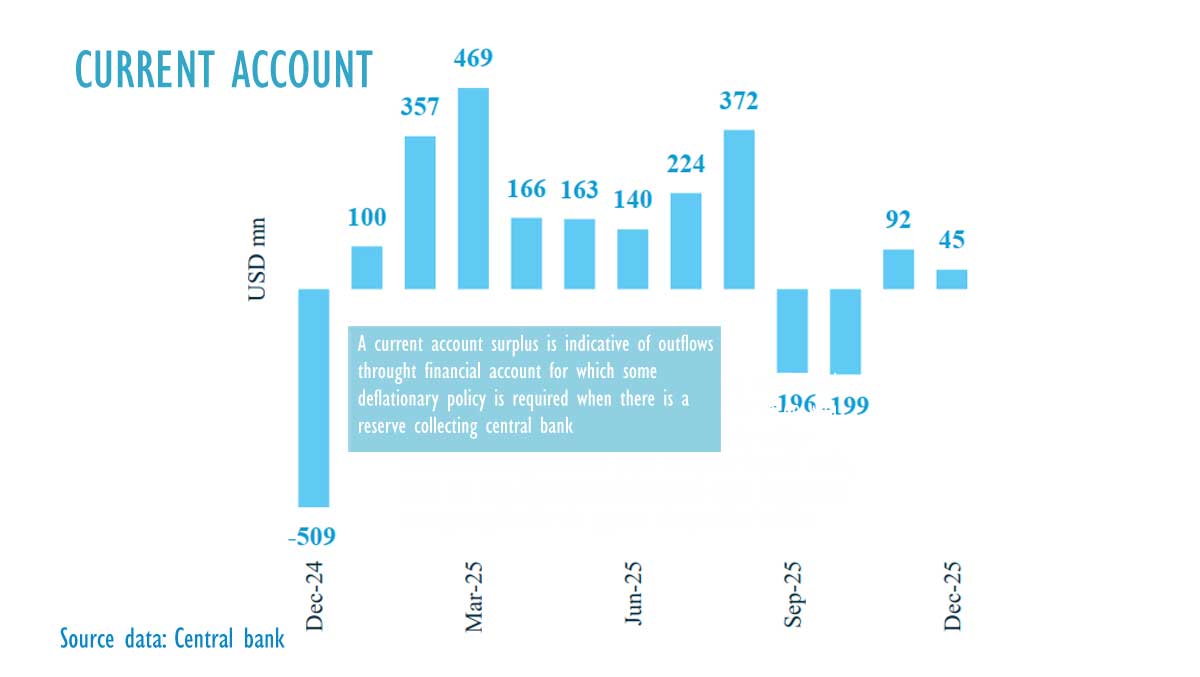

FINANCIAL CHRONICLE – Sri Lanka achieved a current account surplus of 1.7 billion US dollars in 2025, according to official data, highlighting net outflows through the financial account for debt repayment. In December, the current account surplus stood at 45 million US dollars, a decrease from 92 million dollars in the previous month.

The current account serves as a mirror image of the financial account, accounting for errors and omissions. Sri Lanka has been actively repaying debt, with the central bank settling loans from the International Monetary Fund related to a currency crisis triggered by rate cuts in 2015, alongside loans from India following rate cuts in 2020.

The central bank has implemented broadly deflationary policies by paying coupons into its bond portfolio, which has allowed for the accumulation of reserves while permitting a minimal amount of bonds to expire. Additionally, the central bank sold dollars to the government in an unsterilized peg defense, converting some current inflows into financial account outflows.

Analysts have suggested that the Treasury should purchase dollars to repay debt. In 2025, importers bought 21.4 billion US dollars, whereas the Treasury struggled to secure one or two billion dollars for debt repayment, leading to defaults. Analysts argue for ending the monopoly privileges of the central bank, which carries an inflation bias.

Furthermore, it has been recommended that the Treasury impose dollar taxes, ending the so-called ‘Government Acceptance’ privilege granted to central banks by Western monarchs, to prevent potential defaults. Despite these measures, the rupee depreciated in 2025 due to unsterilized purchases of dollars by the central bank exceeding unsterilized sales and deflationary policies.

To prevent depreciation, if liquidity from dollar purchases—termed ‘monetization’ of a balance of payments surplus by the central bank’s founding Governor—is unsterilized, the dollars must be returned at the same rate at which they were purchased. (Colombo/Jan03/2026)