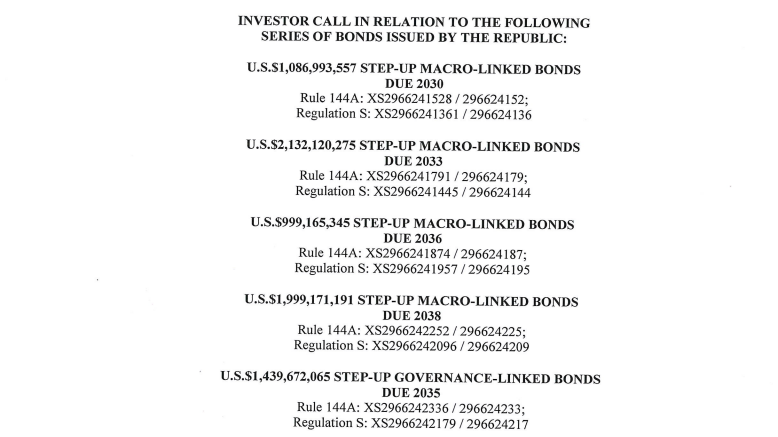

The question many are asking—quietly in boardrooms, loudly at dinner tables—is this:

Is SriLankan Airlines finally being run as a commercial enterprise answerable to the Treasury, or is it still a playground for deal-makers with national letterheads?

The honest answer sits somewhere in between.

There has been a shift. The rhetoric has changed. The language is now about cost control, route rationalisation, fleet discipline, and cash flow. Losses are no longer worn as patriotic badges. Treasury oversight is tighter. There is less tolerance for free-for-all procurement, vanity routes, and opaque leasing decisions. On paper, at least, the airline is no longer pretending losses don’t matter.

But commercial aviation is not a press release sport.

True commercial discipline means one brutal thing: bottom-line reporting with consequences. Not just to the Cabinet. Not just to Parliament. But to the balance sheet. And here’s where SriLankan Airlines remains trapped by its past.

The legacy debt is the anchor around its neck.

Decades of accumulated losses—driven by fuel hedging disasters, politically motivated route choices, overstaffing, expensive leases, and governance drift—have left the airline structurally uncompetitive. Even if today’s management runs a tight ship, they are doing so while towing yesterday’s wreckage.

So the obvious question follows: Why not let the State write it off ?

In theory, yes. The State can absorb the legacy debt. After all, much of it arose from decisions taken in the name of the State. Writing it off would clean the slate, reset the balance sheet, and give the airline a fighting chance to operate like a real business rather than a patient on life support.

But here’s the catch—and it’s a big one.

A debt write-off without governance reform is not a rescue. It’s a reset button for the next disaster.

If legacy debt is wiped without:

legally enforced commercial mandates

independent board appointments

procurement transparency

political non-interference written into operating DNA

then all the taxpayer has done is fund the sequel.

This is why Treasury officials are cautious. Not heartless— cautious. Every rupee written off must be defensible to a public that has already paid for the same mistakes multiple times.

The pro-people solution lies in sequencing.

First: ring-fence the airline as a commercial entity, with explicit performance metrics reported to the Treasury— not negotiated in corridors.

Second: isolate legacy debt transparently, acknowledge it as sovereign baggage, and decide—openly—what portion the State will absorb.

Third: lock in governance so that no minister, official, or “well-connected intermediary” can quietly reintroduce the habits that created the mess.

A flag carrier can be a strategic asset. Many countries run them successfully. But none do so by confusing symbolism with solvency.

SriLankan Airlines does not need romance.

It needs rules.

And if the State is to give it a new lease of life, it must also give itself a new rulebook.

Otherwise, we are not reforming an airline—we are merely refinancing memory loss at public expense.