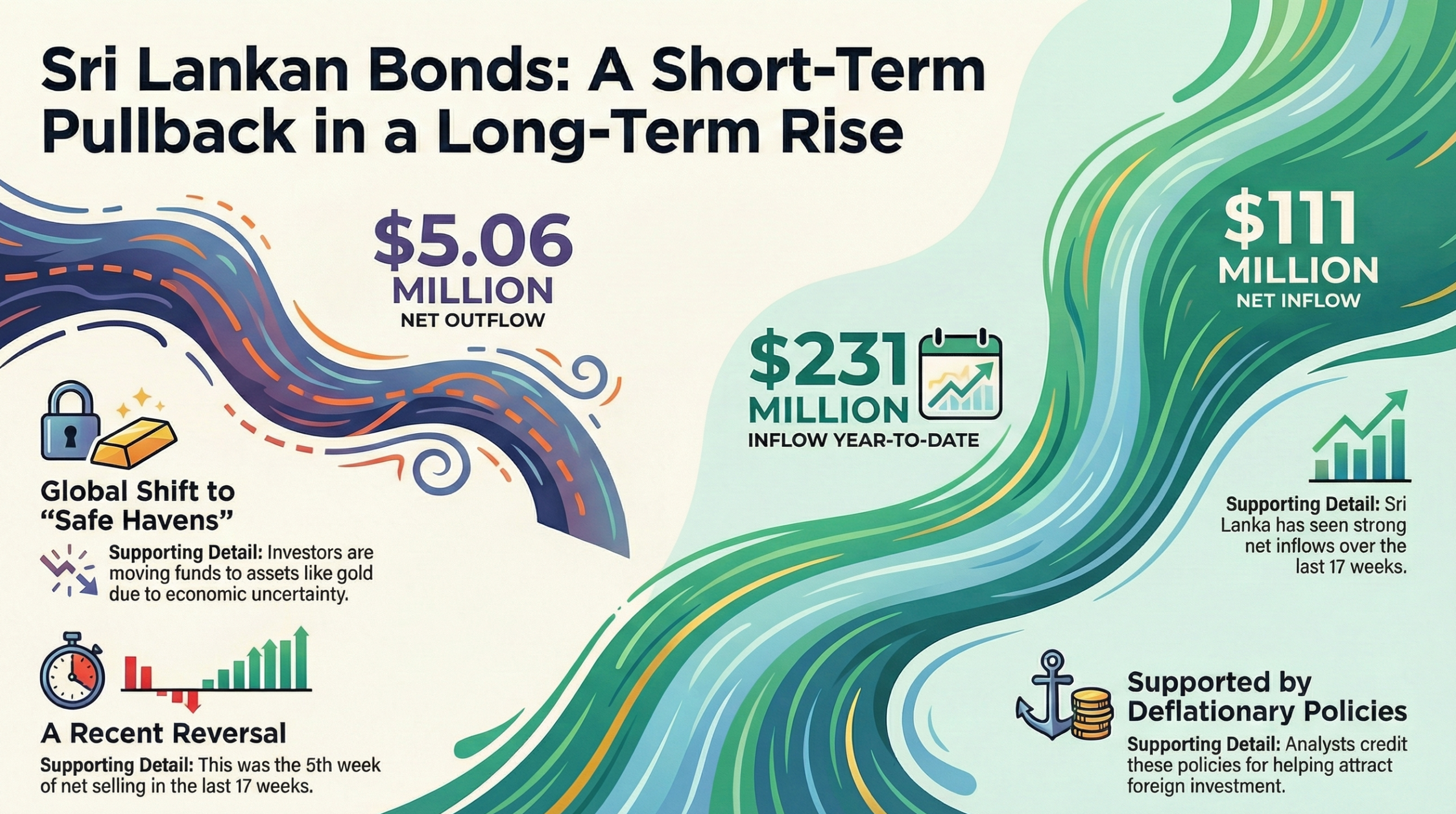

Foreign investors divested approximately 5 million US dollars in Sri Lankan government securities during the week ending December 24, according to data from the Central Bank. This marks a reversal from the previous week’s inflows, as investors gravitated towards safe-haven assets amid speculation of further interest rate cuts by the U.S. Federal Reserve.

This development represents the fifth instance of foreign sales of rupee bonds in the past 17 weeks, with foreign holdings in government securities dropping from a near two-year high. Specifically, foreign entities sold a net 1,545 million rupees (equivalent to USD 5.06 million, based on an exchange rate of 1 USD = 305 rupees) during the week, following purchases of bonds worth 2.44 million dollars in the preceding week.

The shift towards safe-haven assets, such as gold, comes in the wake of a recent Fed rate cut earlier this month. Gold prices, a key safe-haven asset, reached a record high last week, driven by demand for safety and growing expectations of additional rate cuts by the Federal Reserve.

Despite these outflows, Sri Lanka has experienced net inflows of 33,855 million rupees (approximately 111 million dollars) over the last 17 weeks. However, the country faced an outflow of 10.1 billion rupees (32 million dollars) in the two weeks following the announcement of tariffs by Donald Trump in the first week of April, coupled with a slight depreciation of the rupee.

Since December 26 of the previous year, Sri Lanka has seen a total inflow of around 70.6 billion rupees (approximately 231 million dollars) into rupee bonds up to December 24, as indicated by the data. Analysts attribute these inflows to Sri Lanka’s deflationary policies, which have supported investments amid reduced imports.

In 2024, foreign outflows amounted to 48.2 billion rupees, with a significant portion—66 percent, or 78.1 billion rupees—emanating from government securities during the first nine months of the year.

(Colombo/December 29/2025)