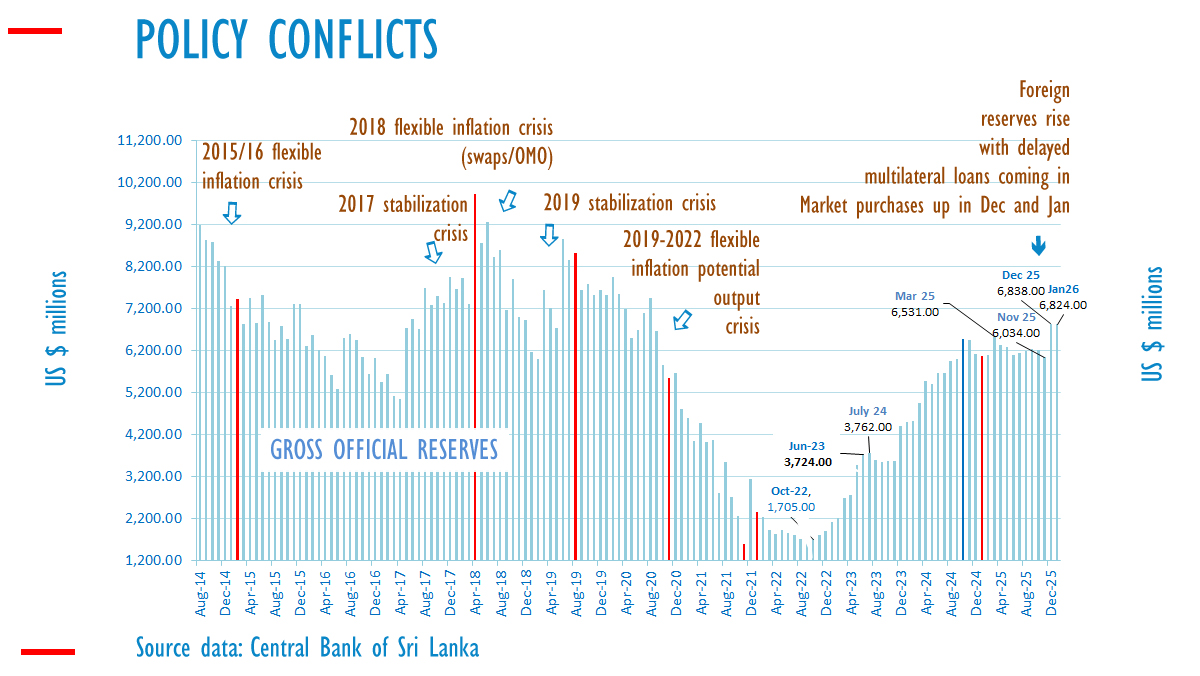

In January 2026, Sri Lanka’s foreign reserves experienced a slight decline to 6.824 billion dollars from the previous month’s 6.838 billion dollars, despite the central bank’s market purchase of 200 million dollars following cyclone Ditwah. The country’s reserve levels barely surpassed debt repayments, a situation exacerbated by a contentious rate cut in May 2025 and the central bank’s reduced deflationary stance.

Both the central bank and the government face the dual challenge of debt repayment and managing rate cuts, which, while spurring domestic investment credit, also limit the resources available for reserve accumulation or debt repayment, thereby creating an “external financing gap.”

Enforcing rate cuts with injected cash could impair the central bank’s capacity to accumulate dollars, potentially leading to actual foreign exchange shortages. Nevertheless, some deflationary policies were observed in 2025. Public resistance to the central bank’s inflationary strategies remains strong. However, analysts suggest that in 2025, authorities monetized a nonexistent balance of payments surplus, exceeding the surplus generated by deflationary policies to pursue monetary depreciation.

In December, the central bank purchased 272.5 million dollars and sold 18.8 million dollars to banks to curb further rupee depreciation amid dollar purchases under a so-called flexible exchange rate. In January, it acquired 209.8 million dollars and sold 9.5 million dollars, while separately selling dollars to the Treasury, thereby reducing liquidity through unsterilized sales.

In 2026, the government of Sri Lanka faces significant debt settlements, with the central bank’s loans also set to decrease by year-end. The nation employs a flexible exchange rate, a policy criticized for undermining confidence and increasing uncertainty by disregarding classical economic principles.

Sri Lanka experienced a default in 2022, not due to war, but after multiple cycles of flexible inflation targeting and potential output targeting, which led to foreign exchange shortages and a surge in foreign borrowing as “external financing gaps” arose from rate cuts. Analysts have advocated for the Treasury to independently acquire dollars and levy taxes in dollars to mitigate exposure to the central bank’s inflationary bias and prevent a resurgence of foreign borrowing frenzies and a potential second default.

(Colombo/Jan10/2026)