By Faraz Shauketaly

There are two kinds of capital markets participants in Sri Lanka.

Those who trade headlines — and those who compound value.

Dhammika Perera belongs firmly in the second category. And once again, through Hayleys PLC, he has reminded the market what disciplined capital allocation looks like.

Yesterday’s announcement — a Rs. 6 per share dividend alongside a rights issue at Rs. 200 per share (3-for-50) — is not just a corporate action. It is a signal.

A signal of confidence.

A signal of balance-sheet intent.

And a signal that Hayleys is being run for long-term owners, not short-term applause.

Dividend and Rights: A Deliberate Pairing

The combination matters.

The dividend rewards existing shareholders with immediate cash return. The rights issue, priced at a level that invites participation rather than exclusion, offers shareholders the option to reinvest alongside management — not be diluted by it.

This is classic Perera logic:

return capital when performance allows,

raise capital when opportunity demands,

and price both in a way that respects the shareholder base.

There is no financial pyrotechnics here. No leveraged bravado. Just method.

Why the Market Pays Attention

Hayleys is not a speculative vehicle. It is a diversified industrial, export-heavy group operating across plantations, textiles, logistics, rubber products, consumer goods, and manufacturing — precisely the kind of enterprise that benefits from patient capital and disciplined reinvestment.

The rights issue is not about survival. It is about positioning.

And the dividend is not about optics. It is about credibility.

Markets can tell the difference.

The Singer Parallel: A Masterclass in Long-Term ROI

To understand why Dhammika Perera’s moves still command attention, one has to revisit his acquisition of Singer Sri Lanka roughly a decade ago.

At the time, Singer was a solid but unglamorous consumer durables and retail business — asset-heavy, operationally complex, and undervalued by a market obsessed with faster stories.

Perera saw something else:

entrenched distribution

brand trust

pricing power in a growing consumer economy and the scope for operational tightening

Since then, Singer has:

delivered consistent profitability,

generated steady cash flows,

paid regular dividends, and

remained resilient through economic cycles that broke less grounded businesses.

Measured over a 10 horizon, the return on investment from the Singer acquisition — through dividends plus capital value — has been substantial by any reasonable benchmark, comfortably outperforming passive market exposure over the same period.

That is not luck.

That is time in the market, not timing the market.

The Buffett Comparison — With a Sri Lankan Accent

The “Sri Lankan Warren Buffett” label is often thrown around loosely. In this case, it fits — with caveats.

Perera does not mimic Buffett’s portfolio letter prose or US-style capital markets theatre. What he mirrors is the philosophy:

buy understandable businesses,

hold through cycles,

extract value through operations and patience, and let compounding do the heavy lifting.

Singer was not flipped.

Hayleys is not being dressed up for exit.

These are owner-operator decisions, not trades.

What This Means for Shareholders — and the Market

For Hayleys shareholders, the message is clear:

you are being paid,

you are being invited to reinvest,

and you are being treated as partners, not passengers.

For the wider market, the lesson is less comfortable: real wealth creation in Sri Lanka has not come from speculative surges,

but from dull words like rights issues, dividends, PBT, and holding periods.

Boring, it turns out, is profitable.

In an Economy Short on Trust, Capital Discipline Matters

Sri Lanka’s equity market has suffered not from lack of opportunity, but from lack of confidence — confidence in governance, in capital allocation, in management intent.

This is why actions like Hayleys’ matter beyond the balance sheet. They restore a basic idea that has been in short supply: that capital will be rewarded if it stays the course.

Dhammika Perera is not dazzling the market with novelty.

He is dazzling it with consistency.

And in today’s Sri Lanka, that may be the most valuable signal of all.

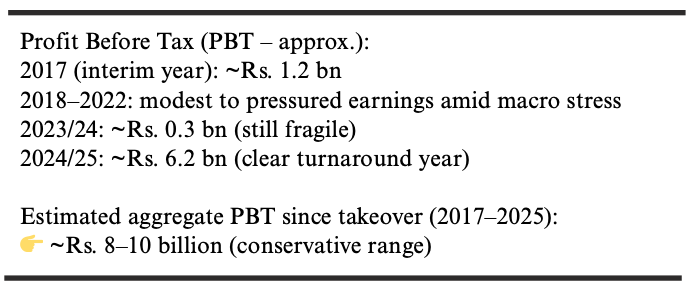

SINGER SINCE HAYLEYS: THE PROFIT TRAJECTORY

When Hayleys PLC took control of Singer Sri Lanka in 2017, the acquisition was seen as solid rather than spectacular.

The numbers since then tell a longer story.

The takeaway is not linear growth, but resilience. Singer absorbed cycles, protected cash flow, and delivered its strongest performance only after patience — a hallmark of Dhammika Perera’s long-hold approach.

Boring businesses. Long horizons. Compounding returns.