Easing of Sri Lanka’s interbank rates over the past week is being observed, highlighted by a decline in both call money and gilt-backed repo rates, according to recent data. This trend typically signifies a reduction in private credit. The central bank intervened by purchasing over 20 million US dollars from the market, thereby preventing the appreciation of the rupee as the nation recovers from the impact of cyclone Ditwah.

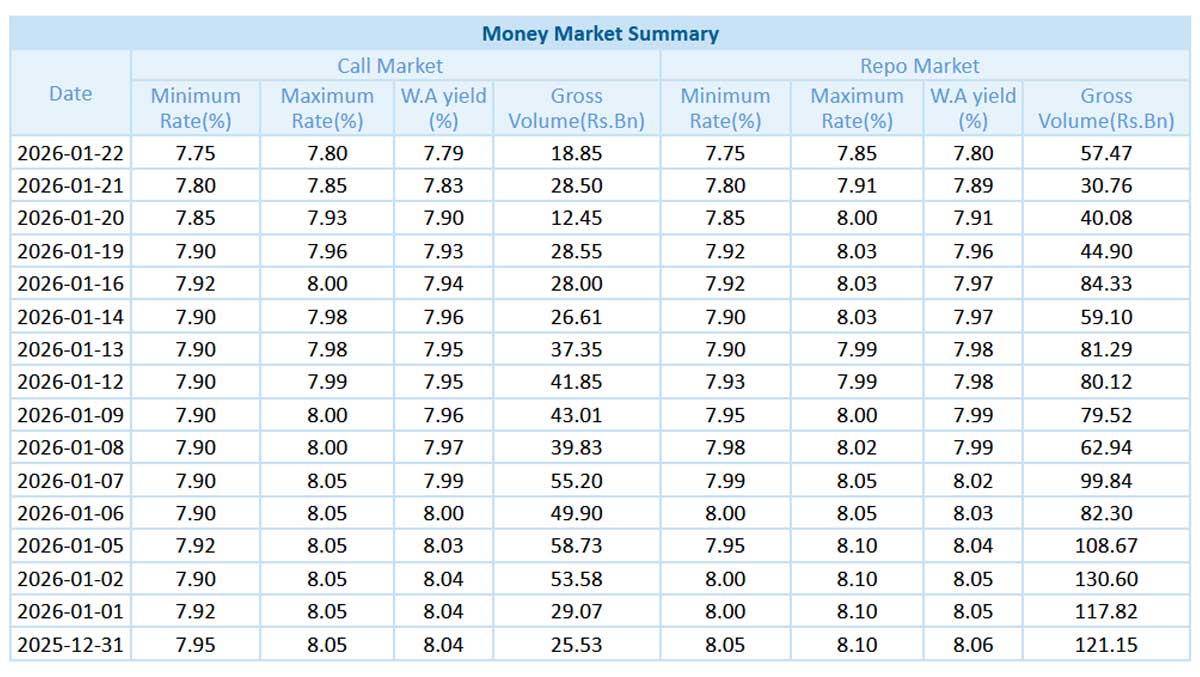

Central bank data reveals that the weighted average call money rates, which hovered around 8.04 percent in December 2025, decreased to 7.79 percent by January 22. Similarly, gilt-backed repo rates, which had reached as high as 8.10 percent by the end of December, fell to 7.80 percent by January 22. Meanwhile, treasury bill rates have increased recently due to the government’s relief payments following cyclone Ditwah.

The central bank of Sri Lanka previously triggered the first balance of payments crisis for independent Ceylon by controlling Treasury bill yields. Generally, falling rates suggest a slowdown in credit, and historically, major natural disasters have triggered such slowdowns, often leading to currency appreciation if permitted by the central bank. Notably, the rupee appreciated sharply after the December 2004 tsunami when the central bank allowed it.

However, in the aftermath of cyclone Ditwah, the central bank has been actively purchasing dollars in the market, thereby preventing the rupee’s appreciation. On January 22, market participants reported that authorities bought over 20 million dollars from banks at a rate of approximately 309.80 to the US dollar, inhibiting any appreciation.

When the central bank buys dollars, new money is created, a process described by the founding governor as the ‘monetization’ of a balance of payments surplus. Such a surplus is feasible through improved monetary policy from the market operations department, operating under a scarce reserve regime, along with coupon interest payments on the central bank’s bond portfolio. However, exchange rate policy has offset the benefits of sound monetary policy and threatens to undermine the current administration’s economic agenda, including efforts to reduce electricity costs.

Analysts have warned that given the hardships faced by the population due to past flawed monetary and exchange rate policies—which led to currency collapse and increased poverty—there is a risk of social unrest if energy and food prices are driven up. Since its creation, the Sri Lankan central bank has depreciated the rupee from 4.70 to 310 to the US dollar, with most depreciation occurring post-1980 as attempts were made to target money supply without a floating exchange rate. This strategy destabilized government finances, incited social unrest, and undermined economic reforms.

Monetary instability intensified after the civil war ended, as money was printed to stimulate growth under the guise of flexible inflation targeting and potential output targeting, ultimately culminating in an external sovereign default.