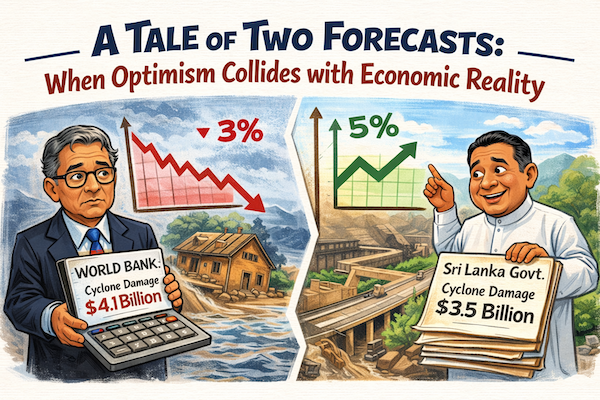

Good morning. If you ever wanted to see a masterpiece of creative accounting, just put these two reports side-by-side.

The World Bank tells us the cyclone cost us $4.1 billion. The Government, in what I can only call a fit of seasonal optimism, says it’s only $3.5 billion. Now, in any other world, $600 million is a lot of money—enough to pay for those road-slopes three times over.

But look at the growth figures. The Government is telling us we’ll hit 5% growth in 2026. 5%! After a cyclone that washed away 10% of our paddy? The World Bank, standing over there in the corner with its calculator, is shaking its head and whispering ‘3%.’

It’s a tale of two realities. One is built on ‘Global GRADE’ standards, and the other is built on ‘Government PR’ standards. We’re being told we can breach our spending laws by 1.4% and still have a ‘stable’ economy. It’s like a man telling his doctor he’s only ‘temporarily’ having a heart attack.

Mr. President, the numbers don’t have a political party. If we build our recovery on the 5% fantasy while the 3% reality is staring us in the face, we’re not ‘building back better’—we’re just building a bigger problem for 2027.

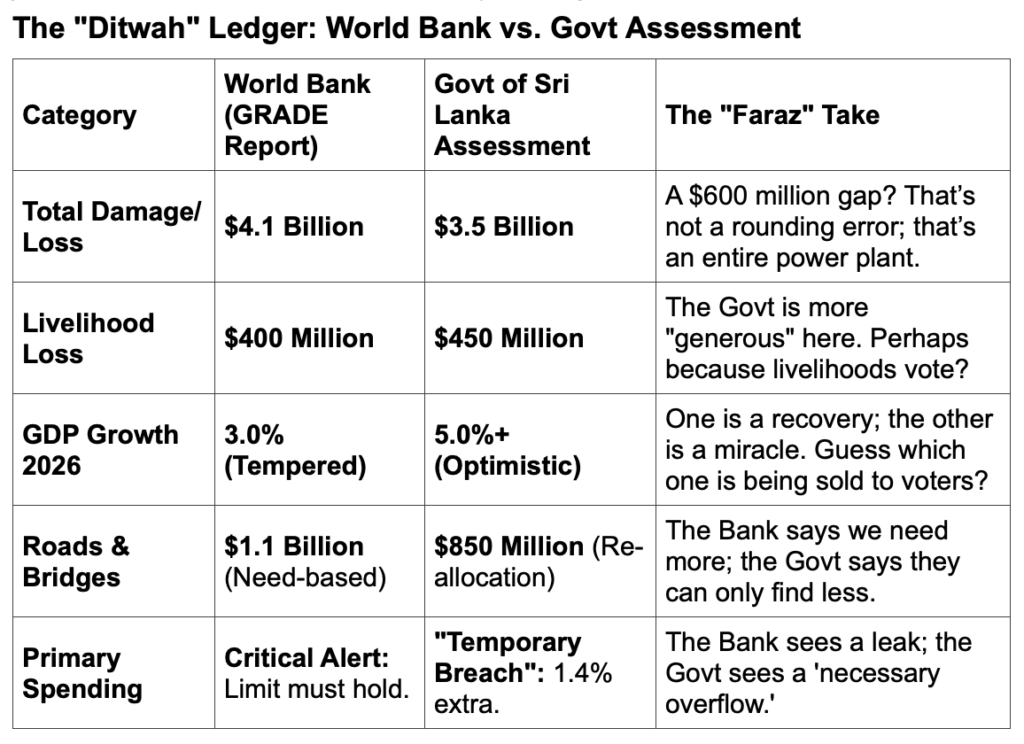

Let’s take a cold, hard look at the ledger. We have the World Bank’s GRADE report on one side and the Government of Sri Lanka’s Ministry of Finance assessment on the other.

It’s a classic case of “how you count the cost,” and as Faraz would say, the devil isn’t just in the details— the Devil’s practically running the department.

The “Ditwah” Ledger: World Bank vs. Govt Assessment

I’m Faraz Shauketaly. Keep your eyes on the decimal points, and as always… God bless you all.”