The delisting and effective collapse of Bimputh Finance PLC marks one of the more sobering failures in Sri Lanka’s non-bank financial sector. Once a licensed finance company and a listed entity on the Colombo Stock Exchange, Bimputh’s journey from public listing to licence cancellation and bankruptcy reflects a prolonged breakdown in governance, capital discipline, and regulatory compliance.

Bimputh Finance was listed on the CSE in 2012, raising public funds and attracting depositors on the strength of being both listed and regulated. The company engaged in typical finance business activities such as lending, leasing, gold loans and accepting public deposits. However, over the years, its financial position steadily deteriorated. Losses mounted, asset quality weakened, and capital adequacy fell below the minimum levels required under the Finance Business Act. By its final reporting periods, the company was technically insolvent, with negative equity, persistent operating losses, and no credible plan to restore capital.

Ownership and control were concentrated among a small group of major shareholders, primarily linked to the Gamage family and related private entities. Despite repeated regulatory directives and time extensions granted by the Central Bank of Sri Lanka, the controlling shareholders failed to inject fresh capital or restructure the business in a meaningful way. This prolonged inaction ultimately sealed the company’s fate.

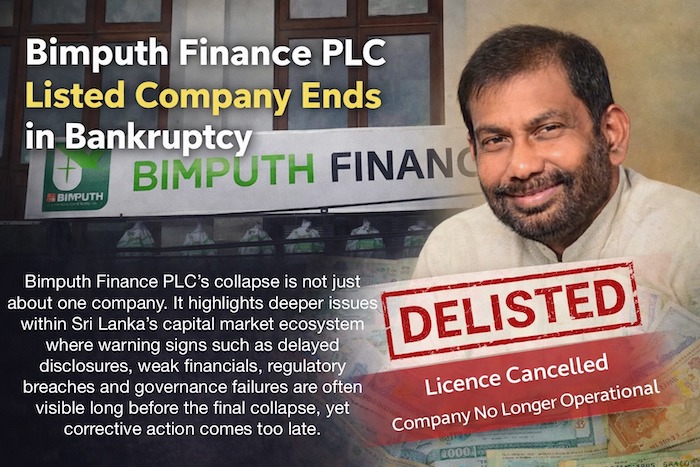

The regulatory end came in September 2023, when the Central Bank of Sri Lanka cancelled Bimputh Finance PLC’s licence to conduct finance business, citing continuous non-compliance with prudential and statutory requirements. Once the licence was revoked, the company could no longer legally accept deposits or operate as a finance company. Trading in its shares had already been suspended, and the eventual delisting from the Colombo Stock Exchange merely formalised what was already clear — Bimputh Finance was no longer a going concern.

The human cost of this failure should not be understated. Depositors, many of whom placed their savings in the company believing that “listed” and “CBSL-regulated” meant safe, were left in uncertainty. While the Sri Lanka Deposit Insurance and Liquidity Support Scheme (SLDILSS) provided compensation up to the insured limit, amounts above that threshold remain at risk, subject to recovery through liquidation. Minority shareholders, meanwhile, saw their investments wiped out entirely.

Bimputh Finance PLC’s collapse is not just about one company. It highlights deeper issues within Sri Lanka’s capital market ecosystem — where warning signs such as delayed disclosures, weak financials, regulatory breaches and governance failures are often visible long before the final collapse, yet corrective action comes too late. A stock market listing is not a guarantee of financial health, and regulation without enforcement is meaningless.

This episode should serve as a clear lesson for regulators, boards, auditors, investors and depositors alike. Strong governance, timely intervention, accountability of controlling shareholders, and transparency are not optional — they are essential. Otherwise, Bimputh Finance will not be the last name added to Sri Lanka’s growing list of listed companies that ended in failure.