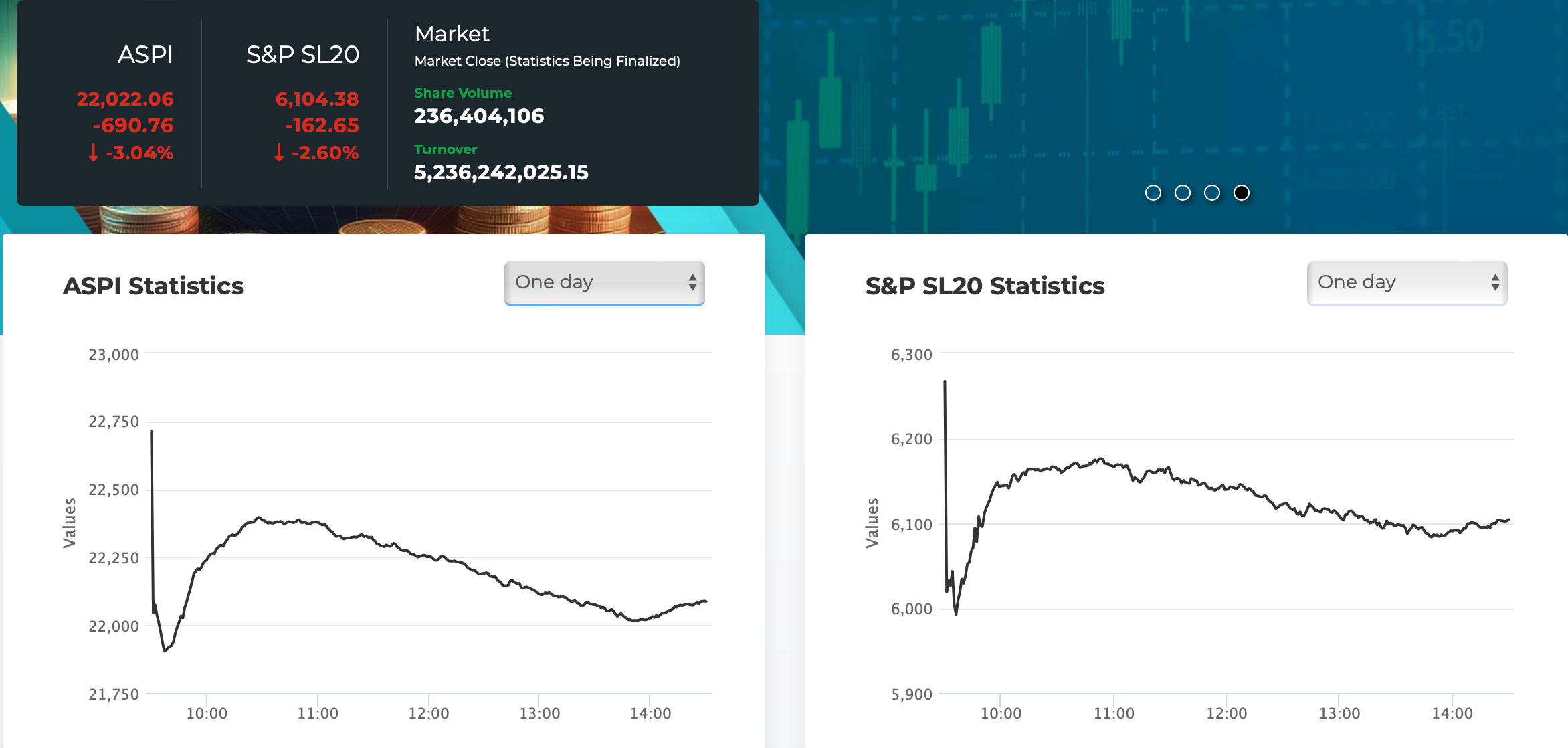

The Colombo Stock Exchange (CSE) experienced a steep and unsettling decline today as trading resumed for the first time following the devastating floods and cyclone that wreaked havoc across Sri Lanka. The All Share Price Index (ASPI) plunged 690.76 points, or 3.04%, closing at 22,022.06 — one of the sharpest single-day falls recorded this year. The S&P SL20 also tumbled 160+ points, sliding 2.60% to finish at 6,104.38.

The sell-off reflects a market reacting to a nation still reeling from widespread destruction, displacement, and economic disruption following several days of torrential rain, flooding, and cyclone-force winds.

Investors Respond to Uncertainty and Economic Strain

Analysts note that today’s downturn was largely driven by investor anxiety over the potential financial impact of the disaster. With transportation networks crippled, supply chains disrupted, thousands displaced, and many businesses forced to halt operations, investors braced for a short-term economic shock.

Market data shows a turnover of Rs. 5.23 billion with a share volume of 236 million, indicating heavy selling pressure across sectors. The ASPI’s fall extends a downward trajectory that began in mid-November, but today’s sharp dip reflects a heightened level of concern.

Insurance, Banking, and Consumer Sectors Under Pressure

Sectors directly exposed to the economic fallout—such as banking, consumer goods, manufacturing, and insurance—saw particularly high levels of volatility.

Insurance companies are expected to face an influx of claims due to widespread flood damage. Banks may experience slower loan recoveries and increased short-term credit stress, especially in affected districts. Consumer spending is also projected to weaken temporarily as households shift focus toward essential needs and recovery.

A Market Testing National Resilience

Market observers emphasize that while the immediate reaction is sharply negative, such drops are not uncommon after natural disasters. The magnitude of today’s decline underscores the scale of the crisis and the uncertainty ahead.

Still, Sri Lanka’s markets have historically shown resilience after major shocks. Recovery will likely hinge on several factors:

- Speed of government response and relief distribution

- Support for small and medium enterprises

- Stability in essential services and transport

- Restoration of business activity in affected regions

- International assistance and aid flows

Path Ahead: Volatility Expected

With damage assessments still ongoing and state agencies yet to quantify the economic cost, investors may continue to trade cautiously over the coming days. Market volatility is expected until clear signals emerge regarding the recovery timeline and the government’s broader response strategy.

Today’s market crash, while severe, is ultimately a reflection of national turmoil. As Sri Lanka works to recover and rebuild, the CSE — like the country itself — will be looking for stability, direction, and reassurance in the days ahead.