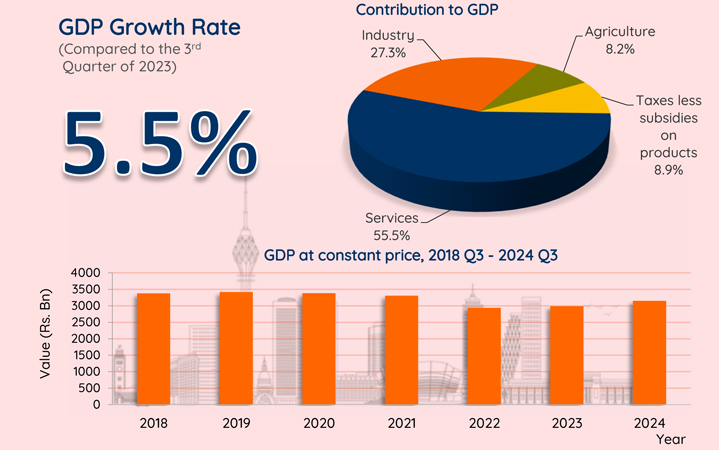

Sri Lanka’s real gross domestic product (GDP) for the first nine months of the year has been estimated at 9,866 billion rupees in constant terms, according to the latest data released by the state statistics office. This figure is nearly equal to the 9,751 billion rupees reported for the full year of 2021.

Following the end of a 30-year civil war, Sri Lanka experienced a series of currency crises. Inflationary monetary policies disrupted the balance of payments, leading to increased foreign borrowing and repeated stabilization measures. These factors contributed to slower economic growth and currency depreciation, which in turn eroded domestic capital.

In 2018, amid inflationary policies and significant foreign borrowing, GDP reached 9,925 billion rupees, though this was accompanied by sharp currency depreciation in the latter half of the year. The following year, in 2019, stabilization efforts and further foreign borrowing saw nine-month GDP slightly decrease to 9,905 billion rupees.

The onset of the COVID-19 pandemic in 2020 led to a decline in nine-month GDP, which fell to 9,311 billion rupees. In 2021, a partial recovery spurred by excess liquidity from extraordinary money printing and a drawdown of foreign reserves helped GDP climb back to 9,751 billion rupees for the same period.

However, in 2022, the rupee collapsed following continued inflationary policies. The economy contracted over the next two years, with nine-month GDP figures dropping to 9,203 billion rupees in 2022 and 8,794 billion rupees as stabilization measures took effect and foreign borrowing became unavailable after a sovereign default.

Over the past two years, Sri Lanka’s GDP has shown signs of recovery under a more moderate deflationary policy, following a period of radical deflationary measures from the third quarter of 2022. These policies were implemented to stabilize the rupee and prevent spontaneous dollarization.

Classical economists have long argued that using inflation as a tool for economic growth is unsustainable. While initial profits may rise for companies and producers when inflation is unexpected, real wages and other production factors can suffer losses.

To achieve stable output growth, economists emphasize the need for capital formation and economic freedom. There have been ongoing calls for the government to lift restrictions on trade, land, and labor, and for the central bank to avoid relying on inflationary measures to stimulate growth.

Friedrich Hayek, a classical economist, noted in his work Constitution of Liberty that, “Inflation at first merely produces conditions in which more people make profits and in which profits are generally larger than usual… This situation will last, however, only until people begin to expect prices to continue to rise at the same rate. After that, factor prices would be bid up and profits would fall.”

Hayek further warned, “Inflation thus can never be more than a temporary fillip, and even this beneficial effect can only last as long as somebody continues to be cheated and expectations of some unnecessarily disappointed. Its stimulus is due to errors it produces. It is particularly dangerous because its harmful after effects of even small doses of inflation can be staved off only by larger doses of inflation. Once it has continued for some time, even the prevention of further acceleration of inflation will create a situation in which it will be very difficult to avoid a spontaneous deflation.”

(Colombo/Dec17/2025)