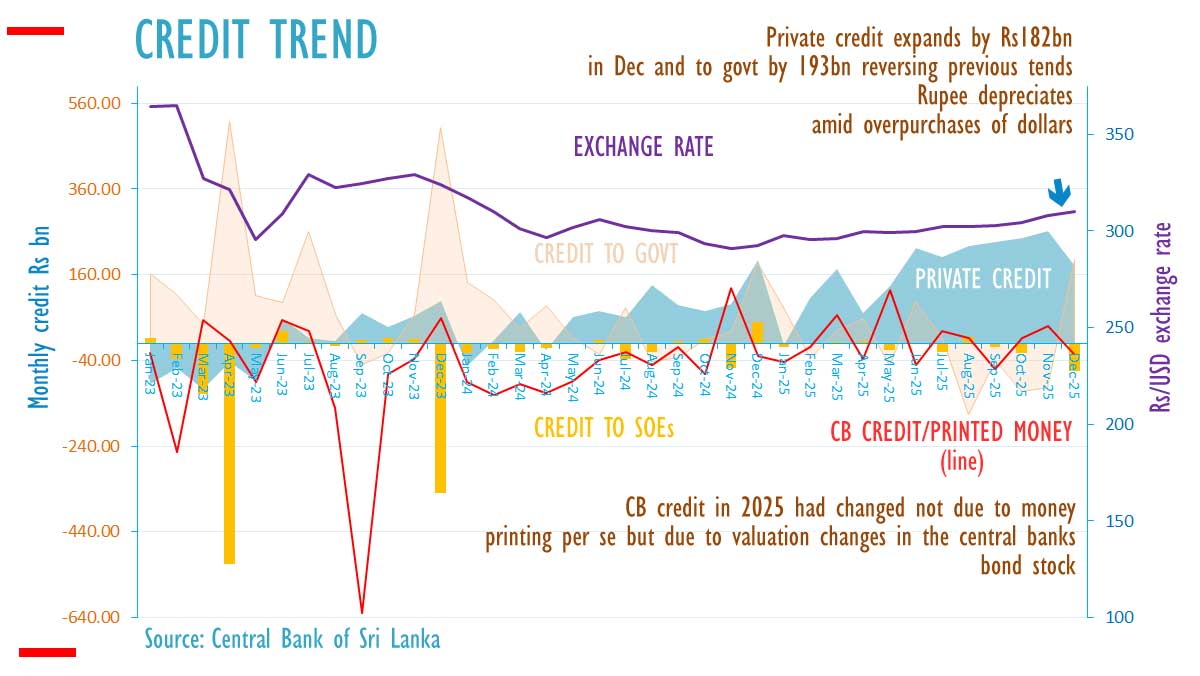

FINANCIAL CHRONICLE – In December 2025, credit extended by Sri Lankan commercial banks to private borrowers decreased to 182.8 billion rupees from a peak of 262 billion rupees in the previous month, according to official data. This decline coincided with a significant rise in government borrowings.

Throughout 2025, Sri Lankan banks provided a total of 2,056 billion rupees in loans to private borrowers, directing a substantial portion of savings towards non-government sectors, including vehicle purchases. While car imports generate significant cash flow for the government, thereby reducing the fiscal deficit, credit extended to the government, or net credit to government, rose by 194.7 billion rupees in December, contrasting with a 103.5 billion rupee reduction in November.

During December, Treasury bill yields surged as the government issued Ditwah relief payments. By allowing T-bill rates to climb, the Public Debt Department may have averted external financial troubles and staved off the initial signs of a potential second sovereign default.

Sri Lanka had previously established a substantial domestic buffer under the central bank’s control to manipulate interest rates. However, analysts have argued that these domestic buffers are insufficient to manage interest rates effectively, advocating instead for an external sovereign wealth fund. The buffer, deposited in state banks, is often lent in interbank markets or used to purchase Treasury bills, resulting in no tangible buffer, aside from excess liquidity held by the central bank, which tends to bolster foreign reserves.

When government deposits are withdrawn, the affected banks must reduce interbank credit lines, halt further private credit, or cease participating in Treasury auctions. Initiating open market operations could lead to a currency crisis by injecting money into the banks. Nevertheless, an increase in bill rates could mitigate any imbalance by crowding out private credit.

The central bank refrained from resuming open market operations and allowed interbank rates to rise, thus avoiding a systemic crisis and loss of confidence. Sri Lanka faced the Ditwah natural disaster in December, which typically reduces private credit, triggers inflows, and places appreciation pressure on the currency. In contrast to the 2004 tsunami, the central bank in 2025 opted to overpurchase dollars and resisted allowing the rupee to appreciate, despite President Anura Dissanayake’s earlier call to halt monetary depreciation.

This call echoed a statement by then Deputy Minister of Economic Development Harsha de Silva in 2018, when the central bank depreciated the rupee after printing money. De Silva, an economist and former bank treasurer, had outlined methods to reform the central bank’s operating framework to strengthen the currency by allowing interbank rates to rise and reach the corridor’s ceiling, thereby restoring a scarce reserve regime.

“If it is hitting the ceiling and you’re not injecting money at below 8.5 percent, then it’s alright and there’s no need currently to increase your policy rates,” de Silva remarked in October 2018, amid a struggling economic program and free trade agenda. “But at least let the overnight rates be within the higher margin of the policy rate. It’s prudent. Of course, it’s going to have a negative impact on growth, but that is what we have to give to have some sort of stability on the exchange rate.”

At that time, the central bank was also printing money to sterilize interventions, creating a cycle of interventions reminiscent of the ‘Penelope’s web’ described by David Ricardo, referring to undoing by night what was done in the daytime, a statement by Adam Smith. De Silva advised against sterilizing reserve sales, which would allow rates to increase.

In 2025, the central bank sold reserves to the government and the private sector without sterilization, approximately 117 million dollars, which tends to prevent depreciation by reducing excess liquidity and interbank rates. However, questions have been raised about buy-sell swaps. (Colombo/Feb06/2026)