Sri Lanka’s Ministry of Finance – Public Debt Management Office has successfully sold 5,100 million rupees worth of bonds via a tap issue at an average rate determined by this week’s auction. This brings the total bond sales for the week to 56.1 billion rupees, according to official data.

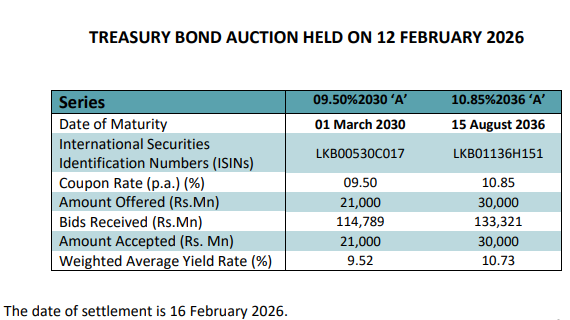

The debt office issued a bond maturing on March 1, 2030 (LKB00530C017), achieving a weighted average yield rate of 9.52 percent. Additionally, a bond maturing on August 15, 2036 (LKB01136H151) was sold at a weighted average yield rate of 10.73 percent.

On Wednesday, bonds with maturities in 2030 and 2036 totaling 51 billion rupees were sold.

The total market subscription reached 10,000 million rupees. The settlement date for these transactions is set for February 16.

(Colombo/Feb13/2026)