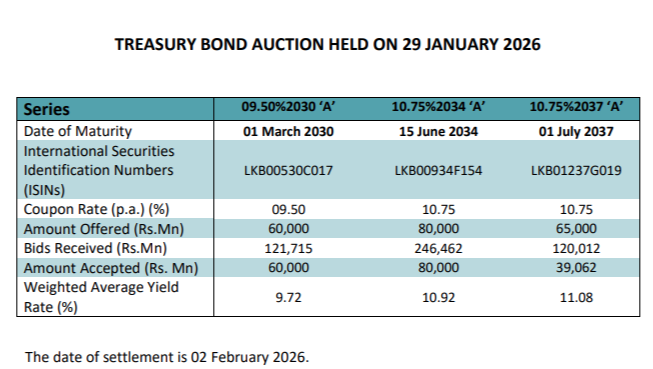

FINANCIAL CHRONICLE – Sri Lanka successfully raised 179.062 billion rupees through the sale of bonds maturing in 2030, 2034, and 2037, according to data from the public debt management office. The bonds were offered in a total amount of 205 billion rupees.

The entire offering of 60 billion rupees in bonds maturing on March 1, 2030 (LKB00530C017), was sold at an average yield of 9.72 percent.

Similarly, the full offering of 80 billion rupees in bonds maturing on June 15, 2034 (LKB00934F154), was sold at an average yield of 10.92 percent.

For the bonds maturing on July 1, 2037 (LKB01237G019), 39.062 billion rupees of the 65 billion rupees offered were sold, achieving an average yield of 11.08 percent.

The 2030 bonds remain available for purchase on tap. (Colombo/Jan29/2026)