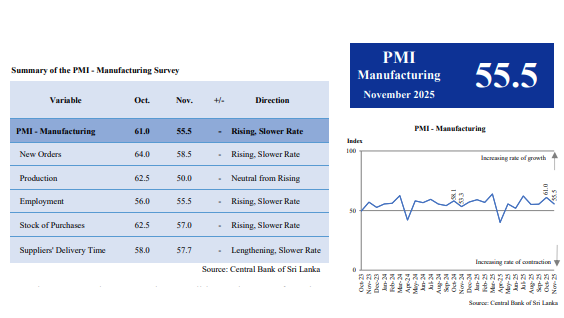

Sri Lanka’s manufacturing sector continued to grow in November, although the pace of expansion slowed compared to the previous month. According to the Central Bank of Sri Lanka’s Purchasing Managers Index (PMI), the manufacturing sector recorded a value of 55.5 in November, down from 61.0 in October.

The Central Bank noted that this figure reflects ongoing month-on-month growth in manufacturing activities, with positive contributions from all sub-indices.

The increase in the New Orders sub-index was primarily driven by higher activity in the food and beverages sector as well as the textiles and apparel sector. However, overall production in November stabilized at a neutral level, following an uptick in the previous month due to seasonal demand.

Both the Stock of Purchases and Employment sub-indices showed slower rates of growth during the month. Meanwhile, supplier delivery times remained extended.

(Colombo/Dec16/2025)