Sri Lanka does not have a transport problem.

It has a foreign exchange problem that happens to move on wheels.

Every diesel bus and petrol-powered tuk-tuk that clogs our roads is not merely a vehicle; it is a daily withdrawal from an already fragile balance of payments. Fuel imports drain dollars, pollute cities, and lock working people into volatile operating costs that the State then tries — unsuccessfully — to cushion with subsidies.

If Sri Lanka is serious about economic reform, electrifying public transport is no longer a climate aspiration. It is a fiscal necessity.

The question is not whether Sri Lanka should convert public buses and tuk-tuks to electric. That decision has effectively already been made by arithmetic. The real question is whether the transition will be designed, or merely announced.

The False Comfort of Diesel

For decades, transport policy has been treated as an engineering issue rather than an economic one. Buses were purchased. Fuel was subsidised. Losses were absorbed. The Treasury bled quietly.

Today, that model is unsustainable.

Fuel imports remain one of Sri Lanka’s largest and most inescapable dollar outflows. Every spike in oil prices triggers inflation, political pressure, and emergency policy reversals. No IMF programme can insulate an economy that insists on importing volatility by the barrel.

Electric public transport changes that equation structurally. Once a bus is electrified, the fuel bill does not fluctuate with geopolitics. Once a tuk-tuk is electric, the driver’s daily costs stabilise. These are not abstract benefits; they are measurable, permanent savings.

This Is Where Climate Finance Actually Works

Sri Lanka often speaks about climate vulnerability but struggles to convert that reality into funding. Electrifying buses and tuk-tuks is one of the few interventions where climate finance, development finance, and domestic self-interest align perfectly.

Multilateral lenders — the World Bank, ADB, AIIB — are already predisposed to fund urban transport electrification. Climate funds such as the Green Climate Fund and Global Environment Facility exist precisely for such transitions. Carbon markets, under Article 6 of the Paris Agreement, reward projects that replace fossil fuels with clean alternatives at scale.

What has been missing is not money. It is coherence.

Electric transport cannot be pursued through scattered pilots, competing ministries, or press-conference policy. It

requires a single national framework, clean procurement, and ruthless focus on outcomes.

The State Should Not Buy Every Bus

One of Sri Lanka’s habitual errors is assuming that reform means State ownership. It does not.

The Treasury does not need — and cannot afford — to purchase every electric bus or tuk-tuk outright. What it must do

is design markets.

Public–private partnerships can deliver electric fleets through fleet-as-a-service models, battery leasing, and route concessions where the State pays for kilometres served, not vehicles owned. This shifts capital risk away from the public balance sheet while forcing efficiency into operations.

Done correctly, such models reduce corruption, limit upfront borrowing, and align incentives. Done badly, they recreate past procurement disasters. The difference lies in contract transparency — something Sri Lanka has learned the cost of ignoring.

Tuk-Tuks: The Quiet Opportunity

If buses are the backbone, tuk-tuks are the bloodstream.

Hundreds of thousands of drivers operate as owner- operators, absorbing fuel price shocks daily. For them, electric conversion is not ideological; it is economic. Lower running costs translate immediately into higher take-home income.

Corporate ownership models, state-back micro finance, and battery-as-a-service structures can make electric tuk-tuks viable without burdening the Budget. If drivers save money from day one, adoption will not need coercion. It will spread organically

Beware the Easy Money

Vendor-financed electric fleets from foreign manufacturers will arrive quickly — particularly from China and India. Some of these offers will be attractive. Some will be dangerous.

Tied procurement, limited local value addition, and opaque financing terms can replace fuel dependency with technology dependency. Sri Lanka cannot afford to repeat past mistakes under a green banner.

Electric does not automatically mean sovereign-safe.

The Political Test

Electrifying transport will not deliver instant applause. Arrival statistics are easier to sell than avoided fuel imports. Ribbon-cutting is more visible than balance-of- payments relief.

But this is precisely why the decision matters.

A government serious about reform must be willing to trade short-term optics for long-term stability. Fuel subsidies are politically addictive. Electrification breaks that addiction — slowly, structurally, and permanently.

The Choice Ahead

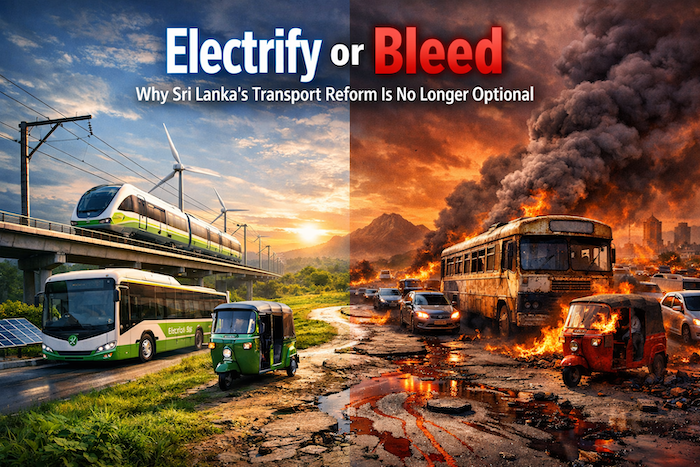

Sri Lanka can continue importing fuel, subsidising losses, and announcing audits after the damage is done. Or it can redesign its transport system to stop bleeding dollars every time an engine turns over.

Electric buses and tuk-tuks are not luxury experiments. They are economic infrastructure.

The only real risk is not acting — or worse, acting without a plan.

Electrify, with discipline.

Or continue bleeding, with applause.