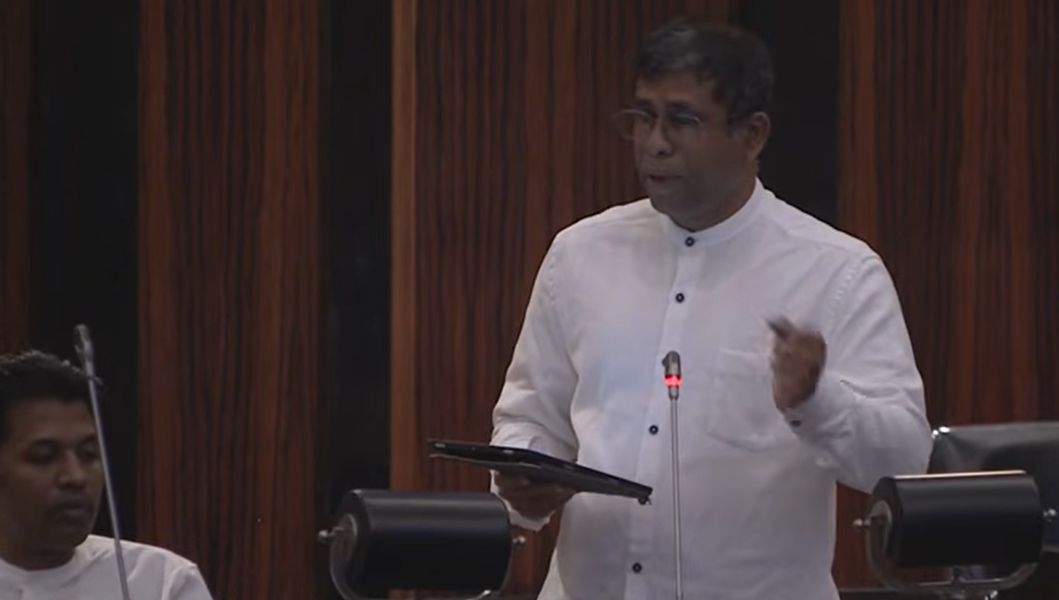

According to a report by the Committee on Public Enterprises (COPE), Sri Lanka’s state-owned National Savings Bank (NSB) is grappling with non-performing loans (NPLs) amounting to 7,972 million rupees. This includes a significant loan to a foreign entity, as stated by the bank’s chair, Nishantha Samaraweera, during a parliamentary session.

The investigation targeted the bank’s outstanding loan balances that exceeded 5 million rupees as of September 30, 2025. Of the total loan amount of 96,046 million rupees, approximately 7,972 million rupees have been classified as non-performing loans. Samaraweera highlighted that there are four major NPLs of concern.

One notable case involves a $9 million loan that was granted in June 2018 to R P I Private (Ltd), a company registered in the Maldives. This loan was part of a syndicated facility with the state-owned Bank of Ceylon (BOC), as NSB is legally prohibited from issuing loans to foreign companies. Samaraweera noted that the debt has since escalated to 14.73 million dollars with no principal repayment made to date. Although the loan was intended for hotel construction, investigators found no evidence of any buildings being erected.

The COPE report also identified significant losses related to Bimputh Finance, a microfinance firm that entered liquidation in February 2025. Despite a liquidation order from the Colombo Commercial High Court and ongoing winding-up procedures, NSB did not take timely action to recover funds. Bimputh Finance had secured loans totaling 200 million rupees in 2016 and 100 million rupees in 2019 as corporate guarantees. The firm now owes NSB over 258 million rupees in principal and interest.

Among the top four NPLs is a 750 million rupee facility granted to Techno-Park Development Company. COPE has recommended a specialized forensic audit into these credit approvals, citing inadequate recovery mechanisms and unauthorized extensions of grace periods to defaulting borrowers.

(Colombo/Feb19/2026)