The Colombo Stock Exchange (CSE) ended today’s (Dec 26, 2025)

trading session on a positive note, with key indices recording moderate gains amid healthy activity led by banking and port-related counters.

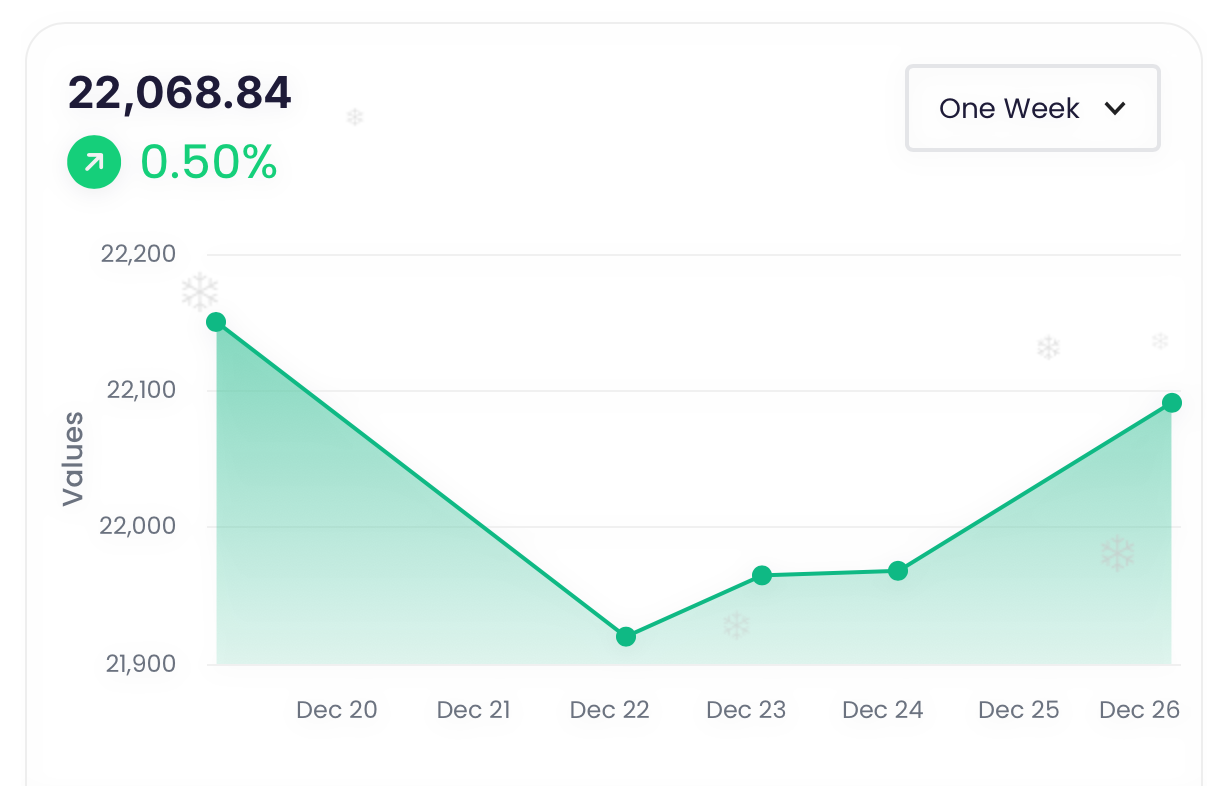

The All Share Price Index (ASPI) gained 109.79 points, or 0.50%, to close at 22,068.84, while the S&P SL20 Index rose 26.05 points, or 0.43%, to finish at 6,041.53. Market sentiment remained cautiously optimistic, supported by selective buying in large-cap and banking stocks.

Total market turnover reached Rs. 2.71 billion, with 91.4 million shares traded across 19,819 transactions, indicating steady participation despite the year-end holiday period.

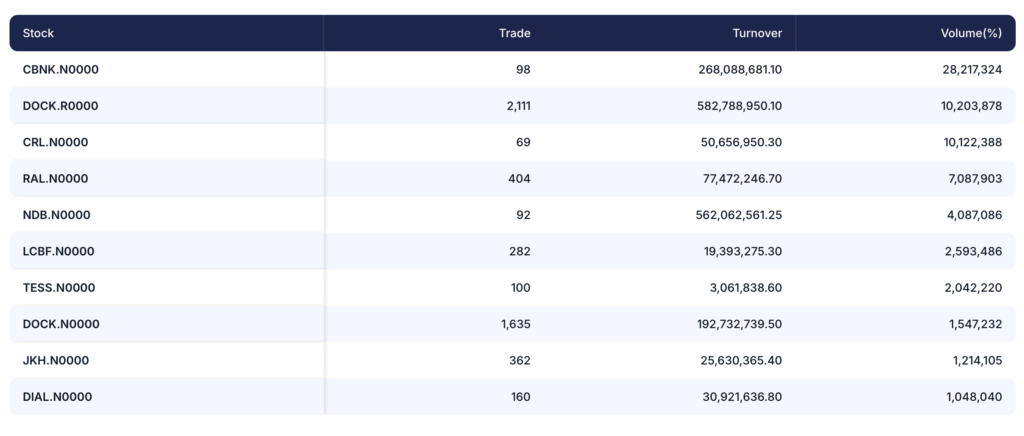

Commercial Bank (CBNK) emerged as the top volume contributor, with over 28.2 million shares traded, generating a turnover of approximately Rs. 268.1 million from 98 trades. Dockyard PLC (DOCK) was the leading turnover contributor, recording Rs. 582.8 million from 2,111 trades, alongside an additional Rs. 192.7 million turnover from another active trading segment, highlighting strong investor interest in the counter.

Foreign investor activity turned net positive during the session, providing additional support to market sentiment. The market recorded a net foreign inflow of Rs. 18.9 million, with total foreign purchases amounting to Rs. 23.1 million, comfortably outweighing foreign sales of Rs. 4.2 million. Foreign buying was led by John Keells Holdings (JKH) with purchases worth Rs. 8.4 million, followed by CCS, Dockyard, and Hatton National Bank, reflecting selective interest in large-cap and fundamentally strong counters. On the selling side, GRAN, SCAP, and Tokyo Cement accounted for the bulk of foreign outflows. Market participants noted that while foreign participation remains modest in absolute terms, the return to net inflows is a positive signal, particularly in a low-liquidity, year-end trading environment.

From a valuation standpoint, market indicators remained broadly stable. The price-to-earnings ratio edged up to 10.53 times from 10.48 times, while the price-to-book value increased marginally to 1.42 times. The dividend yield eased slightly to 2.67% from 2.69%.

On the price movers’ front, SEMB.X topped the gainers’ list, surging 33.33% to close at Rs. 0.40. ODEL.N gained 7.27% to Rs. 11.80, while TESS.N rose 7.14% to Rs. 1.50 on heavy volume. SFIN.N and ACME.N also recorded gains of 6.74% and 6.67%, respectively.

Meanwhile, ASPH.N led the losers, plunging 20.00% to close at Rs. 0.40. CPRT.N declined 11.89% to Rs. 700.25, while PARA.N, AUTO.N, and CHL.X recorded losses ranging between 5.93% and 7.27%.

Intraday trading showed early strength, followed by range-bound movement, before a firm close driven by late-session buying in selected stocks. Market participants noted that activity continues to be driven by stock-specific interest, particularly in fundamentally strong banking and infrastructure-related companies.

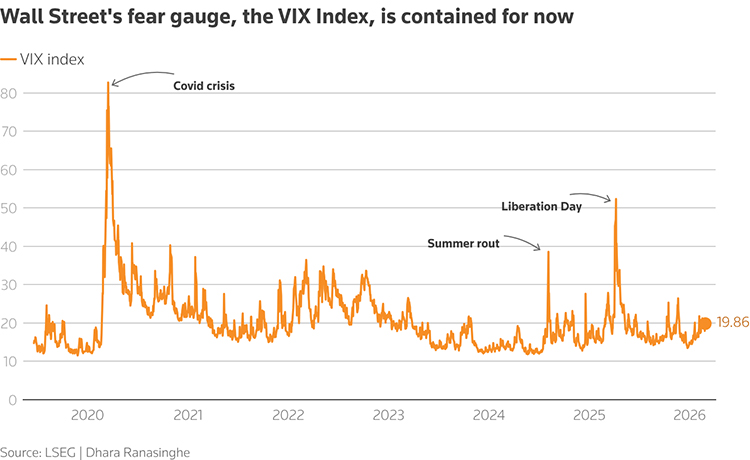

Overall, today’s performance reflects a stable and cautiously positive market tone as investors approach the final trading days of 2025, with attention remaining on liquidity trends, corporate developments, and broader macroeconomic signals.