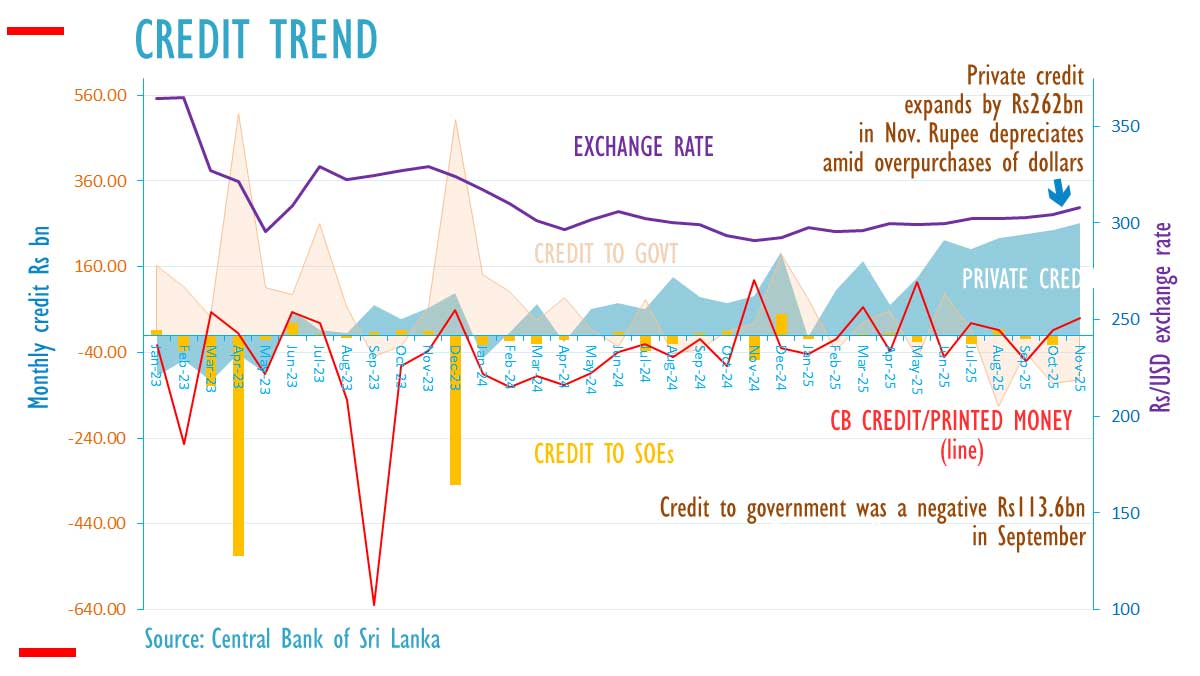

Sri Lanka’s private credit from commercial banks has reached a record high of 262 billion rupees in November 2025, up from 246 billion rupees in October, resulting in a 12-month growth rate of 26 percent, according to official data. Private credit exceeded 10 trillion rupees, totaling 10,029 billion rupees in November.

Net credit to the government from banks decreased by 103 billion rupees to 6,262 billion rupees in November 2025. Following the currency crisis triggered by central bank rate cuts in 2020, Sri Lanka has increased taxes, which have bolstered budget improvements. Additionally, credit to state enterprises declined by 2.1 billion rupees to 584.8 million US dollars.

In November, the central bank depreciated the rupee to 308 per US dollar from 304, a move analysts attribute to a critical flaw in its operating framework. Currency depreciation often results in higher energy and food prices, leading to political upheaval, regardless of government efforts to improve state finances through taxation.

Iran is currently experiencing public protests due to a currency collapse. While macro-economists often cite budget deficits as a cause, imports are largely influenced by total credit. Some government credit, unless the central bank prints money to maintain low rates, comprises interest payments on rolled-over bonds, which do not directly generate imports.

Sri Lanka has a domestic fiscal buffer invested in local banks, which can strain banks if large state deposits are withdrawn, analysts warn. This fiscal buffer, funded by excessive borrowing, raises questions about the rationale behind the Gross Financing Need cited by the International Monetary Fund as a factor in sovereign defaults.

Sri Lanka’s central bank has maintained low inflation, facilitating budget improvements, with the 2026 budget showing modest increases in current spending and revenue. However, analysts caution that the entire framework could collapse if the rupee depreciates.

EN’s Economic columnist, Bellwether, states, “The exchange rate reflects the cumulative impact of the central bank’s monetary and exchange rate policies. The current depreciation of the rupee results from efforts to accumulate reserves without implementing sufficient deflationary measures, such as selling central bank bond stocks.”

If the central bank reduces its bond holdings, private credit and imports will decrease, enabling the central bank to collect more dollars. Without these measures, the rupee will depreciate. As the central bank creates money when purchasing dollars, either the resulting rupees must be extinguished to prevent them from fueling credit and imports, or the dollars must be returned.

Failure to take these actions will lead to rupee depreciation and discredit government economic policies, resulting in social unrest, as seen in Iran. A reduction in imports by 100 million dollars per month through central bank securities sales can generate an additional billion dollars for debt repayment, preventing a potential second default.

Currently, the Treasury is reliant on central bank deflationary policies for reserve accumulation, as it neither purchases dollars in markets nor imposes dollar taxes on those capable of paying. The Treasury should consider implementing dollar taxes beginning with the dollarized Colombo Port City, then extending to exporters, hotels, and banks.

The surge in private credit is partly due to car imports. The central bank has tightened loan-to-value (LTV) ratios for cars to curb credit volume, slowing vehicle sales. However, if interest rates are misaligned, credit will shift to other sectors, reducing the capacity to settle maturing foreign debt.

Leave a Reply

You must be logged in to post a comment.