FINANCIAL CHRONICLE – According to a recent monetary policy report, Sri Lanka’s central bank anticipates an increase in the annual cost of living, targeting a rise towards the contentious 5 percent floor rate by the second half of 2026. The report states, “Inflation is projected to accelerate gradually and is expected to move towards the 5 percent target by H2-2026.” This trajectory is largely due to a gradual recovery in demand, alongside the stabilization of energy and transport inflation and persistent volatility in food prices. The central bank expects inflation to stabilize around the 5 percent target in the medium term, supported by appropriate policy measures.

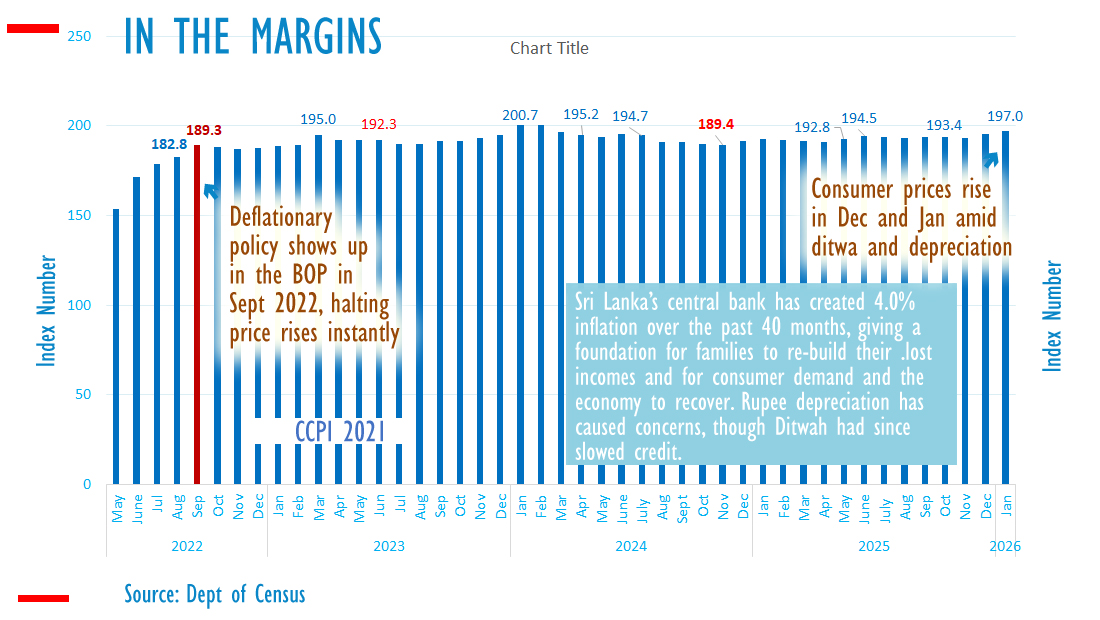

Despite claims of deflation by the central bank, citing 12-month changes in the consumer price index, the index has increased by approximately 4 percent since September 2022. This period marked the end of the central bank’s deflationary policies, which previously addressed balance of payments deficits.

Concerns have arisen as the central bank continues to push up the cost of living, partly by depreciating the rupee. Critics argue that attempts to inject liquidity or debase the currency to achieve 5 percent inflation have historically led to multiple balance of payments crises and currency depreciation. The central bank’s actions are under scrutiny, especially since a government committee has been appointed to control the cost of living, while the central bank’s policies seem to counteract these efforts.

In 2025, the central bank depreciated the rupee, selectively denying convertibility to the general public, according to analysts. President Anura Kumara Dissanayake has advocated for exchange rate stability, particularly as the rupee depreciated sharply in 2025 despite record current account surpluses. The current administration’s prudent fiscal policy has maintained the exchange rate around 300 for a year, a point highlighted by the president as evidence of economic stability. Analysts suggest this claim is valid, as macroeconomists have long blamed budget deficits, rather than flawed central banking frameworks, for external monetary issues.

The central bank has faced resistance regarding its 5 percent inflation target and reliance on inflationary policies for growth. The Committee of Public Finance in parliament, which includes members from an administration that saw its ‘social market economy’ agenda falter, has voiced concerns. The committee attributes forex shortages and rising living costs to inflationary policies.

Historically, Sri Lanka’s inflation diverged from advanced nations in the 1980s, amid significant social unrest and economic reforms. In the 1960s and 1970s, Sri Lanka’s inflation levels were more aligned with those in advanced nations, driven by full employment policies. Classical economists have warned against inflationary policies, emphasizing that any short-term gains are temporary and often result from misleading certain segments of the public.

Friedrich Hayek, a renowned economist, noted that inflation can only provide a temporary boost and that its harmful effects necessitate increasingly larger doses of inflation to sustain the economy. Hayek cautioned that continued inflation could lead to a situation where preventing further acceleration becomes challenging, potentially resulting in spontaneous deflation.

Attempts to reflate the US economy at the turn of the century, based on fears of falling prices, eventually led to the end of the Great Moderation and triggered the Housing Bubble. The subsequent collapse resulted in a true deflationary crisis, marked by bank runs and credit contraction. The US and Western nations later resorted to quantitative easing and fiscal stimulus, creating an abundant reserve regime or single policy rate.

These inflationary beliefs influenced Sri Lanka, leading to forex shortages, excessive foreign borrowings, and eventual default. State agencies like Ceylon Petroleum Corporation were forced to borrow from state banks and suppliers as the rupee depreciated. Some of these borrowings have now transitioned into national debt.

The gold and cryptocurrency bubbles fueled by quantitative easing and single policy rates have sparked fears of spontaneous deflation, as warned by Hayek. Kevin Warsh, President Trump’s nominee for Fed Chair, criticized the ample reserves regime, unsettling investors benefiting from the liquidity bubble despite high public prices.

In Britain, the birthplace of Keynesian economics, the government struggles to alter the monetary framework due to ‘central bank independence.’ Rising costs of living have led to housing shortages and reduced domestic tourism spending, despite increased taxes. Younger individuals in the UK are resorting to credit cards and loans to maintain social activities, while disposable income has been affected by both the Bank of England’s policies and new taxes.