In 2025, Binance achieved a significant milestone by becoming the first global exchange to secure full authorization under the internationally recognized framework of the Abu Dhabi Global Market (ADGM). This achievement, coupled with surpassing 300 million registered users worldwide, marked a new era where both scale and regulatory oversight advanced hand in hand.

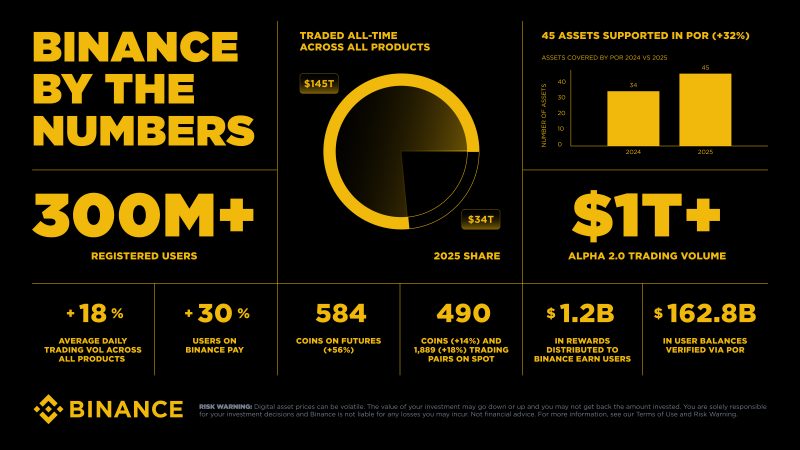

Continuing its role as a primary hub for global crypto liquidity, Binance facilitated $34 trillion in trades on its platform during 2025, with spot volume exceeding $7.1 trillion. The average daily trading volume across all products saw an 18% increase. The focus on expanding beyond traditional order book trading was evident as Binance Alpha 2.0 surpassed $1 trillion in trading volume, engaging 17 million users. Meanwhile, efforts in security, compliance, risk management, and governance delivered significant user protection outcomes at scale.

The Binance State of the Blockchain 2025 year-in-review report highlights key themes and growth metrics, including regulation, liquidity, Web3 discovery, institutional adoption, user protection, and the everyday use of crypto. The full report is available for those interested in a comprehensive overview of findings, product updates, and data points.

Two major milestones occurred at the close of 2025: Binance became the first crypto exchange to secure full authorization under the Financial Services Regulatory Authority (FSRA) of ADGM’s stringent regulatory framework, enabling regulated global trading, and the community expanded to over 300 million registered users worldwide. These developments reflect the evolving expectations in the crypto industry, where platforms are increasingly assessed as financial infrastructure, focusing on governance, resilience, user protection, and performance under stress, alongside scale, liquidity, and community strength.

Trust as Infrastructure: Regulation, Resilience, and Measurable Outcomes

The ADGM framework encompasses governance, risk management, custody, clearing, and consumer protection, aligning the crypto market structure more closely with traditional financial venues’ expectations.

The report underscores that trust can be quantified through outcomes. Since 2023, Binance has reduced direct exposure to major illicit fund categories by 96%. In 2025, Binance’s measures helped prevent $6.69 billion in potential fraud and scam losses for 5.4 million users. During the same period, Binance processed over 71,000 law enforcement requests, supported the confiscation of approximately $131 million linked to illicit activities, and conducted more than 160 law enforcement training sessions.

Trust is also built by minimizing unnecessary hurdles for legitimate users. The report highlights the Enhanced Due Diligence redesign, where submission steps were simplified, and pass rates improved swiftly, aiming to bolster compliance without complicating the user experience.

Where Liquidity Lives: Depth, Participation, and New Discovery Flows

Liquidity remains crucial for users’ trading experiences, affecting spreads, slippage, and execution reliability. In 2025, Binance processed $34 trillion in trading volume across all products, with spot trading volume exceeding $7.1 trillion. The all-time traded volume reached $145 trillion across all products.

Participation has become more diverse. Binance expanded its spot markets to 490 coins and 1,889 spot trading pairs, and futures coverage to 584 coins. Tools have shifted user behavior towards more structured participation, including simulation and automation. Binance Demo Trading, offering a unified spot and futures demo environment with virtual funds, was utilized by over 300,000 users to familiarize themselves with interfaces and test strategies before trading with real funds. In futures, over 1.2 million users subscribed to Smart Money, a live suite tracking aggregated behavior signals from profitable traders.

The report also highlights a significant shift in how users discover and engage with new projects. Binance Alpha 2.0 became a major discovery platform integrated into the Binance experience, surpassing $1 trillion in trading volume and attracting 17 million users in 2025. It distributed $782 million in rewards across 254 airdrops. With this scale came enhanced integrity requirements: risk controls blocked 270,000 dishonest reward participants attempting to exploit campaigns, ensuring rewards aligned with genuine users rather than bot activity.

Institutions in Motion: From Pilot Programs to Operational Workflows

Institutional adoption has transitioned from experimentation to integration, with institutions seeking crypto infrastructure that aligns with existing governance, collateral, reporting, and settlement requirements. The growing scale of institutional presence on Binance was evident as institutional trading volume increased by 21% compared to the previous year, with OTC fiat trading volume surging by 210%.

In 2025, tokenization moved closer to operational use cases, including tokenized funds as eligible off-exchange collateral under Binance’s institutional collateral framework. The report describes how modular offerings, like white-label rails through Crypto-as-a-Service, enable regulated firms to offer digital assets without having to build exchange infrastructure from scratch. Account structures offered through Fund Accounts, Binance Wealth, and Binance Prestige align with traditional finance, supporting managed strategies, entity onboarding, and dedicated service models.

Everyday Crypto: Local Rails, Payments, and Earning

Beyond trading and discovery, crypto adoption depends on users’ ability to fund accounts in local currency, move value effortlessly, and select earning tools that match their risk preferences. In 2025, Fiat and P2P volume grew by 38%; Binance Pay users increased by 30% year over year, with acceptance expanding to over 20 million merchants. Across its product line, Binance Earn distributed $1.2 billion in rewards to users in 2025.

“2025 demonstrated that crypto platforms are now being assessed as financial infrastructure, not just technology platforms. Becoming the first global crypto exchange to secure full authorization under ADGM while serving over 300 million users worldwide reflects how regulation, scale, and resilience must progress together. Our focus during the year was on delivering measurable outcomes, preventing $6.69 billion in potential fraud, strengthening market integrity, and supporting deeper institutional participation alongside record liquidity of $34 trillion traded across products. As adoption expands across markets, long-term growth will depend on governance-led frameworks that protect users, encourage responsible participation, and enable the ecosystem to scale sustainably,” said SB Seker, Head of APAC, Binance.

Final Thoughts

Digital finance is becoming more standards-driven, more liquid where execution reliability is ensured, and more user-directed as discovery and participation are simplified. Binance’s 2025 numbers demonstrate scale, but the deeper implication is the requirements of that scale: regulatory anchors like ADGM authorization, resilience and security programs that prevent real losses, strong data protection and AI governance, and product design that reduces friction for legitimate users while increasing the cost of abuse. This summary only highlights a selection of the report’s findings. The full report contains deeper breakdowns, supporting context, and additional product and infrastructure updates.