Sri Lanka’s external sector in 2025 was increasingly underpinned by workers’ remittances, which surged to record levels, even as foreign tourism revenue lagged behind growth in arrivals, highlighting a widening divergence in the country’s key foreign exchange earners.

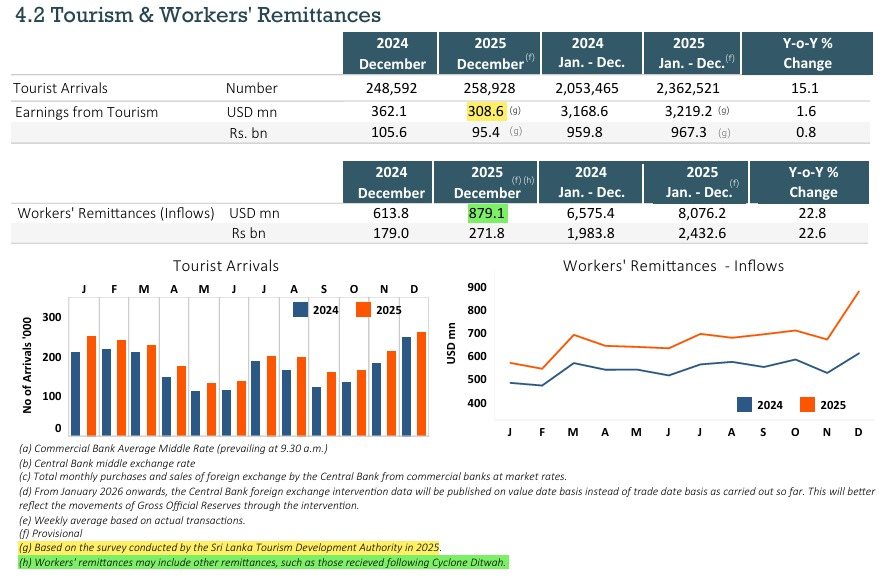

Workers’ remittances hit an all-time monthly high of US$879 million in December 2025, lifting total inflows for the year to around US$8.1 billion, a 23% year-on-year increase. Analysts note that part of the December spike was driven by cyclone-related relief transfers, underscoring the continued role of the Sri Lankan diaspora as the country’s most reliable net foreign exchange source. Remittances had already shown strong momentum earlier, rising 27% year-on-year to US$673 million in November 2025, the highest November inflow in over a decade.

In contrast, tourism earnings painted a more subdued picture. Foreign tourism revenue fell 15% year-on-year to US$309 million in December 2025, despite tourist arrivals rising 15% year-on-year during the month. Revised survey-based estimates indicate that while arrivals recovered strongly, average spending per tourist declined, dampening overall earnings. For the full year, tourism revenue grew by only 2% year-on-year, significantly underperforming the rebound in visitor numbers.

Data from the tourism and remittance statistics show that December 2025 arrivals increased to around 259,000 visitors, compared to 248,600 a year earlier, yet earnings slipped from US$362 million to US$308.6 million. Meanwhile, remittance inflows for December jumped sharply from US$613.8 million in 2024 to US$879.1 million in 2025, reinforcing their dominance in the external accounts.

Economists point out that the divergence reflects structural issues within the tourism sector, including pricing, length of stay, and spending patterns, while remittances continue to benefit from improved formal channel usage, currency stability, and extraordinary inflows linked to disaster relief.

As Sri Lanka enters 2026, the data suggest that while tourism remains vital for employment and activity, workers’ remittances have firmly consolidated their position as the country’s largest and most stable source of foreign exchange, providing a critical buffer to the balance of payments amid uneven recovery in other external inflows.