Colombo, November 24, 2025 – Sri Lanka’s stock market experienced a sharp downturn today after the Government announced the launch of a new auction for U.S. dollar–denominated domestic bonds, prompting investors to exit equities and move capital into safer fixed-income investments.

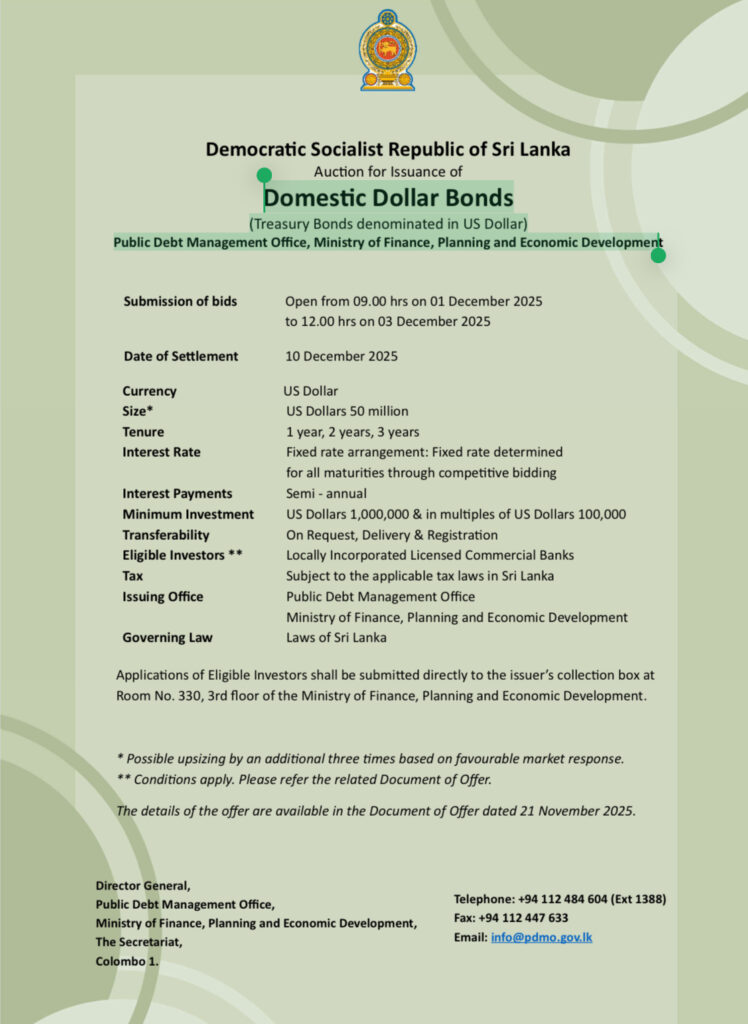

The Public Debt Management Office of the Ministry of Finance has opened bidding for the new bonds from December 1 to December 3, with settlement scheduled for December 10. The initial offering amounts to USD 50 million, with the possibility of further expansion depending on market demand. The bonds, available in one-, two-, and three-year maturities, will carry fixed interest rates determined through competitive bidding and pay interest semi-annually.

Market analysts said the announcement has triggered a wave of repositioning across the financial system. Many investors who have already benefited from strong stock market gains during 2025 are now opting to lock in profits and shift into government-backed, dollar-denominated returns, which are perceived as comparatively lower-risk during a period of policy uncertainty. Financial strategists noted that high interest rates, coupled with the security of government debt, present an attractive alternative for banks and other institutional investors who may prefer guaranteed returns amid concerns about currency volatility and external debt pressures.

Officials and economists say the new issuance is part of a broader strategy to strengthen Sri Lanka’s foreign currency reserves ahead of substantial sovereign repayment obligations due in 2028. By raising funds domestically in dollars, the Government aims to reduce reliance on external commercial borrowing and enhance fiscal sustainability. Market expectations are that more dollar bond auctions will follow in the coming year, which could continue to absorb liquidity away from the stock market.

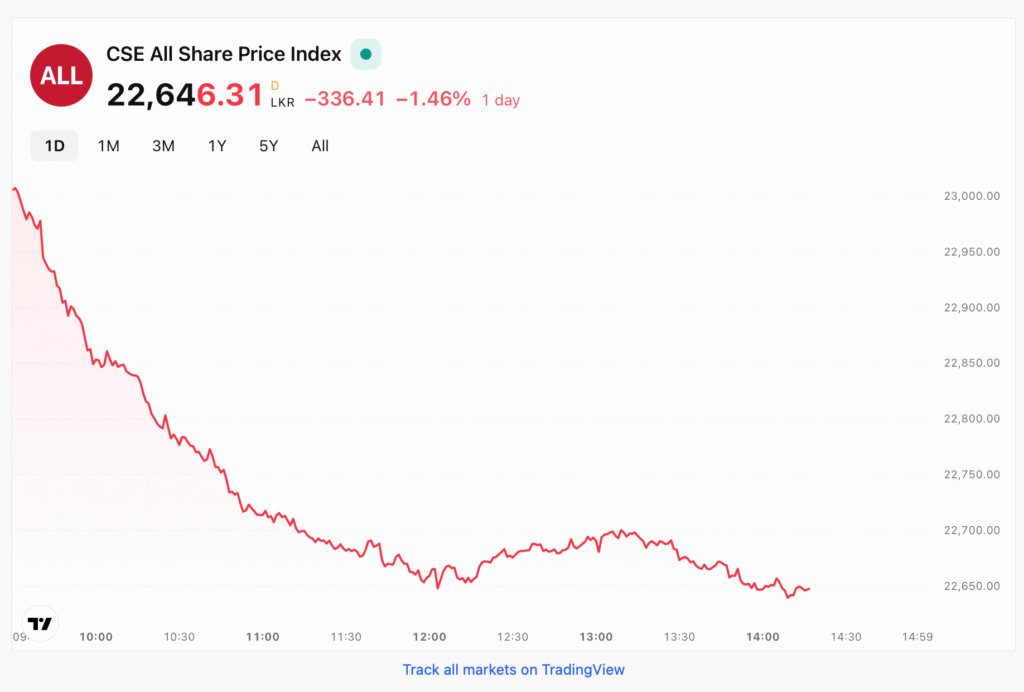

The Colombo Stock Exchange reacted swiftly and negatively to the news. The All-Share Price Index (ASPI) plunged by 338.72 points, a fall of 1.47 percent, closing at 22,644.31. The decline marks one of the steepest single-day losses in recent weeks and follows a 2.1 percent drop over the past week as sentiment had already begun to soften. Trading floors reported broad-based selling, particularly in financial stocks, which have been under pressure in recent sessions. The market has also been trading at a relatively high valuation, with the current price-to-earnings multiple around 10.4 times, noticeably higher than the three-year average of 8.5 times. This elevated pricing contributed to selling pressure as investors reassessed the risk–reward balance in the face of shifting capital flows.

Market watchers noted that today’s sell-off was not driven solely by the bond auction announcement but also by ongoing macroeconomic uncertainties. Concerns regarding the stability of the rupee, the pace of fiscal consolidation, and the broader debt management framework continue to weigh on investor confidence. However, the timing of the new dollar bond auction acted as a decisive catalyst, accelerating profit-taking and sparking a pronounced correction in share prices.

Analysts said the coming weeks will be crucial in determining whether today’s fall represents a short-term correction or the beginning of a deeper shift in market momentum. The level of subscription to the upcoming bond auction, movements in foreign reserves, and comments from monetary authorities will be closely watched. Should the Government proceed with further sizable bond issues, the equity market may face continued liquidity challenges as capital rebalances in favor of government securities.

Sri Lanka’s stock market had delivered strong gains earlier this year, but today’s decline highlights the sensitivity of domestic equities to policy announcements and macroeconomic shifts. Investors and analysts alike will now be watching for signs of market stabilization or further volatility as the financial system adjusts to the implications of the Government’s new funding strategy.