Sri Lanka’s recent surge in investor optimism is unlikely to last, arguing that the country’s recovery remains “extremely fragile” especially in light of the devastating cyclone and floods that ravaged parts of the island this month.

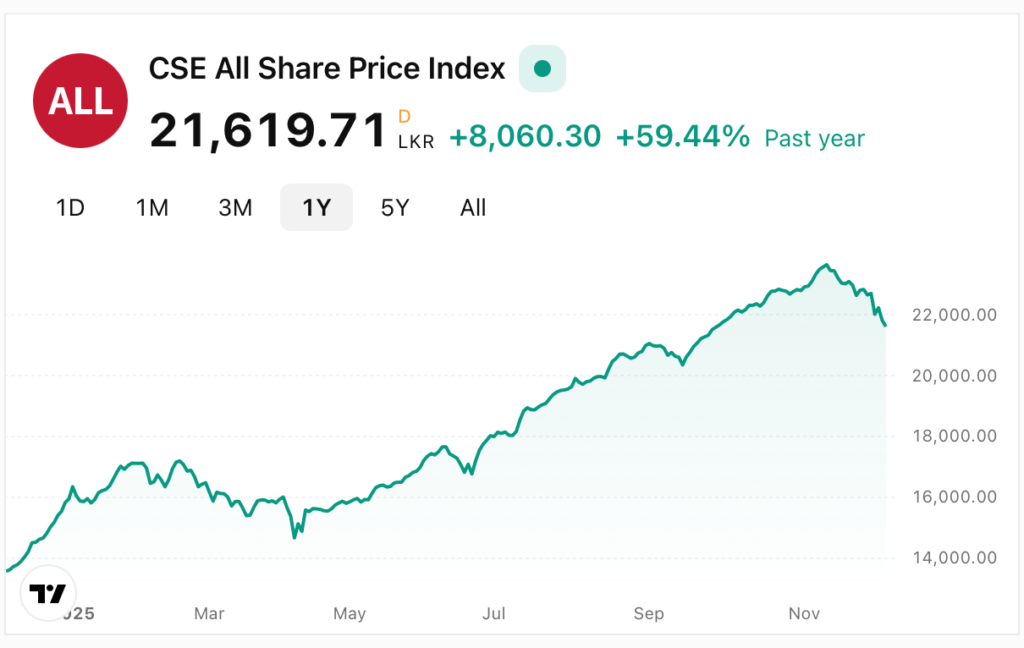

The assessment notes that the popular narrative of Sri Lanka being an “undervalued investment opportunity” stands in stark contrast to deteriorating economic conditions on the ground. Weather-related destruction, mounting fiscal pressures, a heavy external debt-repayment schedule, and a massive post-disaster reconstruction burden signal a far more turbulent road ahead than the buoyant sentiment currently seen on the Colombo Stock Exchange (CSE).

Cyclone Impact – Growth Hit, Corporate Earnings in Danger

The analyst estimates that the cyclone and widespread flooding have inflicted billions of rupees in economic losses. Agriculture, supply-chains, transport networks, and regional industries have all suffered “significant operational setbacks,” which are likely to depress GDP growth over the coming quarters.

Small and medium-sized businesses already weakened by years of crisis now face fresh disruptions: halted production, property damage, and a sharp drop in consumer spending. Insurers, utilities, and exporters are also expected to record steep near-term earnings losses.

“These are not just temporary disruptions. This is a major economic shock hitting at the worst possible time,” the analyst warned.

Equity Market Priced for Economic Conditions That No Longer Exist

Despite the widespread damage, equity valuations remain near multi-year highs a trend the analyst believes is unsustainable. Given the combination of weather-related destruction, weak consumer resilience, shaky currency stability and rising investor caution, the market is now “overvalued and priced for economic conditions that no longer exist.”

A meaningful market correction is expected in the coming weeks, once companies begin to release financial results that reflect the true impact of the disasters on earnings, supply-chains, and forward-looking guidance.

“Once reality hits corporate balance-sheets, a correction appears inevitable,” the analyst said.

A Huge Reconstruction Cost

Authorities now estimate that Sri Lanka will require around US$ 6–7 billion to rebuild destroyed homes, industries, roads and other critical infrastructure across all 25 districts affected by the cyclone.

That burden even after accounting for pledges of donations and grants is likely to weigh heavily on the already fragile economy. The financing needs will compete with urgent demands: relief efforts, social support, restoration of agriculture, and stabilising exports.

Debt Obligations

Sri Lanka also faces substantial external debt-repayment obligations with much of these coming due in 2028 even as the country must mobilise funds for reconstruction. Given weak revenue mobilisation, higher disaster-related government spending, and depressed growth prospects, the fiscal burden is rising fast.

The analyst warns that this combination natural-disaster damage, huge reconstruction costs, fragile reforms, and mounting debt creates a dangerous risk profile.

Possibility of Another Sovereign Default Cannot Be Dismissed

If fiscal slippage continues or if further external shocks emerge, the risk of another sovereign default becomes a realistic scenario. Without strict and disciplined economic management, there may be few buffers left to protect the economy from a downward spiral.

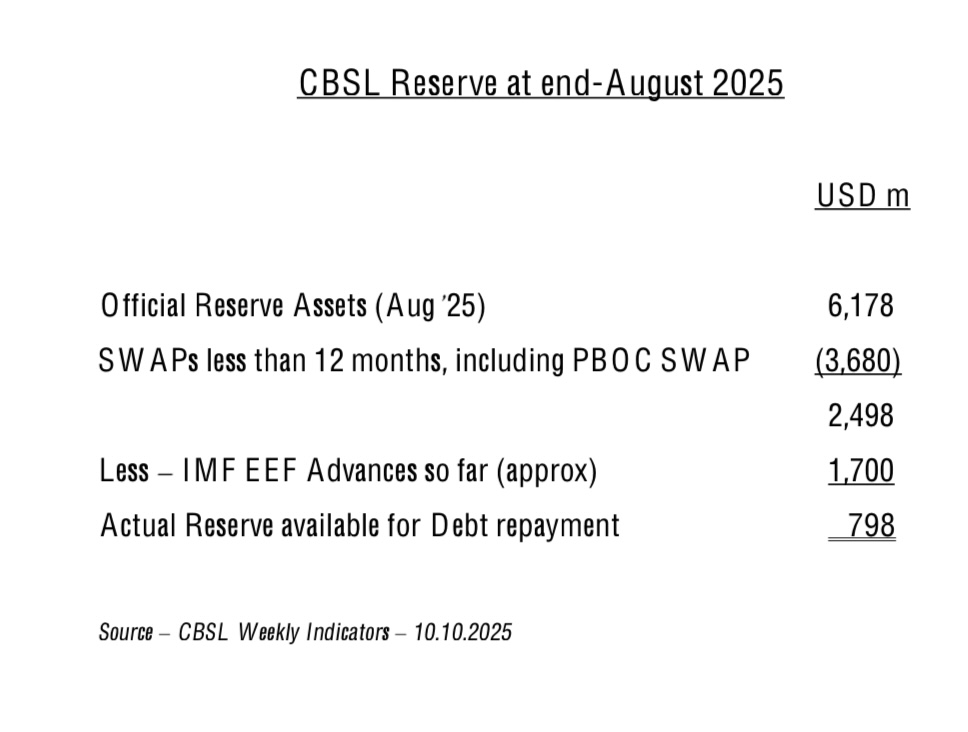

Sri Lanka’s external reserve position at end-August 2025 appears significantly weaker than headline figures suggest. Although the CBSL reported official reserve assets of USD 6.18 billion, a large portion consists of short-term SWAP arrangements USD 3.68 billion, including the PBOC swap which must be excluded when assessing usable reserves. After adjusting for these liabilities, the net balance falls to USD 2.50 billion. Furthermore, once IMF Extended Fund Facility (EFF) advances already disbursed (approximately USD 1.70 billion) are deducted, the actual reserve stock available for external debt repayment is only about USD 798 million. This highlights Sri Lanka’s continued vulnerability to external financing pressures despite reported improvements in gross reserves, underscoring the need for stricter reserve management and timely debt restructuring progress.

A Long, Difficult Path Ahead

While investors earlier in the year were hopeful that the worst was over, the scale of destruction and the financial obligations now facing the country expose deep structural vulnerabilities. The cyclone and floods have laid bare problems that were not reflected in market prices — and could unravel much of what has been gained.

“Optimism must now be balanced with realism,” the analyst concludes. “Sri Lanka now faces a painful convergence of disaster damage, overvalued equities, heavy reconstruction needs, fiscal strain, and mounting debt. Without careful, disciplined economic management, the gains of the past year could quickly unravel.”