One of the more sensational and troubling corporate stories currently circulating in the capital. Continental Insurance Lanka Limited (CILL), a subsidiary of the Melstacorp/DCSL group, is finding itself in a “perfect storm” of legal and ethical scrutiny.

As I say, when a company that’s supposed to protect you from disaster becomes a disaster itself, we have a very serious problem. This is an analysis of what has gone wrong, based on the recent breaking developments this month.

1. The CEO’s Arrest and the “Government Analyst” Connection

The most damning development occurred on December 12, 2025, when the CEO of CILL, Gerard Gunadasa, was arrested by the Bribery Commission (CIABOC). He is accused of facilitating a bribe of over Rs. 6.4 million to a senior official in the Government Analyst’s Department.

The “matter” here is deeply systemic. It is alleged that these bribes were paid to secure favorable vehicle inspection reports. In the insurance world, a compromised report can mean the difference between a company paying out a massive claim or denying it entirely.

This suggests a “fixing” mechanism that undermines the entire integrity of the insurance industry.

2. The Founder-Director’s Involvement

Just days prior to the CEO’s arrest, one of CILL’s founder directors and Deputy Chairman, Chaminda De Silva, was also taken into custody. These aren’t just mid-level managers; this is the very leadership of the firm being implicated in a bribery scheme. The court heard that information came to light showing these high-ranking officials specifically approved payments that were allegedly redirected as “gratification” to public servants. Chaminda De Silva was co-founder. The other was the late Harry Jayawardena of Stassens fame. Now deceased and has handed over the reins to his son DHS Jayawardena as Group Chairman.

3. The “Disaster” Defence

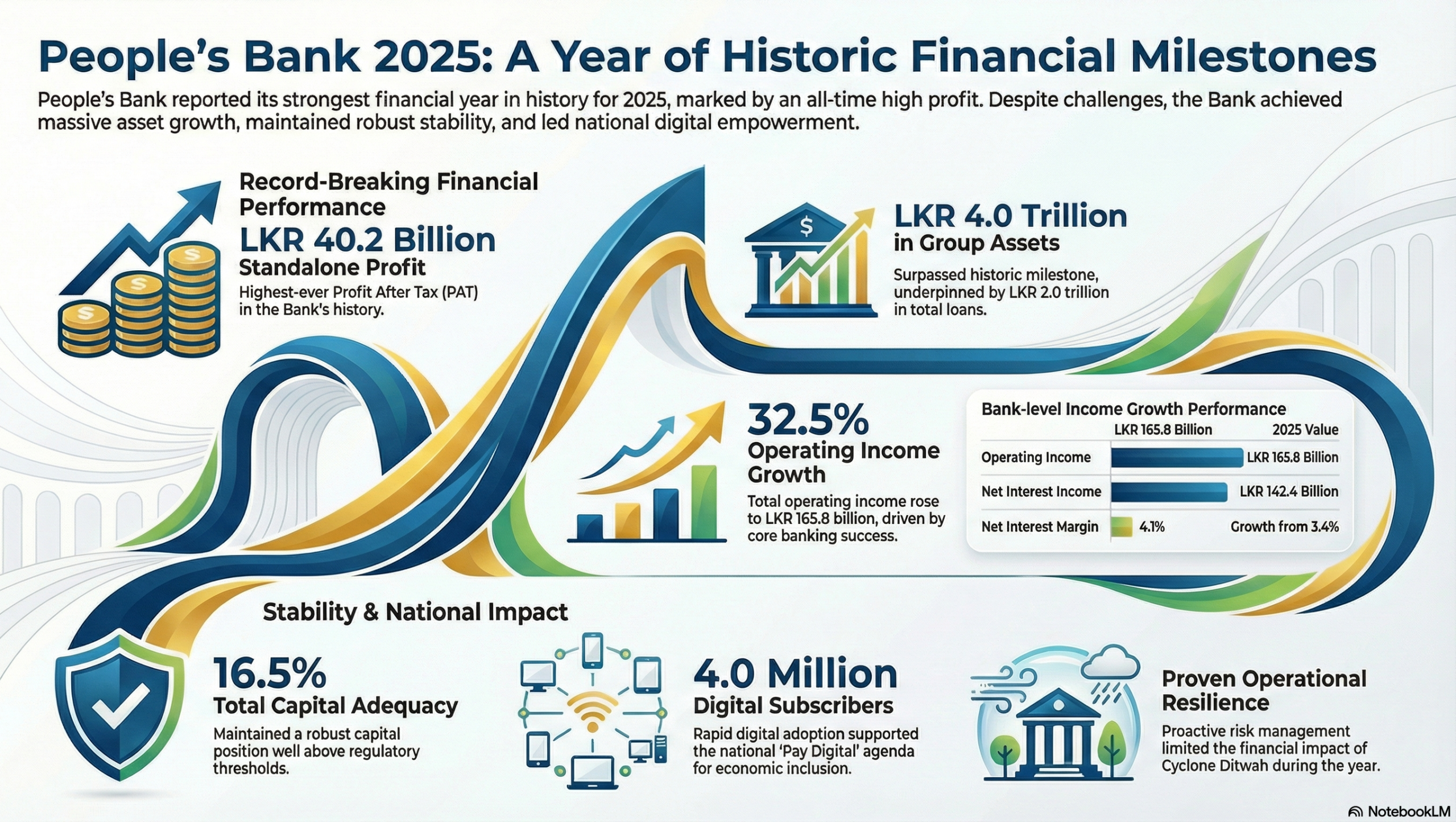

In a move that some might call “clutching at straws,” the legal defense for the CEO argued in court that remanding him would disrupt the payment of over Rs. 3 billion in compensationrelated to recent disasters (like Cyclone Ditwah).

As I dryly observe, using the suffering of disaster victims as a “get out of jail free card” for a bribery charge is a bold, if not entirely cynical, strategy. It frames the company as “too essential to fail,” while the underlying charges suggest they were potentially cheating those very systems for years.

4. Regulatory and Reputational Fall

Fitch Ratings has historically rated CILL at A-(lka), citing its strong parentage (DCSL). However, a bribery scandal involving the CEO and Deputy Chairman creates a massive governance risk.

• Trust Deficit: Insurance is a business of trust. If reports are being “bought,” every policyholder must now wonder if their own claims were handled fairly.

• Loss to the State: The Bribery Commission alleges these actions caused “financial losses to the government,” likely through improper claims handling and tax implications.

The Faraz Perspective

“Let’s talk about ‘Continental,’ shall we? A company whose motto is ‘service with excellence,’ but whose current reality seems to be ‘bribery with convenience.’

We have the CEO and the Deputy Chairman in court, accused of buying reports from the Government Analyst’s Department. If you can buy the report, you can buy the result. And if you can buy the result, the entire insurance industry isn’t a safety net—it’s a rigged game of blackjack.

They say they need to be out of jail to pay 3 billion rupees in disaster claims. Well, one has to ask: if they hadn’t been allegedly spending 6 million on bribes, maybe they’d have had even more to pay those victims? It’s a classic case of ‘corporate entitlement.’ You can’t use the people you’re supposed to help as a shield to protect yourself from the law.

Mr. President, this is the ‘crony capitalism’ we keep talking about. It’s not just about politicians; it’s about the boardrooms. If the ‘system change’ doesn’t reach the insurance sector, then the only thing that’s truly insured in this country is corruption.

As for the co-founder, Chaminda De Silva. His spouse is afflicted with a major medical challenge and is in Australia; her husband has been embroiled in this scandal and some quarters say that he is being used as a scapegoat for what ‘higher ups’ wanted done.

A one-master dog type, Chandima De Silva must reflect on his commercial life now that he’s tasted remand time, finds himself unable to travel to Australia to be with the love of his life – all the time having done what he was possibly asked to do. He may well feel he’s holding the can. Others will say, if you cant do the time don’t do the crime.

I’m Faraz Shauketaly. Keep your eyes on the policy, and your hands on your receipts. God bless you all.”