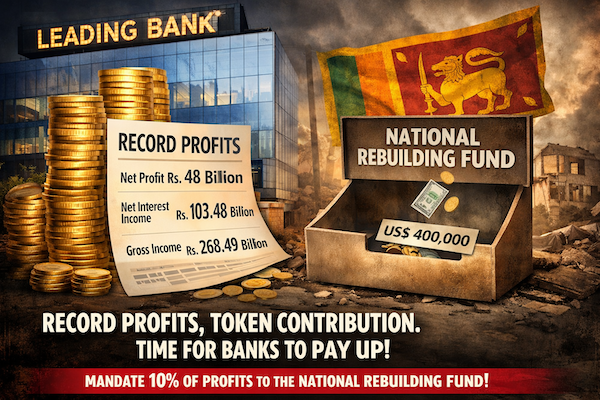

One of Sri Lanka’s leading commercial banks named as the first Bank to reach US$ 1 Billion market Capitalisation in August 2025 by translating national hardship into extraordinary financial returns during Financial Crisis in 2022 has contributed a mere Rs. 110 million to the National Rebuilding Fund. That’s the headline figure. The reality is far more revealing when you look at the scale of what this institution is actually earning.

According to its most recent financial filings, this bank’s gross income over nine months in 2025 reached Rs. 268.49 billion, with net interest income alone at Rs. 103.48 billion and a net profit of over Rs. 48 billion for the period a tidy 52 % year-on-year growth in bottom-line profits.

These aren’t small numbers. They resemble powerful economic throughput, not a sector struggling to stay afloat.

Let’s rewind to 2022: that was the year when lenders tightened rates aggressively, imposed punitive interest charges, and pursued aggressive foreclosure practices. Businesses buckled, households went into distress, and credit restructuring often followed terms that disproportionately favoured the lender’s balance sheet. Add in the gains from those restructurings at times coming at the expense of major public funds like the Employee Provident Fund (EPF) and what do you have? A banking sector that didn’t just survive a crisis, it leveraged it.

So when the nation still healing set up the National Rebuilding Fund, many of us assumed that those who benefited the most would step up. Instead, we are handed a cheque that wouldn’t keep the lights on for a small public school for a year. This is even less than the Provisions of Rs 179mn the bank made on account of of leave encashment during 2024.

This brings us to the question everyone is whispering and should be shouting:

Are banks lining up for another cycle of super profits, with the public once again carrying the cost of adjustment?

Because if this is the new standard of corporate responsibility, then the public has every reason to be sceptical about what to expect from the banking sector in 2026 and beyond.

Here’s the hard part: moral suasion isn’t working not when the numbers tell a different story. If an institution posts tens of billions in profit within a single quarter or nine-month period, yet offers up what amounts to loose change to repair the very economy it profited from destabilising, then something is deeply off.

This is where the Central Bank of Sri Lanka must act not with press releases or gentle nudges, but with clear policy. A sensible starting point would be a directive requiring all licensed banks to contribute at least 10 % of their annual profits to the National Rebuilding Fund. Not token gestures. Not voluntary goodwill. A defined, enforceable mandate.

Banks do not operate in a vacuum. They benefit from regulatory frameworks, public liquidity mechanisms, deposit insurance, and a system underpinned by public trust. When times are tough, that trust is supposed to be honoured — not shrugged off with a cheque that barely registers against the backdrop of their recent Rs. 48 billion profit figures.

Rebuilding Sri Lanka is going to cost billions, not millions. If those who gained the most from the crisis aren’t willing to meaningfully participate in the recovery, then the social contract underpinning our financial system will erode further.

Solidarity isn’t measured in press statements!

It’s measured in numbers on the balance sheet!