Sri Lankan authorities are currently exploring the feasibility of offering a regular pension, or annuity, to contributors of the Employees Provident Fund (EPF), according to Deputy Labour Minister Mahinda Jayasinghe. Presently, the EPF is disbursed as a lump sum upon reaching retirement age.

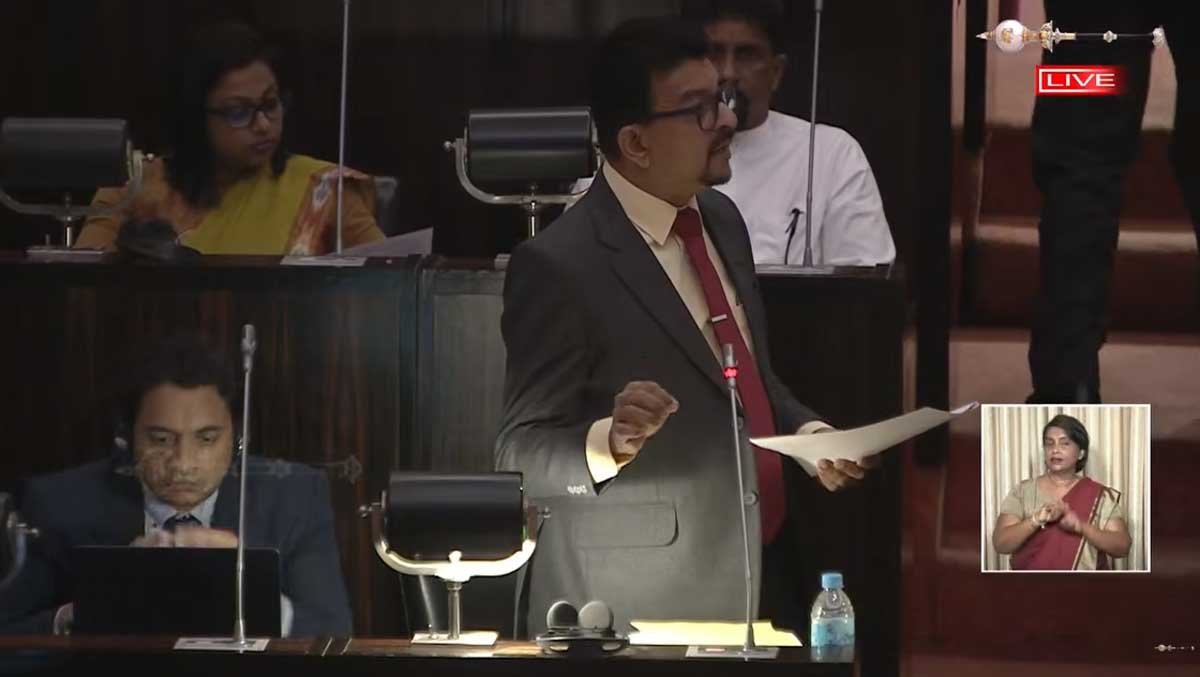

“We are examining the potential to provide a pension,” Jayasinghe informed parliament on Tuesday. “While we are not considering abolishing the lump sum option, we are increasingly focused on the possibility of ensuring a consistent payment throughout retirees’ lives.”

Historically, the discontinuation of the lump sum at retirement has sparked controversy. With an aging population, the EPF, which partly finances budget deficits, is experiencing net outflows. Concerns have been raised about Sri Lanka’s extensive public service, which is heavily impacted by the employment of numerous graduates, thereby consuming a substantial portion of funds in salaries and pensions. Currently, there are approximately 100,000 development officers.

State workers receive pensions through an unfunded system supported by taxpayers, including those contributing to the EPF. Jayasinghe was addressing inquiries regarding difficulties faced by applicants requesting a second early lump sum payment of 30 percent.

He noted that a provision exists to withdraw 30 percent of the balance from 2015, with a subsequent 20 percent available a decade later. These withdrawals must be justified with documentary evidence for specific purposes. Out of 744 such applications, 702 have been processed.

While the Employees Trust Fund provides more interim benefits to its beneficiaries, the EPF is primarily intended for social security upon retirement. “Even interim payments, provided occasionally, can compromise the ability to ensure security at retirement,” Jayasinghe emphasized. (Colombo/Jan05/2026)