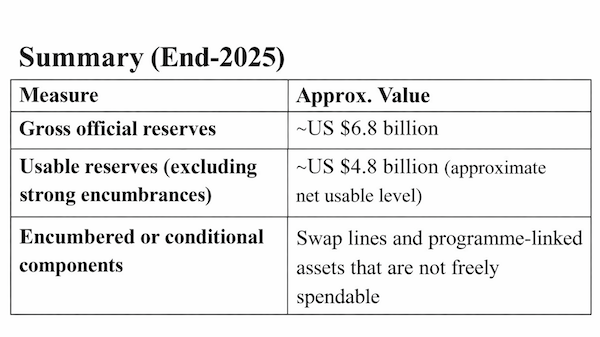

a) Gross Official Foreign Reserves

Sri Lanka’s gross official reserves — the total stock held by the Central Bank of Sri Lanka (CBSL) including foreign currency, gold, IMF position, and any swap arrangements — were reported at approximately US $6.82 billion by December 2025. This figure represents the central bank’s official reserve assets and reflects a modest increase from earlier in the year.

b) Usable (Net) Foreign Reserves

Estimates of usable reserves — the portion of gross reserves that are readily available to meet import bills, debt service, and external obligations — differ depending on what counts as usable:

When swap arrangements (such as foreign currency swaps with the People’s Bank of China) are included in gross figures, the headline reserves tend to appear higher.

However, usable reserves excluding swaps and conditional assets are significantly lower. According to central bank and IMF reporting practices, reserves net of swap arrangements were previously estimated near US $4.8 billion by late in 2025. This reflects reserves that are more freely available to cover essential imports and debt obligations.

Encumbrances and Conditions

It is important to understand that not all of the stated gross reserves are fully “usable” in an unrestricted sense:

Swap Arrangements: The gross figure often reported by the CBSL includes foreign exchange obtained under swap facilities (notably with the People’s Bank of China). Such swaps technically contribute to gross reserves but can have usability conditions, meaning they cannot be freely spent unless certain reserve thresholds are met. Markets and independent analysts have noted that including full swap amounts can overstate usable reserves.

Conditional Access: Some reserve components (like certain IMF or multilateral credit lines) may be legally part of reserve assets but are conditional on programme reviews or compliance with IMF and bilateral financing terms. These may not be immediately deployable without fulfilling policy requirements.

Debt Servicing Needs: A portion of the usable reserves is effectively earmarked for scheduled external debt service (including IMF repayments and other external liabilities). Large debt outflows can rapidly reduce the net available buffer, even if headline reserves remain stable.

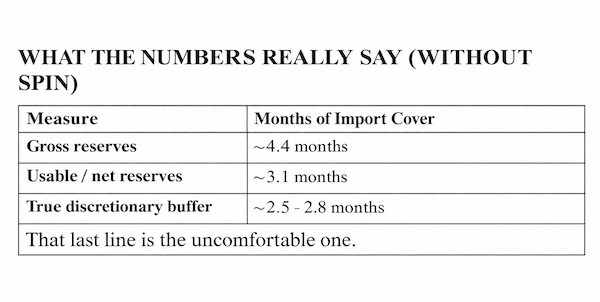

BASELINE: WHAT DO WE MEAN BY “MONTHS OF IMPORT COVER”?

Months of import cover answers one simple question:

If all foreign inflows stopped tomorrow, how long could Sri Lanka keep importing essential goods using its reserves alone?

International norms:

- 3 months -> minimum safety threshold

- 4–5 months -> comforting buffer

- Below 3 months -> external vulnerability

IMPORT BILL ASSUMPTION (REALISTIC)

Sri Lanka’s post-crisis import compression means we are not using pre-2020 import levels. Average monthly imports (2025 run-rate): approx. US$1.5–1.6 billion per month. For calculation purposes, US$1.55 billion/month.

(That reflects continued controls, subdued consumer demand, and IMF programme discipline.)

GROSS RESERVES IMPORT COVER Gross official reserves (end-Dec 2025) ~US$6.8 billion

Gross import cover: 6.8 ÷ 1.55 ≈ 4.4 months

USABLE (NET) RESERVES

Now we remove what cannot be freely used.

Usable reserves (net of major encumbrances)

~US$4.8 billion

(Excludes effectively locked swap components and conditional assets.)

Usable import cover: 4.8 ÷ 1.55 ≈ 3.1 months

OPERATIONAL REALITY

Sri Lanka’s usable import cover is closer to 3.1 months.

That is just above the IMF’s minimum comfort line — not a cushion.

WHAT IS “ENCUMBERED” — AND WHY IT MATTERS

Not all reserves are equal. Some are counted, but not spendable at will.

Key encumbrances:

1. Currency swaps (notably China) Included in gross reserves

Often cannot be drawn down freely Trigger conditions apply . Markets discount them heavily

2. IMF-linked assets

Legally reserves, Practically conditional, Access tied to programme compliance and review timing

3. Earmarked outflows

IMF repayments, Multilateral obligations, Essential imports (fuel, medicine)

These don’t disappear — they queue up.

WHY THIS MATTER POLITICALLY & ECONOMICALLY

Any external shock — oil prices, shipping disruptions, global tightening — would immediately test this buffer The margin for policy error is thin

This is why:

– IMF discipline remains non-negotiable

– Populist fiscal moves are risky

– Reserve “growth” headlines must be read carefully

THE ONE SENTENCE THAT SUMS IT UP

Sri Lanka’s reserves look stable on paper, adequate in headlines, and tight where it actually counts.

Leave a Reply

You must be logged in to post a comment.