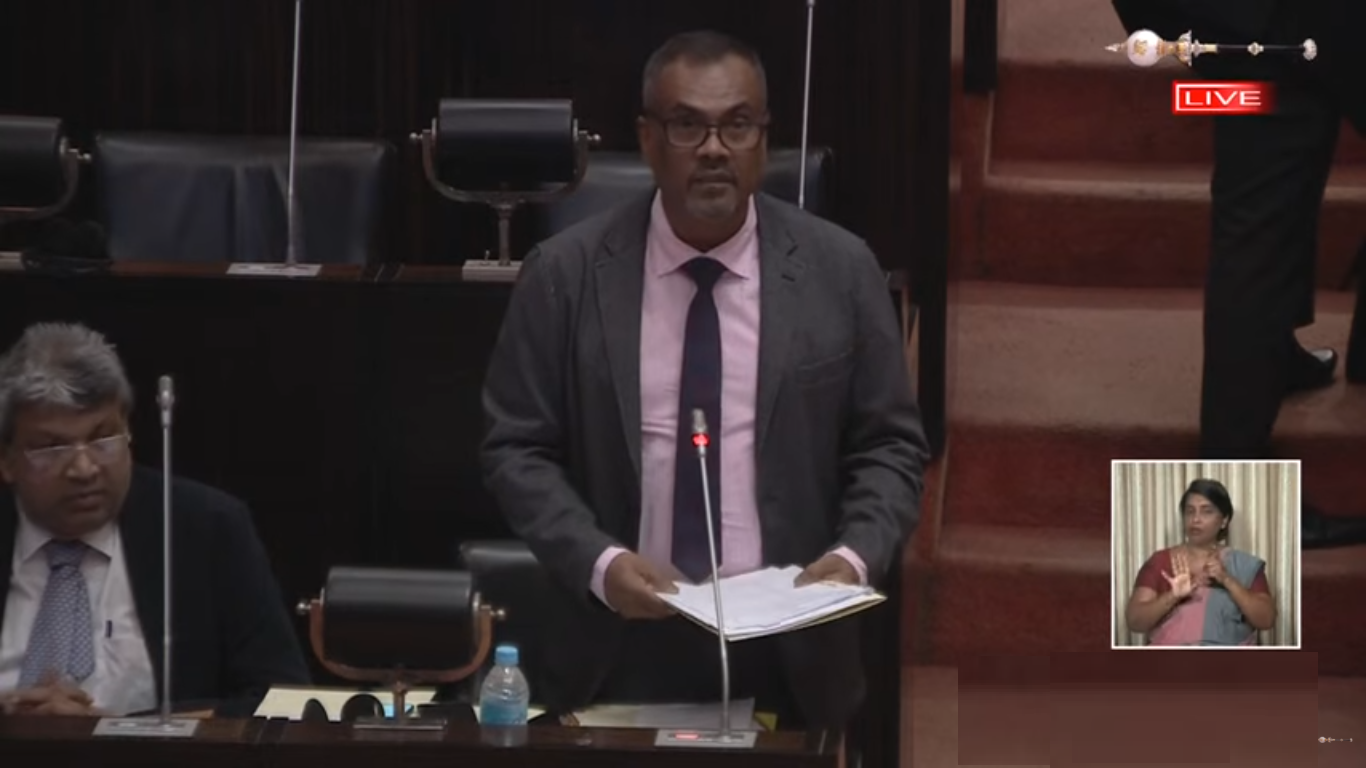

FINANCIAL CHRONICLE – Sri Lanka’s Deputy Finance Minister has defended the central bank’s decision to set a 5 percent inflation target, emphasizing that it aligns with the structural characteristics of a developing economy. “For a developing and open economy like Sri Lanka, a 5 percent inflation target is most suitable as it is more exposed to external shocks, supply-side disruptions, and exchange rate volatility,” Anil Jayantha explained to parliament.

Jayantha was responding to a question from opposition MP Ravi Karunanayake, who inquired why the government opted for a 5 percent target instead of the 2 percent target commonly seen in other nations. Under the 2023 Monetary Policy Framework Agreement with the government, the central bank (CBSL) established the 5 percent inflation target to aim for medium-term stability following the 2022 crisis. However, this target has faced criticism for being too high, given the persistent deflationary pressures.

Economists and opposition figures argue that a 5 percent target risks triggering unnecessary demand-pull inflation through loose policy. In 2025, headline inflation averaged just 2.1 percent, well below the target, indicating a weak recovery, low consumer spending, and excess capacity rather than an overheating economy. Critics suggest that historical averages around 5 percent reflect past monetary excesses, not an optimal goal for a fragile economy. They propose lowering the target to 2-3 percent to better anchor expectations and support IMF reforms.

Jayantha noted, “Empirical and historical evidence also supports the appropriateness of the 5 percent target. Between 2009 and 2021, inflation in Sri Lanka averaged 5 percent, while from 1978 to 2008, it averaged 12 percent per annum.” He further stated that quantitative analysis using Sri Lanka’s historical data indicates that maintaining the inflation target around 5 percent helps maximize economic growth.

Questions remain about why a developing nation needs to create inflation above 5 percent (+/- 2 percent), potentially causing unnecessary hardship for its population, when similar economic growth could be achieved with a 2 percent inflation target. The central bank had previously requested a 5 percent floor target and a 7 percent ceiling from the last administration, which was granted. However, the target was missed last year, as the central bank exceeded its monetary stability goals.

There are growing calls to reduce the target and establish a ceiling to prevent currency depreciation and avert a possible second default.

(Colombo/Jan8/2026)