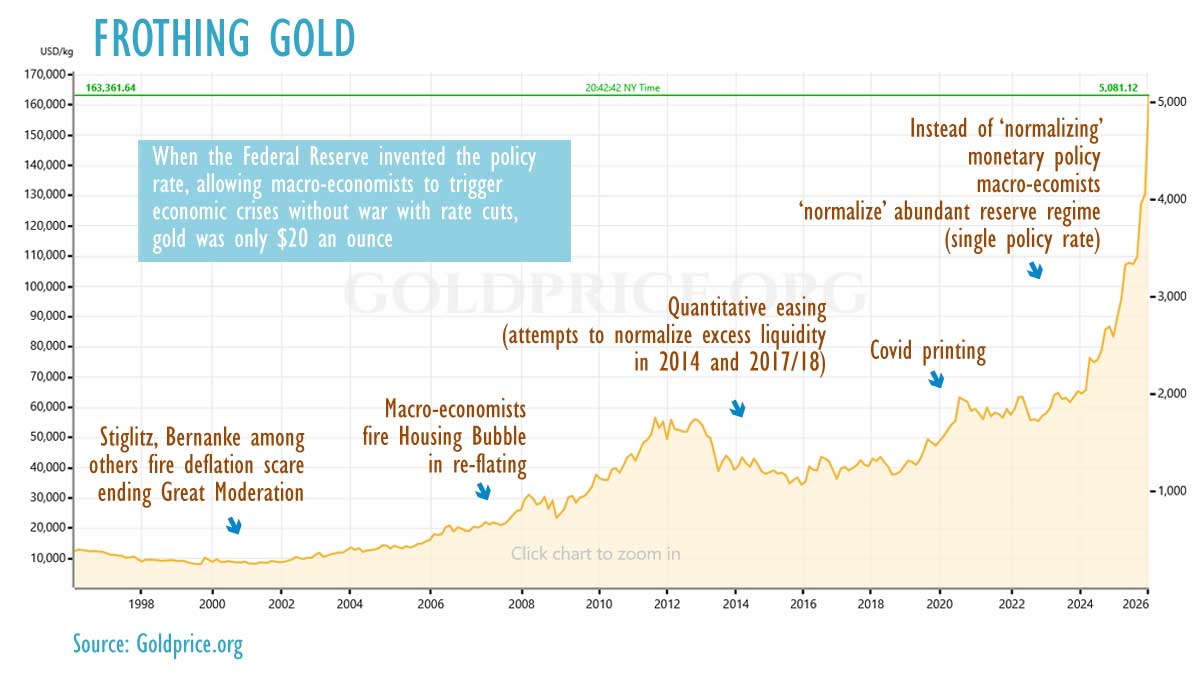

On Monday, gold prices surged to over $5,000 per ounce, driven by speculative demand amid uncertainty surrounding erratic U.S. policy, according to reports. This increase is also attributed to the Federal Reserve and the European Central Bank maintaining abundant reserve regimes.

In a note to investors, HSBC, as quoted by CNBC, a U.S. business news channel, stated, “The recent further leg up in gold and silver prices has arrived on the back of geoeconomics issues related to Greenland.” Silver experienced a rally as well, with prices rising 3 percent to $106.1 per ounce.

Since 2001, gold prices have been on a steady incline after the Federal Reserve kept interest rates low to ‘reflate’ the U.S. economy under pressure from inflationists. Following the housing bubble, the so-called quantitative easing was implemented, moving away from monetary policy normalization in favor of an abundant reserve regime.

Gold prices received another boost after money was printed during the COVID-19 pandemic, and they have risen exceptionally fast following the election of President Donald Trump. Leading up to 2008 and quantitative easing, central banks were net sellers of gold. However, after quantitative easing weakened the U.S. dollar, purchases by central banks, as well as speculative and investment buying, increased significantly.

According to the World Gold Council data, central banks purchased 913 tonnes of gold in 2015, with China acquiring 708 tonnes. In the first three quarters of 2025, central banks bought 342.1 tonnes, compared to 427.7 tonnes for the entire year of 2024.

At the turn of the millennium, gold prices were only $284 per ounce when inflationists, including Ben Bernanke and Joseph Stiglitz, began raising a deflation scare. Stiglitz also urged the International Monetary Fund to print special drawing rights in 2001, as detailed in “Lessons from the Global Slowdown.”

The recent surge in demand has largely been driven by ‘investment’ or speculative interest. When the Federal Reserve was established, gold was priced at only $20 per ounce. After implementing policy changes in the 1920s, which fueled the Roaring Twenties bubble, the Fed devalued gold to $35 per ounce in a competitive devaluation in 1935, as many countries failed to maintain the gold standard due to policy rates.

The Bretton Woods system set gold at $35 per ounce, but it eventually collapsed as rate cuts for ‘full employment’ policies led to its downfall when President Nixon closed the gold window. (Colombo/Jan26/2026)