Hyundai Motor’s labor union in South Korea issued a warning to the automaker on Thursday, cautioning against the deployment of humanoid robots without union consent. The union expressed concerns that introducing these robots could lead to significant “employment shocks.”

The announcement of Hyundai’s intention to deploy humanoid robots by 2028 has led to a surge in the company’s share prices, reaching record highs. However, this development has not been well-received by the workforce, according to an internal letter from the union reviewed by Reuters.

The union emphasized, “Remember that without a labor-management agreement, not a single robot using new technology will be allowed to enter the workplace.”

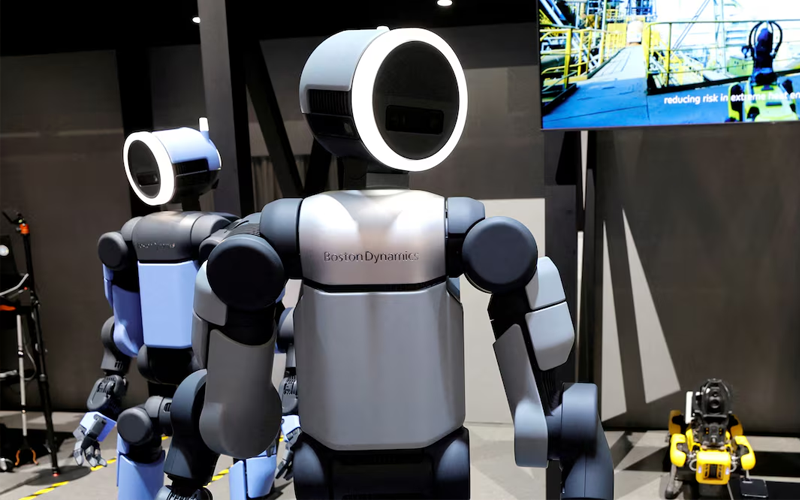

Earlier this month, Hyundai Motor Group showcased the production version of the Atlas humanoid robot, developed by its subsidiary Boston Dynamics, at the Consumer Electronics Show in Las Vegas.

The company revealed plans to establish a factory capable of producing 30,000 robot units annually by 2028. Furthermore, Hyundai aims to introduce humanoid robots at its U.S. plant in Georgia starting in 2028, with intentions to expand their deployment across all production facilities.

The union has accused Hyundai of attempting to increase profits by using robots to reduce the workforce.