A full contraction. Borders shut, forex inflows dry up.

• 2022 – Debt crisis & default: The deepest collapse. This was not a shock absorbed — it was a system failure.

• 2025 – Cyclone Ditwah: Growth survives, but only because the economy is already compressed, demand subdued, and imports constrained.

The key insight

Sri Lanka has already used up its shock absorbers.

Before 2019, shocks reduced growth.

By 2022, a shock collapsed the system itself.

Post-IMF, shocks no longer cause freefall — but they cap recovery.

That’s the danger zone.

What this means for April 2027

• Growth around 3% suggests survival, not resilience.

• The economy can absorb one moderate shock without collapse.

• Two overlapping shocks — say climate damage plus an external financial hit — would likely force:

o fiscal slippage,

o reserve pressure,

o and political retreat from reform.

Bottom line

Sri Lanka is no longer fragile in the way it was in 2022 — but it is not yet shock-proof.

By 2027, the question won’t be can the economy grow?

It will be can it grow while being hit again?

Right now, the honest answer is: only once — and barely.