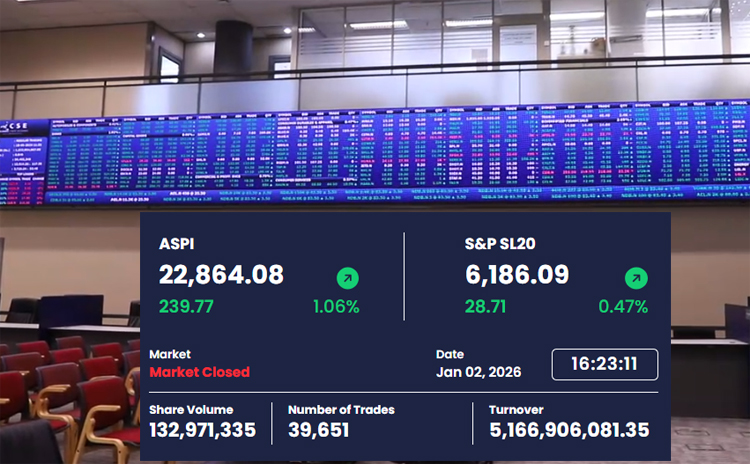

The Colombo Stock Exchange (CSE) commenced the new year on an optimistic note, marked by robust investor engagement that led to notable gains in key indices on the first trading day of 2026.

On January 2, the benchmark All Share Price Index (ASPI) surged by 239.77 points, reflecting a 1.06% increase from the previous closing. Concurrently, the S&P SL20 Index, which monitors the performance of the 20 largest and most liquid stocks, rose by 28.71 points, concluding at 6,186.09 points.

A significant highlight of the day was the market turnover, which soared to an impressive Rs. 5.16 billion, setting a record transaction value. This heightened level of activity underscores renewed investor confidence as the market opened for the year 2026.

Local investors played a dominant role in trading activity, with purchases amounting to Rs. 5.02 billion and sales totaling Rs. 4.93 billion, resulting in net local buying. In contrast, foreign participation recorded purchases of Rs. 146 million against sales of Rs. 233 million, indicating a net foreign outflow for the day.