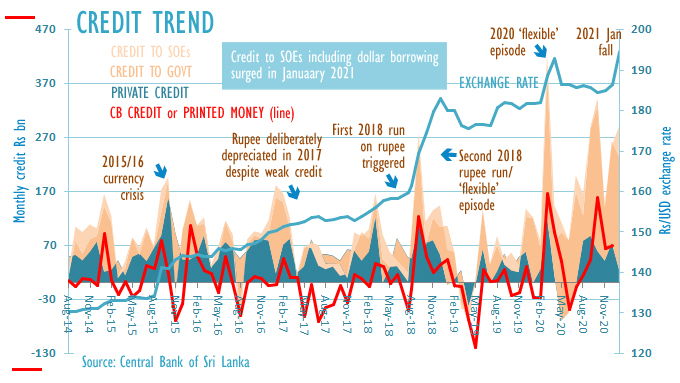

The recent Sri Lanka credit surge has captured the attention of analysts and investors alike, as private credit reached an unprecedented 246.1 billion rupees in October 2025, marking a significant increase from the previous month. According to the Central Bank of Sri Lanka, this surge in credit growth highlights a dynamic shift in lending practices, with banks channeling 1.61 trillion rupees into private businesses this year alone. In contrast, credit to the Sri Lankan government has stumbled, declining by 39 billion rupees in the same period. This complex landscape of Sri Lanka government credit versus private credit raises intriguing questions about the sustainability of this growth amid economic challenges. As the Central Bank navigates these waters, a deeper economic analysis reveals the potential implications for inflation and long-term fiscal health, making it a crucial topic for observers of Sri Lanka’s evolving financial narrative.

Exploring the phenomenon of credit expansion within Sri Lanka, particularly the remarkable escalation in private lending, presents a multifaceted view of the country’s economic landscape. This uptick in financial support for the private sector contrasts sharply with the declining fiscal support afforded to government initiatives, illustrating a pivotal shift in credit allocation. The Central Bank’s role in managing these dynamics is at the forefront of discourse, especially considering the impact of recent monetary policies on market liquidity and inflation trends. As we delve deeper into the implications of this credit surge, it becomes evident that analyzing the interplay between government financing and private credit in Sri Lanka is essential to understanding the broader economic climate. Through a balanced examination of these financial elements, we can grasp the challenges and opportunities that lie ahead for Sri Lanka’s economy.

Leave a Reply