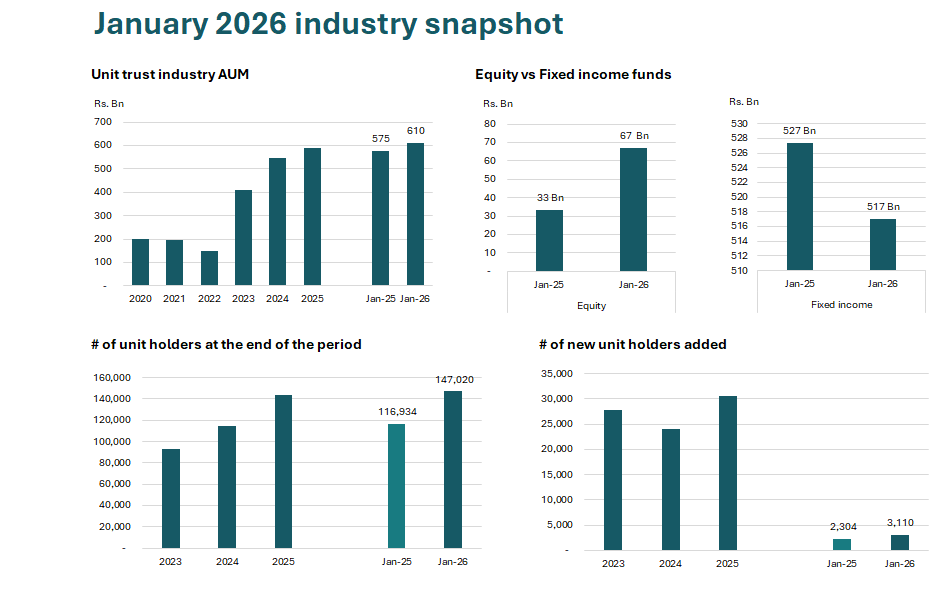

The unit trust industry in Sri Lanka has reported a 6.1% increase in assets under management (AUM) year-over-year, surpassing the Rs. 600 billion mark by the end of January 2026. AUM also saw a 3.8% rise since December 2025. These assets are currently managed across 84 funds by 16 management companies.

The growth in AUM was largely driven by equity-related funds, which doubled to Rs. 67 billion from the previous year and experienced a rapid growth of 10.2% since December 2025. In contrast, fixed income funds grew by 2.9% year-over-year. The robust growth in equity-related funds reflects positive investor sentiment and a willingness to engage in the strong capital market performance observed over the past two years, as investors increasingly seek long-term capital appreciation.

In January, the industry welcomed 3,110 new unit holders, marking a 35.0% increase year-over-year, and bringing the total number of unit trust investors to 147,020, a 25.7% rise compared to the previous year. This expansion underscores the ongoing efforts of the Unit Trust Association of Sri Lanka (UTASL) and regulators to enhance awareness, accessibility, and confidence in unit trust investments.

Commenting on the January industry results, Asanka Herath, Treasurer of the UTASL and CEO – Unit Trusts & Head of Equities at LYNEAR Wealth Management, stated: “The industry’s performance in January reflects a healthy start to 2026, supported by sustained inflows into equity-related funds and steady overall expansion of assets under management. This trend suggests that investors are becoming more deliberate in their allocation strategies, seeking growth opportunities while maintaining diversified exposure through professionally managed funds.”

He further affirmed: “We are also encouraged by the continued rise in new unit holders, which signals widening participation in capital markets. As we move further into the year, the focus will remain on improving investor awareness, enhancing product accessibility, and ensuring that disciplined fund management continues to deliver long-term value to investors.”

The UTASL serves as the representative body for the country’s licensed fund management companies, committed to upholding the highest standards of professionalism, integrity, and transparency across the industry. Comprising 16 member companies regulated by the Securities and Exchange Commission of Sri Lanka (SEC), the UTASL aims to popularize unit trusts and encourage Sri Lankans to prioritize long-term and professionally guided investing, alongside short-term savings, while contributing to national economic growth.

For more information on unit trusts and to connect with management companies, visit www.utasl.lk.