The downfall of Touchwood Investments PLC remains one of the clearest cautionary episodes in Sri Lanka’s capital market history. Marketed as an innovative plantation-based investment model, the company drew thousands of retail investors with promises of attractive long-term returns from agarwood, sandalwood, mahogany, and other high-value timber crops. The narrative was compelling: invest in trees today, harvest wealth tomorrow. Many investors committed funds based largely on trust in the vision presented by the company’s leadership and the credibility attached to a listed entity.

In its earlier years, Touchwood reported operating profits and published figures suggesting earnings before finance costs and tax, with profits attributable to shareholders. Financial results around 2012 reflected positive operating performance and earnings per share during growth years, creating the impression of a profitable and expanding enterprise. However, this picture of profitability later came under scrutiny because of the way the company valued its core assets — its plantations.

Years before the final collapse, the Sri Lanka Accounting and Auditing Standards Monitoring Board had raised serious concerns about the reliability of Touchwood’s valuation of biological assets in its financial statements for 2005 and 2006. The regulator determined that the fair value estimates used for timber plantations were “clearly unreliable” and that the method adopted was not in accordance with IAS 41 – Agriculture, the very standard the company claimed to follow. The Board noted that if IAS 41 had been properly applied — valuing assets closer to cost or cost less impairment — the company would not have reported net profits for those periods. Given the material effect on the financial statements, the matter was referred to the Attorney General, and the auditors’ compliance with auditing standards was also brought into question.

At the same time, the issue was far from straightforward. Commentary published in a 2010 newsletter of the Bar Association of Sri Lanka discussed a related legal judgment and expressed the view that the Monitoring Board’s statutory authority to challenge valuation judgments purely on IAS 41 grounds was itself debatable. Further adding to the mixed signals, Touchwood received a Certificate of Compliance at the Annual Report Awards from the Institute of Chartered Accountants of Sri Lanka in 2010, covering financial reporting and compliance — implying that, at least from a professional accounting standpoint at the time, the company’s reporting practices were considered acceptable.

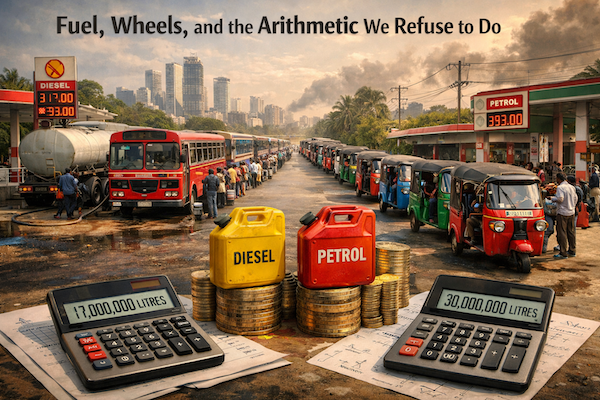

Note: Recent warnings by the Central Bank of Sri Lanka, highlight the resurgence of high-yield plantation and agriculture-based investment schemes operating in largely unregulated spaces. The Governor cautioned that such ventures often promise unrealistic returns and fall outside the central bank’s regulatory scope, leaving investors without protection if funds are lost. Ongoing investigations into alleged illegal deposit-taking linked to plantation ventures reinforce how the lessons from Touchwood remain highly relevant today.

These conflicting positions — regulatory criticism, legal debate, and professional recognition — created significant ambiguity around the true strength of Touchwood’s financial position. For investors, the reported profits and rising asset values provided comfort. In hindsight, however, the valuation of biological assets played a central role in shaping a perception of profitability that may not have been supported by underlying cash flows.

As maturity periods for investor contracts approached, Touchwood’s cash flow position weakened. Despite claims of holding assets worth billions and plans to settle dues, the company struggled to generate liquidity to meet obligations to investors and creditors. A winding-up petition followed, and in 2014 the Commercial High Court ordered the company to be wound up after concluding that it could not satisfy its debts. By then, trading of Touchwood shares on the Colombo Stock Exchange had already been suspended, leaving shareholders without an exit.

The company was chaired by Roscoe A. Maloney, under whose tenure Touchwood expanded aggressively and promoted its plantation investment narrative. The collapse triggered wider questions about corporate governance, financial disclosure standards, and the responsibility of listed company leadership toward public investors.

Years later, the Touchwood case stands as a lesson in how complex accounting treatments — especially involving biological assets and fair value estimates — can significantly influence perceptions of profitability and financial strength. It underscores that strong narratives and reported profits must ultimately be supported by transparent reporting, sound governance, and sustainable cash flows.

Source: https://srilankaequity.forumotion.com/t3965p125-touchwood-case-review