John Keells Holdings PLC (JKH) has posted a strong rebound in earnings for the quarter and nine months ended 31 December 2025, reporting sharp growth in revenue and operating performance. However, the group’s latest financial statements reveal a parallel and far more dramatic development on its balance sheet — a significant rise in liabilities that now tower over its profit levels.

For the December quarter, JKH recorded a profit of Rs. 8.5 billion, up 150% year-on-year, while nine-month profit rose to Rs. 13.4 billion, reflecting a 240% increase. Revenue for the nine months climbed 69% to Rs. 384.0 billion, supported by improved performance across core segments and stronger gross margins. Results from operating activities surged 365% to Rs. 26.3 billion, indicating that underlying business operations have strengthened considerably.

Yet, alongside this improvement, the group’s liabilities have expanded sharply.

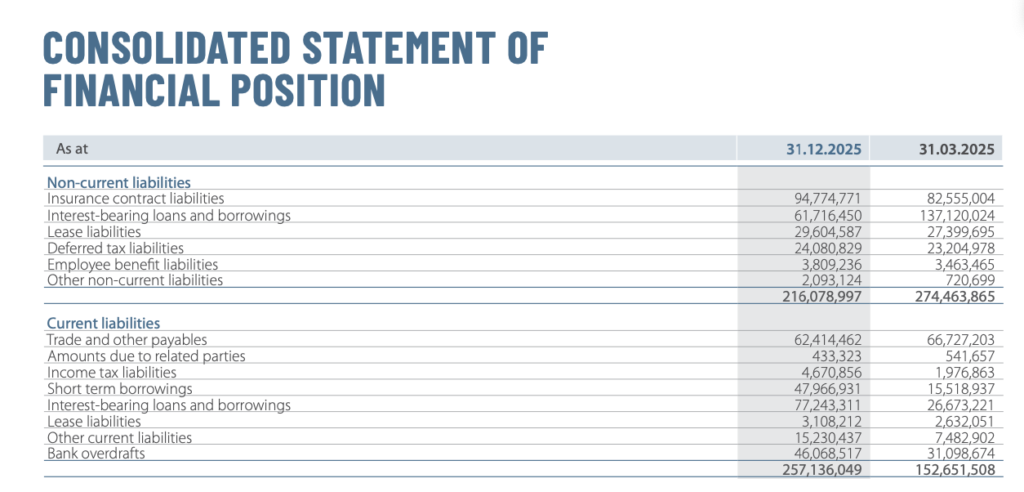

As at 31 December 2025, current liabilities increased to Rs. 257.1 billion, compared with Rs. 152.7 billion a year earlier — a rise of more than Rs. 104 billion. This was driven by a notable jump in short-term borrowings to Rs. 47.9 billion (from Rs. 15.5 billion), current interest-bearing loans to Rs. 77.2 billion (from Rs. 26.7 billion), and bank overdrafts rising to Rs. 46.1 billion.

Non-current liabilities stood at Rs. 216.1 billion, including Rs. 61.7 billion in long-term borrowings, Rs. 94.8 billion in insurance contract liabilities, and Rs. 29.6 billion in lease liabilities. In total, the group’s liabilities now amount to approximately Rs. 473 billion.

The contrast between earnings and obligations is striking. JKH’s nine-month profit of Rs. 13.4 billion is outweighed by liabilities that are more than 35 times that figure. Even when annualised, profit levels remain small relative to the scale of the group’s borrowings and payables.

Finance costs have also risen in line with the increased reliance on funding, climbing 36% for the nine-month period to Rs. 18.4 billion.

While JKH’s operational performance indicates a recovery and growth trajectory, the composition of its liabilities — particularly the large portion of short-term borrowings and overdrafts — highlights a growing dependence on short-term funding lines to support operations and expansion.

The results leave investors with a dual narrative: a company delivering stronger profits, but doing so while carrying a rapidly expanding liability base that could become a key risk factor if funding conditions tighten or interest costs rise further.

Latest Accounts