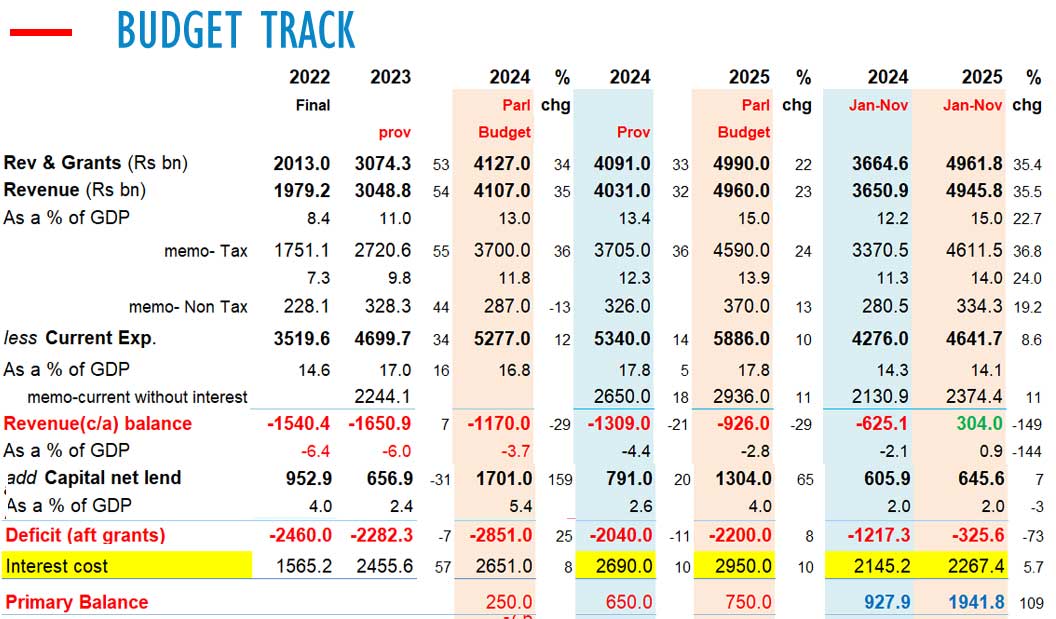

Sri Lanka’s overall budget deficit experienced a significant reduction of 73% to 325 billion rupees, while revenues increased by 35.5% to 4,945 billion rupees. This improvement was attributed to the recovery of economic activity and the central bank’s efforts to maintain monetary stability, despite missing its inflation target.

According to data from the central bank, tax revenues rose by 36.8% to 4,611 billion rupees, and non-tax revenues saw an 8.6% increase, reaching 334 billion rupees. The country has enhanced its tax administration and increased rates following a sovereign default, which was triggered by aggressive macroeconomic policies aimed at targeting potential output during the previous currency crisis and substantial foreign borrowings amidst foreign exchange shortages caused by rate cuts in three earlier crises.

Since September 2022, the central bank has implemented broadly deflationary policies, providing a solid foundation for recovery following the currency collapse of 2022. However, concerns have been raised for 2025, as the rupee has depreciated to 310 against the US dollar from 290 a year earlier. This depreciation occurred as the central bank selectively restricted convertibility after purchasing dollars and maintaining large volumes of excess liquidity unsterilized until they became import credits. Furthermore, there has been concern regarding the central bank’s 5% inflation target.

Current spending increased by 8.6% to 4,641 billion rupees, despite another state salary hike aimed at compensating for the loss of purchasing power during the last currency crisis. With revenues of 4,945 billion rupees and current spending of 4,641 billion rupees, Sri Lanka achieved a current account surplus of 204 billion rupees until November.

Capital expenditure and net lending amounted to 645 billion rupees, up from 605 billion rupees the previous year. However, December typically sees capital expenditure payments and potential spikes in interest payments, which could potentially eliminate the current account surplus. By the end of the year, capital expenditure was projected at 1,033 billion rupees in the November budget, with the International Monetary Fund projecting 1,048 billion rupees.

Sri Lanka’s tax revenues expanded robustly amid low inflation growth akin to East Asia, with output approaching pre-crisis levels in the first nine months of the year. However, a recent cyclone has somewhat dampened excise revenues and adversely affected motor vehicle sales, which are heavily taxed. When macroeconomists cut rates and trigger external crises, cars are among the first imports to be controlled, leading to reductions in revenues, which analysts describe as a cascading policy error.

(Colombo/Dec28/2025)