Every few months, Sri Lanka rediscovers an old truth: when people are squeezed, they chase miracles. And when people chase miracles, someone sells them a miracle—usually with glossy brochures, confident “returns,” and zero regulation.

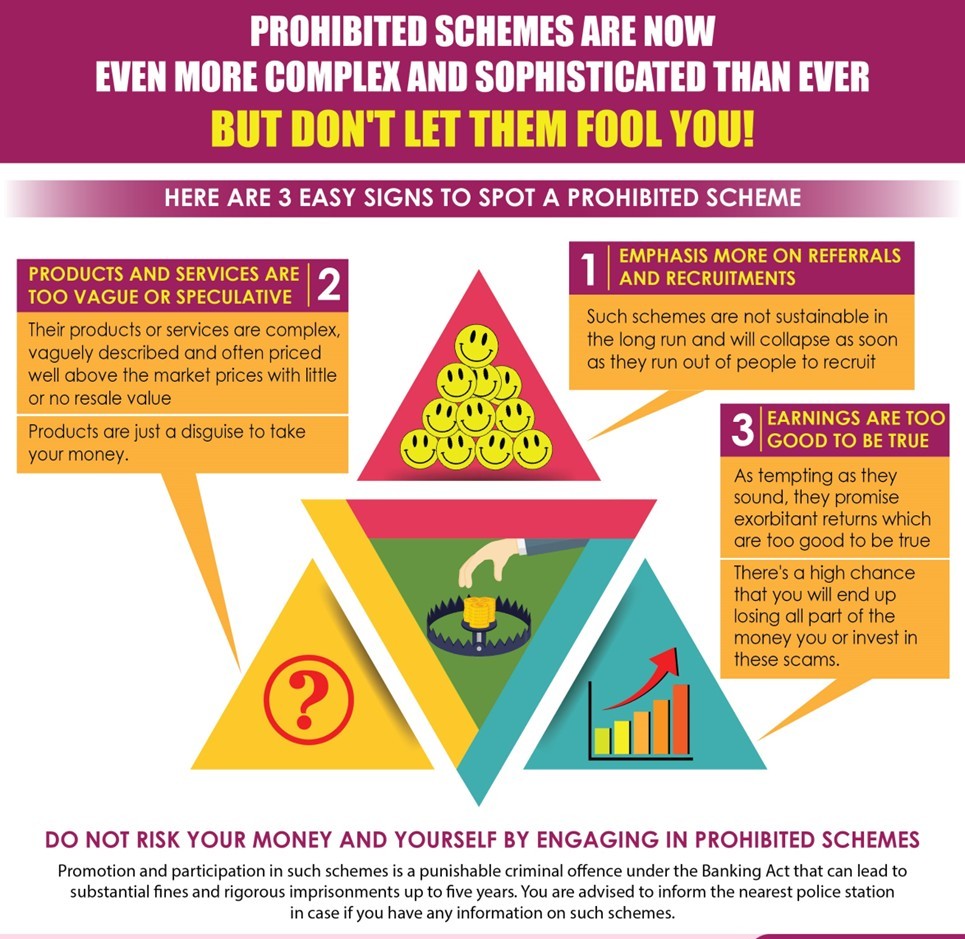

Today’s trending warning comes from the top: the Central Bank Governor has cautioned the public to be vigilant about high-return cultivation / plantation investment schemes, noting that many resemble unregulated pyramid-style traps.

This matters because it lands in a specific social moment. Post-crisis Sri Lanka has a public that is financially bruised: depleted savings, high living costs, and a deep hunger to “make money back.” That’s the precise psychological environment where fraud thrives. The pitch is always dressed as patriotism—“invest in agriculture,” “support cultivation,” “earn guaranteed returns.” The reality, too often, is that the only thing growing reliably is the organiser’s bank balance.

The governor’s point isn’t anti-agriculture. Sri Lanka needs genuine investment into productive sectors. But the warning is about structure: if a scheme promises unusually high yields with vague governance, unclear cashflows, and “early investor payouts” that sound suspiciously like money from the next investor—then congratulations, you’re not investing in agriculture, you’re investing in mathematics. Specifically, the kind that collapses when reality arrives.

The pro-people angle here is clear: regulators must stop acting like moral lecturers and start acting like enforcers. Public warnings are useful, but they are not justice. The average citizen does not have forensic accounting skills. They have hope. And hope is not a due diligence method.

So what should happen next? Public disclosure rules. Licensing. Clear definitions of what constitutes a regulated investment product. Fast action against advertising that implies guaranteed returns. And a single, visible hotline that leads to outcomes, not “we will look into it.”

Because when these schemes collapse, the victims are not “greedy.” They are ordinary people trying to survive. And when the state shrugs after the collapse, society learns the worst lesson: that fraud is only illegal if you’re small enough to be caught.

The Central Bank has sounded the alarm. Now the rest of the system needs to do what it rarely does: follow through.