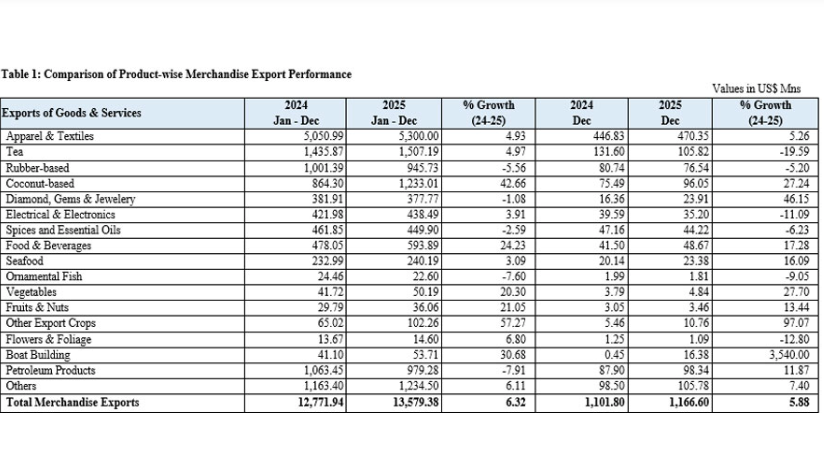

Sri Lanka’s merchandise exports experienced a growth of 6.32% in 2025, reaching a total of $13,579.38 million compared to the previous year. This increase was primarily driven by the sectors of boat building, coconut, and apparel exports, according to data released by the export promotion office.

In December 2025 alone, merchandise exports rose by 5.88% compared to the same month in 2024, amounting to $1,163.66 million.

The Export Development Board highlighted a notable year-on-year increase in coconut-based products, which surged by 27.24% in December 2025.

Despite the introduction of new tariffs by US President Donald Trump, export earnings from apparel and textiles rose by 4.93% year-on-year, amounting to $5,300.00 million.

Conversely, earnings from tea exports saw a decline of 19.59%, falling to $105.82 million in December 2025 compared to December 2024.

Similarly, earnings from rubber-based products decreased by 5.20%, dropping to $76.54 million in December 2025 in comparison to the same period in 2024.

(Colombo/Jan26/2026)