Sri Lanka’s fuel crisis is discussed endlessly — and calculated almost never.

We argue about prices, queues, subsidies, and IMF conditionalities as if fuel were a mood. It is not. It is mathematics. And the arithmetic, once laid bare, explains why every oil shock becomes a national emergency and every fuel price revision becomes a political event.

Start with public transport, the sector meant to save fuel. Sri Lanka has over 113,000 buses registered in various categories, but that figure flatters reality. What actually matters is how many are on the road on a working day. The answer is closer to 8,000 buses — about 5,000 operated by the Sri Lanka Transport Board and just under 3,000 private buses running regular services.

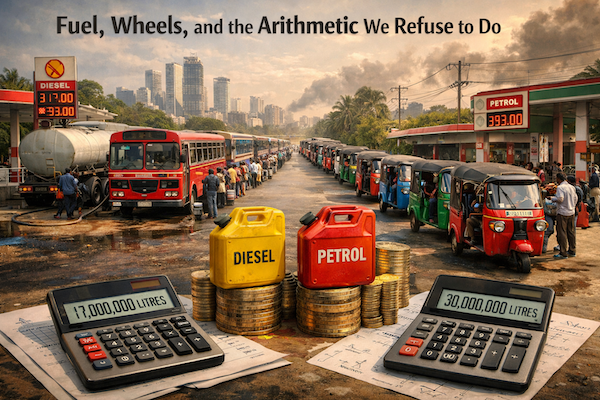

Each of those buses consumes roughly 70 to 75 litres of diesel a day. Multiply that by 30 days, and public transport alone burns around 17 million litres of diesel every month — quietly, predictably, and without controversy.

Then comes the fleet that dominates our streets and our blind spots: three-wheelers.

Sri Lanka has approximately 1.18 million registered tuk-tuks. Not all run daily, but even conservative assumptions suggest hundreds of thousands are active each month. Individually, a three-wheeler consumes little — perhaps 1.5 to 2 litres of petrol a day. Collectively, they are a fuel economy unto themselves. Taken together, three-wheelers are estimated to consume over 30 million litres of petrol every month.

Pause there.

Before counting private cars, motorcycles, vans, or freight — buses and tuk-tuks alone account for more than 50 million litres of fossil fuel consumption every month.

Zoom out to the national balance sheet and the consequence is stark. Sri Lanka’s annual fuel import bill exceeds USD 3.4 billion. That is not an accounting abstraction. That is foreign exchange permanently exiting the country to keep an internal transport model alive — a model built on imported energy and political hesitation.

The pro-people truth is uncomfortable but unavoidable: this is not about drivers, commuters, or livelihoods. It is about a system that never treated transport as energy policy. Every tuk-tuk driver is responding rationally to incentives. Every commuter boarding a bus is doing what survival demands. The irrationality sits higher up — in decades of deferred transition.

You can subsidise fuel.

You can tax it.

You can blame global markets.

But you cannot negotiate with arithmetic. And arithmetic, at the moment, is winning.

POLICY FOCUS | WHAT MUST CHANGE IN 5 YEARS

If Sri Lanka stays on its current path, the next oil shock will look exactly like the last one — queues, anger, subsidies, regret.

These are the five non-negotiables:

1. Electrify Public Transport First

Electric buses cut fuel imports fastest. This is energy security, not climate theatre.

2. Transition Three-Wheelers, Don’t Punish Them

Electric tuk-tuks protect livelihoods and slash petrol use — if financing and charging exist.

3. Move People, Not Vehicles

Design transport around journeys, not ownership. Fewer kilometres matter more than better engines.

4. Price Fuel Honestly — Protect People Directly Subsidise households and public transport, not consumption volume.

5. Measure Volume, Not Just Price

Publish monthly fuel use by vehicle type. Policy without volume data is guesswork.

The Bottom Line

Fuel policy is transport policy. Transport policy is energy security. Energy security is national survival.

The numbers are already telling us the story. We just need to listen.