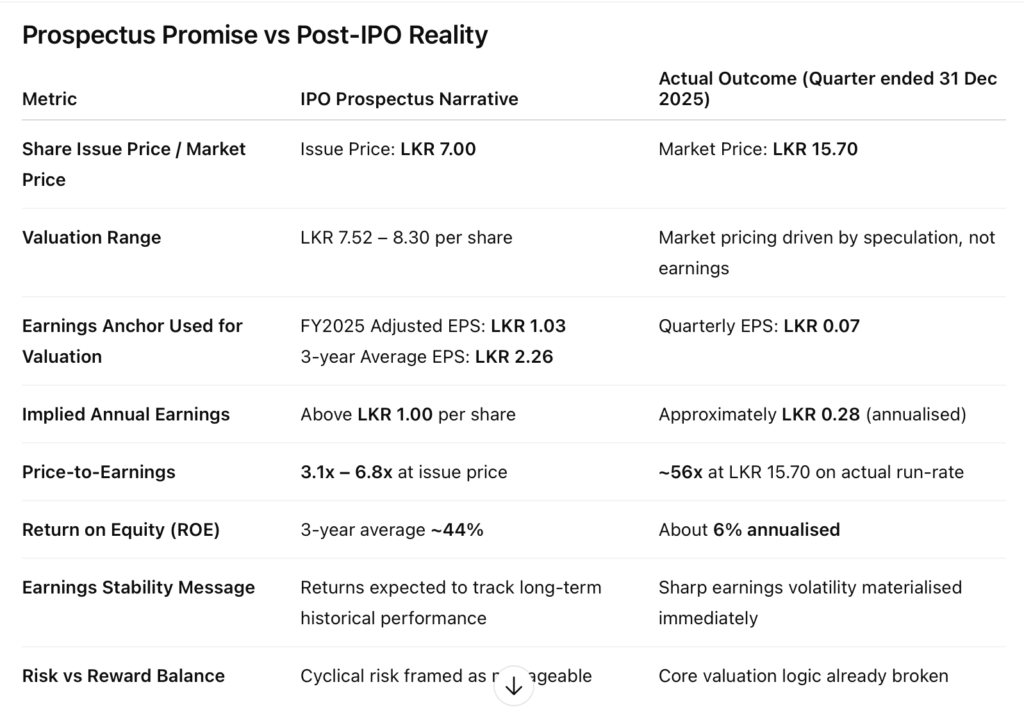

When WealthTrust Securities Limited came to the market in December 2025, the IPO was marketed as a discounted opportunity to participate in a high-return, capital-efficient primary dealer with “secure growth” prospects. The Prospectus justified an offer price of LKR 7 per share using valuation benchmarks ranging from LKR 7.52 to LKR 8.30 per share, anchored on strong historical earnings, robust ROE, and confidence that future performance would align with long-term averages

Barely weeks later, the company’s actual performance for the quarter ended 31 December 2025 tells a sharply different story.

A Collapse in Earnings Power

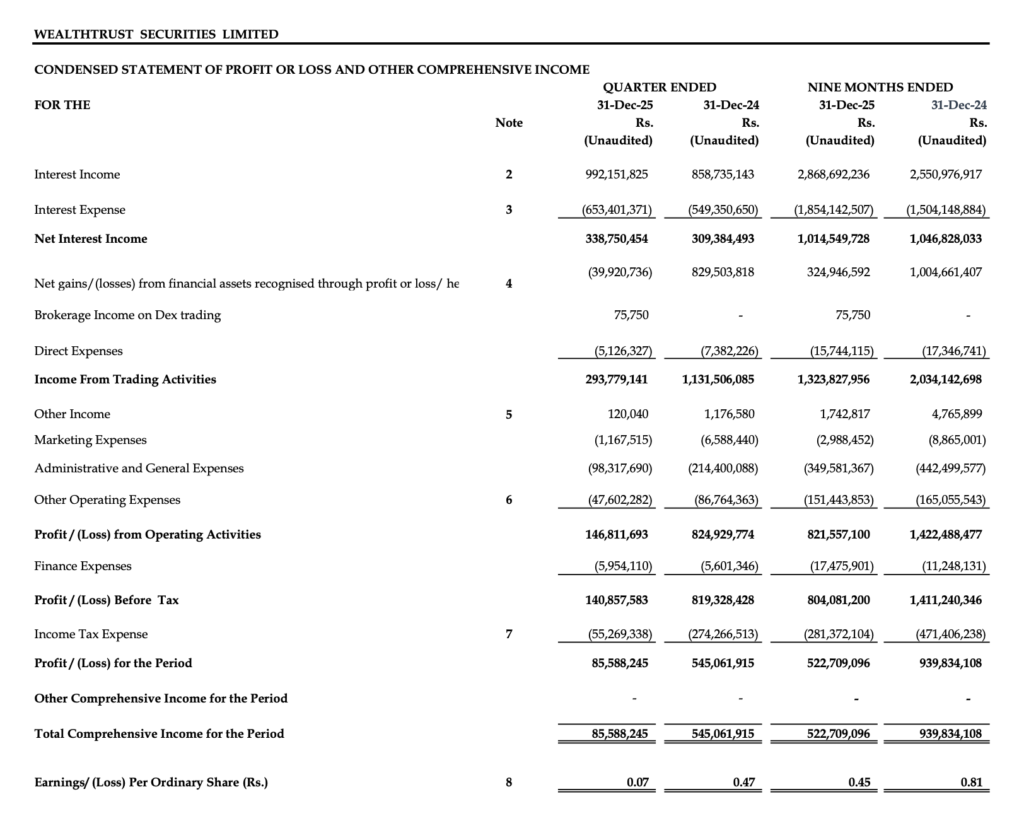

The most striking divergence lies in profitability. For the December 2025 quarter, WealthTrust reported a profit after tax of just LKR 85.6 million, translating into an earnings per share of LKR 0.07. By contrast, the IPO valuation relied on an adjusted FY2025 EPS of LKR 1.03 and a three-year average adjusted EPS of LKR 2.26, figures that underpinned P/E ratios of 6.77x and 3.10x respectively at the issue price.

At the actual quarterly run-rate, annualised EPS would barely reach LKR 0.28, implying a forward P/E of approximately 25 times, not the low-single-digit multiple implied in the Prospectus. This is not a marginal forecasting error; it is a fundamental collapse in earnings power relative to what investors were led to expect.

ROE: From “Industry-Beating” to Single Digits

The Prospectus repeatedly emphasised WealthTrust’s historically strong ROE, citing an average ROE of 44.24% over FY2023–FY2025 as a cornerstone of valuation and investor appeal 3479_1768297464162. However, the December 2025 quarter produced LKR 85.6 million in profit against an equity base of approximately LKR 5.8 billion, implying a quarterly ROE of roughly 1.5%, or 6% on an annualised basis.

This dramatic deterioration was neither hypothetical nor unforeseeable. Interest-rate volatility, mark-to-market sensitivity, and trading income cyclicality are well-known risks in primary dealer businesses. Yet the valuation framework assumed reversion to historical averages, while the actual results reveal how fragile those averages were in a changing rate environment.

Trading Income Volatility, Not “Secure Growth”

The Prospectus positioned IPO proceeds as capital that would be deployed into government securities to generate stable interest income and trading gains “in line with long-term historical performance”. In reality, the December quarter shows that income from trading activities collapsed to LKR 293.8 million, down from LKR 1.13 billion in the corresponding quarter of the previous year, while fair-value movements swung sharply, eroding operating profitability.

What investors received was not secure compounding but highly volatile mark-to-market exposure, precisely at the point when fresh public capital was being raised.

Valuation Built on the Past, Not the Reality at Listing

Crucially, the Prospectus relied on historical and adjusted earnings, including years of extraordinary profitability during favourable rate cycles, to justify a price that was marketed as a “discount” to intrinsic value. What it did not adequately convey was that the earnings environment had already shifted materially by the time of listing, and that near-term performance could diverge sharply from those benchmarks.

The December 2025 quarter ended after the IPO opened but before investors had any post-listing earnings visibility, yet the resulting numbers fundamentally invalidate the valuation logic presented to the public.

Were Investors Misled?

Legally, the Prospectus is careful, layered with disclaimers and forward-looking risk language. Economically, however, the messaging was clear: this was a low-multiple, high-ROE, capital-efficient business offering upside at LKR 7 per share. The first reported quarter as a listed entity shattered that narrative.

Investors were not simply unlucky; they were anchored to projections and valuation multiples that proved irrelevant almost immediately. When a company lists on the promise of earnings stability and delivers a 85%–90% collapse in quarterly profitability relative to implied expectations, the issue is not market volatility alone, but how selectively history was used to sell the future.

The IPO valuation was prepared by Asia Securities Advisors (Private) Limited, the Manager and Financial Advisor to the Issue, and the December results put their credibility uncomfortably in the spotlight. A valuation that unraveled within a single quarter suggests not analytical bad luck, but a failure of rigor. By anchoring pricing to peak historical earnings and optimistic averages while downplaying clear near-term earnings fragility the exercise appears less like independent valuation and more like transaction support. When “fair and reasonable” pricing collapses almost immediately after listing, investors are justified in questioning whether Asia Securities served the market, or merely the deal.

Conclusion: A Case Study in IPO Optimism

WealthTrust’s December 2025 performance exposes a familiar pattern in capital markets: IPO valuations built on peak or average historical performance, launched precisely as conditions turn. While the Prospectus may meet formal disclosure standards, the economic substance is harder to defend. Investors were sold a story of discounted value and secure growth; what they received was a business whose earnings power, at listing, bore little resemblance to the numbers used to justify the price.

In that sense, this IPO will likely stand as a cautionary example for Sri Lankan investors: a reminder that valuation is only as honest as the assumptions it quietly depends on.