Sri Lanka faces substantial external debt-repayment obligations with much of these coming due in 2028 even as the country must mobilise funds for post- cyclone reconstruction. Given weak revenue mobilisation, higher disaster-related government spending, and depressed growth prospects, the fiscal burden is rising fast.

The analyst warns that this combination natural-disaster damage, huge reconstruction costs, fragile reforms, and mounting debt creates a dangerous risk profile.

Authorities now estimate that Sri Lanka will require around US$ 6–7 billion to rebuild destroyed homes, industries, roads and other critical infrastructure across all 25 districts affected by the cyclone.

That burden even after accounting for pledges of donations and grants is likely to weigh heavily on the already fragile economy. The financing needs will compete with urgent demands: relief efforts, social support, restoration of agriculture, and stabilising exports.

If fiscal slippage continues or if further external shocks emerge, the risk of another sovereign default becomes a realistic scenario. Without strict and disciplined economic management, there may be few buffers left to protect the economy from a downward spiral.

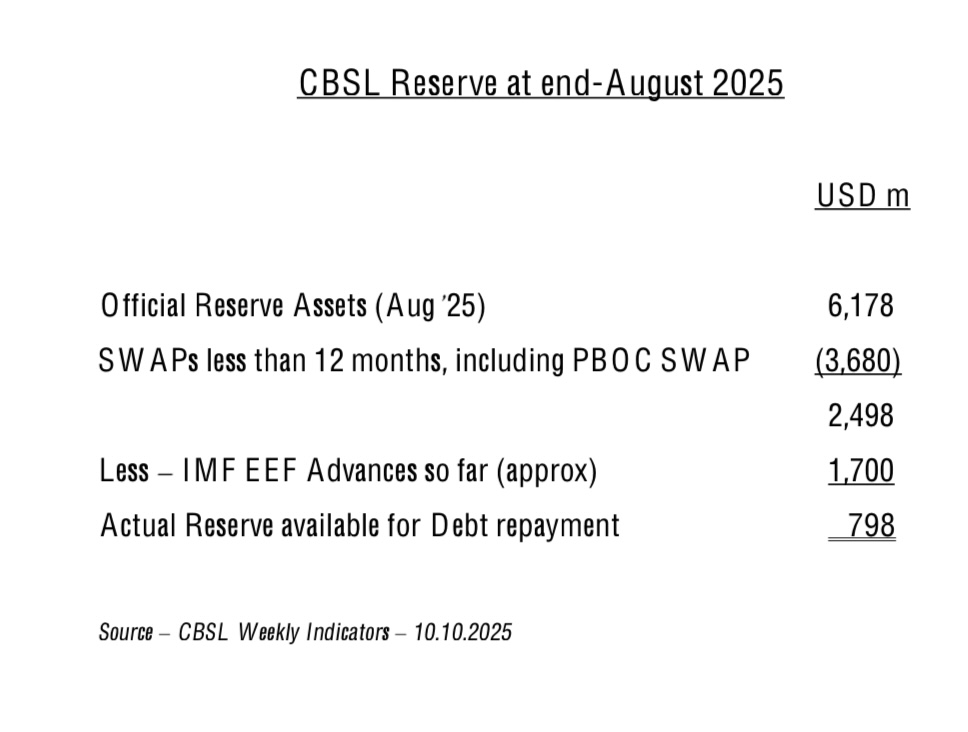

Sri Lanka’s external reserve position at end-August 2025 appears significantly weaker than headline figures suggest. Although the CBSL reported official reserve assets of USD 6.18 billion, a large portion consists of short-term SWAP arrangements USD 3.68 billion, including the PBOC swap which must be excluded when assessing usable reserves. After adjusting for these liabilities, the net balance falls to USD 2.50 billion. Furthermore, once IMF Extended Fund Facility (EFF) advances already disbursed (approximately USD 1.70 billion) are deducted, the actual reserve stock available for external debt repayment is only about USD 798 million. This highlights Sri Lanka’s continued vulnerability to external financing pressures despite reported improvements in gross reserves, underscoring the need for stricter reserve management and timely debt restructuring progress.